|

|

|

|

|||||

|

|

Autonomix Medical, Inc. AMIX recently announced that it has been granted a key U.S. patent for its innovative catheter-based platform designed to sense and differentiate nerve signals in real-time. This technology represents a significant leap forward in the field of neuromodulation, with the potential to enhance treatment precision across a wide range of chronic conditions, including cancer and pain management. The platform enables both sensing and stimulation of nerves through a single device.

With the burden of chronic diseases and the complexity of nerve-related disorders posing ongoing challenges in modern medicine, Autonomix’s patented technology addresses a critical need for more accurate, targeted therapies. Its ability to map nerve activity in real-time during procedures may reduce the risk of nerve damage, improve patient outcomes, and offer physicians a powerful new tool in both diagnostics and treatment.

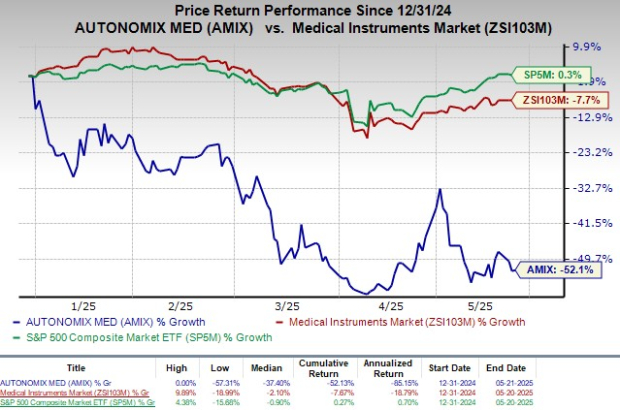

Following the announcement, shares of the company traded flat till yesterday’s closing. Shares of the company have lost 52.1% in the year-to-date period compared with the industry’s 7.7% decline. The S&P 500 has gained 0.3% in the same time frame.

The patent approval significantly strengthens AMIX’s long-term business by securing exclusive rights to its innovative nerve-sensing and stimulation technology. This positions the company as a first-mover in a high-demand market, enabling it to pursue commercialization, licensing, and strategic partnerships with greater confidence. The technology's potential applications across chronic pain, cancer, and other nerve-related conditions open doors to large, underserved markets. Additionally, the patent enhances investor confidence, protects R&D investments, and improves the company's overall valuation and long-term growth prospects.

AMIX currently has a market capitalization of $4.4 million. It has a price-to-book ratio of 0.5X, which is lower than the industry’s 2.30X.

AMIX achieved a major milestone with the issuance of U.S. Patent No. 12,257,071 (‘071 patent). Titled Controlled sympathectomy and micro-ablation systems and methods, the patent covers Autonomix’s novel catheter-based technology, which combines real-time nerve mapping with radiofrequency (RF) ablation. This integrated system is designed to identify and ablate overactive nerves within the peripheral nervous system using a minimally invasive approach. The technology enables more precise and effective treatments for a range of neurological disorders, including chronic pain and hypertension, offering a promising alternative to traditional, less targeted methods.

A key highlight of the ‘071 patent is the set of advanced features that make Autonomix’s technology stand out in the field of nerve-targeted treatments. The system features tiny, flexible “microfingers” with built-in sensors that monitor a patient’s physiological responses in real time. It also enables doctors to sense, map, stimulate, treat, and confirm the success of a procedure, all using a single integrated device. At the heart of the platform is a first-of-its-kind catheter-based microchip antenna that can detect and distinguish nerve signals with far greater accuracy than existing technologies. Once the problematic nerves are identified, Autonomix uses its own RF ablation method to precisely deactivate them. This “sense, treat, and verify” approach offers a major improvement over traditional methods like opioids or alcohol injections, which often provide only temporary relief and come with serious side effects.

Looking ahead, Autonomix plans to submit an IDE and initiate U.S. clinical trials in 2025, targeting pancreatic cancer pain as its first commercial indication.

Currently, AMIX carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the broader medical space that have announced quarterly results are CVS Health Corporation CVS, Integer Holdings Corporation ITGR and AngioDynamics ANGO.

CVS Health, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2025 adjusted earnings per share (EPS) of $2.25, beating the Zacks Consensus Estimate by 31.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $94.59 billion outpaced the consensus mark by 1.8%. CVS Health has a long-term estimated growth rate of 11.4%. Its earnings surpassed estimates in each of the trailing four quarters, with an average surprise of 18.1%.

Integer Holdings reported first-quarter 2025 adjusted EPS of $1.31, beating the Zacks Consensus Estimate by 3.2%. Revenues of $437.4 million surpassed the Zacks Consensus Estimate by 1.3%. It currently sports a Zacks Rank #1.

Integer Holdings has a long-term estimated growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

AngioDynamics, currently sporting a Zacks Rank #1, reported a third-quarter fiscal 2025 adjusted EPS of 3 cents against the Zacks Consensus Estimate of a 13-cent loss. Revenues of $72 million beat the Zacks Consensus Estimate by 2%.

ANGO has an estimated fiscal 2026 earnings growth rate of 27.8% compared with the S&P 500 Composite’s 10.5% growth. AngioDynamics’ earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 70.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 24 min | |

| 25 min | |

| 25 min | |

| 43 min | |

| 55 min | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite