|

|

|

|

|||||

|

|

Cal-Maine Foods, Inc. CALM and Vital Farms, Inc. VITL are major players in the egg industry, both navigating a landscape shaped by evolving consumer preferences for ethical and sustainable farming practices.

Ridgeland, MS-based Cal-Maine Foods, with a market capitalization of $4.6 billion, engages in the production, marketing and distribution of fresh shell eggs, including conventional, cage-free, organic, brown, free-range, pasture-raised and nutritionally enhanced eggs, as well as a variety of ready-to-eat egg products. It is the largest producer and distributor of fresh shell eggs in the United States. The company provides a diverse selection of eggs to meet different consumer preferences and budgets.

Austin, TX-based Vital Farms’ products include shell eggs, hard-boiled eggs and liquid whole eggs, as well as butter. The company, with a market capitalization of $1.5 billion, is a leading U.S. brand of pasture-raised eggs by retail dollar sales. The company sells eggs at a higher price point, reflecting the premium associated with pasture-raised production.

Egg prices have surged in recent times due to supply disruption caused by the outbreaks of the highly pathogenic avian influenza (HPAI) across poultry farms across the United States, impacting supply. According to the U.S. Department of Agriculture, 40.2 million birds had to be depopulated in 2024, with an additional 33.5 million so far this year. The brunt of the impact occurred in January (56%), with the intensity decreasing to 34% in February, 1% in March, 3% in April and 7% in May.

Egg prices have, thus, lost steam lately amid improved supply prospects. The demand remains resilient, as eggs are being valued as a source of high-quality protein and increasingly favored for healthy eating. Also, demand for cage-free and pasture-raised eggs is growing, driven by consumer preference for ethical and sustainable production methods. While prices may have eased from record highs, they are expected to stay elevated, supported by robust consumption.

In this context, we compare the fundamentals, growth potential and risks associated with CALM and VITL to determine which stock presents a more compelling investment opportunity.

In third-quarter fiscal 2025 (ended March 1, 2025), CALM reported earnings per share of $10.38, a significant improvement from earnings of $3.00 in the year-ago quarter. Revenues upsurged 102% year over year to $1.42 billion, driven by higher net average selling price of shell eggs and increased total dozens sold. Farm production costs per dozen moved down 5.7% year over year, reflecting lower feed prices.

The company’s focused approach to adding production capacity through acquisitions and organic growth has led to improved volumes. With customer demand shifting toward cage-free eggs and 10 U.S. states enacting legislation requiring cage-free compliance by 2030, Cal-Maine Foods is investing heavily in its cage-free capacity. The company is on track to complete $60 million in capital projects by the end of this year, which will add production capacity for 1.1 million cage-free layer hens and 250,000 pullets.

Recent strategic acquisitions have bolstered capacity, and are expected to lower production costs and drive efficiencies. The company is also expanding its product portfolio to include value-added egg products. Investments include Meadowcreek Foods (hard-cooked eggs) and Crepini Foods (including egg wraps and protein pancakes), aiming to broaden retail reach.

Cal-Maine Foods recently entered an agreement to acquire Burlington, WI-based Echo Lake Foods, a producer of ready-to-eat egg and breakfast products, marking its entry into the growing value-added egg segment.

VITL reported a 9.6% increase in revenues in the first quarter of fiscal 2025 (ended March 31, 2025) to $148 million. Higher sales for both eggs and butter and price/mix benefits aided revenues. However, earnings declined 14% year over year to 37 cents, which was mainly attributed to increased investments in crew members, partially offset by higher sales and gross profit. The company continues to build the latest programs to develop crew, which will weigh on its earnings.

Vital Farms has been investing in its supply chain. At the end of the first quarter, its supply network stood at 450 family farmers. The company’s products are now available across 26,000 retail stores.

VITL’s internal capacity expansion plans also remain on track, with the construction of an additional egg washing and packing line at its Egg Central Station facility in Missouri slated for completion by this year's end. To help support continued supply and further growth, the company announced plans in 2024 to build a second egg washing and packing facility in Seymour, IN, which will be fully operational in 2027.

Rising consumer awareness benefits not only its egg business but also the butter business. Consumers are willing to pay a premium for brands focused on transparency, sustainability and ethical values, which will continue to be a catalyst for VITL’s growth. Vital Farms, thus, plans to continue to expand its product offerings through innovation in both existing and new categories, leveraging comprehensive consumer insights and trends.

VITL has set a target to attain $1 billion in net revenues in 2027, with an adjusted EBITDA margin of 12-14%.

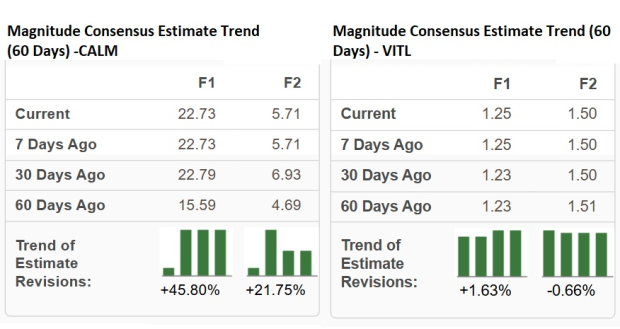

The Zacks Consensus Estimate for Cal-Maine Foods’ fiscal 2025 earnings is at $22.73, indicating a year-over-year upsurge of 299.5%. The estimate for fiscal 2026 of $5.71 suggests a 74.9% decline. EPS estimates for both fiscal 2025 and 2026 have been trending north over the past 60 days.

The Zacks Consensus Estimate for Vital Farm’s fiscal 2025 earnings is at $1.25, indicating a year-over-year rise of 5.9%. The 2026 estimate of $1.50 implies growth of 19.5%. While the estimate for fiscal 2025 has moved up in the past 60 days, the same for fiscal 2026 has moved down 0.66%.

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

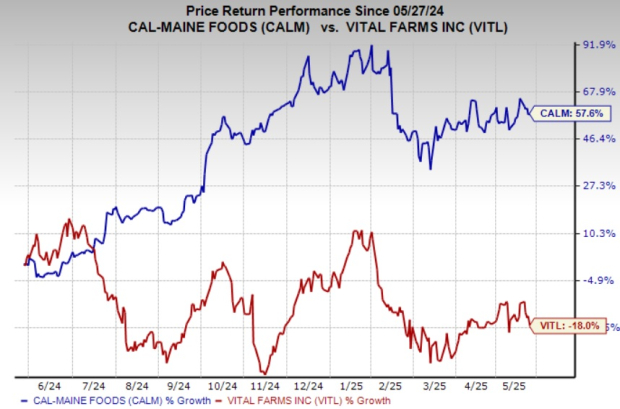

In the past year, Cal-Maine Foods’ stock has gained 57.6% compared with Vital Farm’s 18% decline.

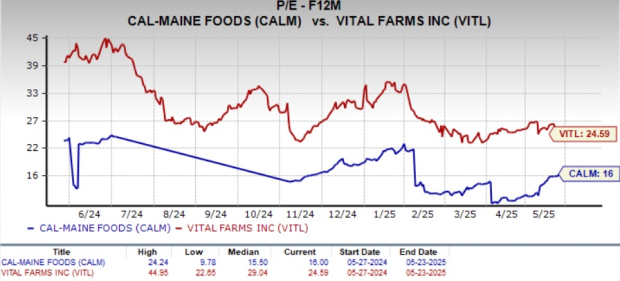

Cal-Maine Foods is currently trading at a forward 12-month earnings multiple of 16.00. Meanwhile, Vital Farms is trading at a forward 12-month earnings multiple of 24.59X.

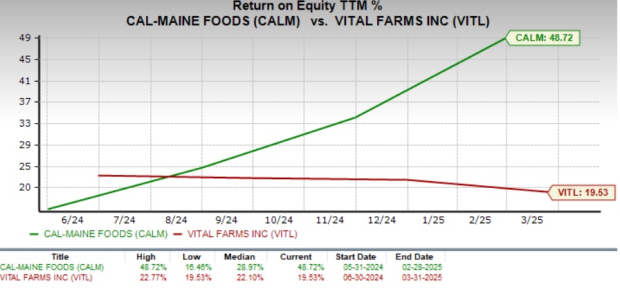

CALM’s return on equity of 48.72% is way higher than VITL’s 19.53%.

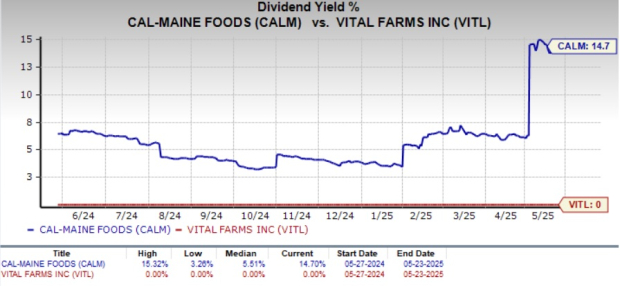

Cal-Maine has a dividend yield of 14.7% currently. Meanwhile, Vital Farms does not pay any dividends.

While the recent decline in egg prices may cause some near-term uncertainty, prices will be supported by stable demand. Growing consumer demand for ethically produced, natural foods continues to drive industry growth as shoppers increasingly prioritize transparency, sustainability and health.

Cal-Maine Food’s efforts to expand capacity, including cage-free and other specialty egg production, pose it for long-term growth. Efforts to diversify its product offerings provide a distinct competitive advantage to the company. Meanwhile, Vital Farm’s efforts to improve its brand awareness and customer reach are impressive. However, increased investments in crew members will continue to hurt its earnings in the near term.

Considering Cal-Maine Foods’ Zacks Rank #1 (Strong Buy), a cheaper valuation and a Value Score of A, as well as rising earnings estimates, it stands out as a more compelling investment choice. In comparison, Vital Foods has a Zacks Rank #3 (Hold) and a Value Score of C.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-23 | |

| Feb-20 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-10 | |

| Feb-06 | |

| Feb-04 | |

| Feb-04 | |

| Feb-02 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite