|

|

|

|

|||||

|

|

The companies operating in the Zacks Oil and Gas Exploration and Production – United States industry play a critical role in the nation's energy landscape. It involves locating underground or underwater oil and gas reserves, drilling wells, and extracting raw hydrocarbons for processing and distribution. The United States is one of the world's leading producers of oil and natural gas, with key production regions including the Permian Basin, Eagle Ford, Bakken Formation, and the Gulf of Mexico. Technological advancements, such as hydraulic fracturing and horizontal drilling, have significantly boosted domestic output, reducing dependence on foreign energy sources.

The industry is increasingly confronted by environmental challenges, regulatory constraints, and the global push toward clean, renewable energy. Fluctuating commodity prices further impact investment and operational strategies. In response, U.S. E&P companies are prioritizing operational efficiency, emissions control and sustainable development to stay resilient. Within this evolving landscape, companies like Devon Energy Corporation DVN and EOG Resources EOG stand out for their robust operations and strong presence across major American basins.

Devon Energy stands out as a leading U.S. onshore oil and gas producer with a diversified asset portfolio and a disciplined approach to capital allocation. The company consistently generates strong free cash flow and maintains shareholder-friendly practices, including a variable dividend strategy and share buybacks. Positioned to capitalize on sustained hydrocarbon demand amid global supply constraints and geopolitical volatility, DVN benefits from a low-cost operating model, a solid balance sheet, and a focus on operational efficiency. Additionally, its continued investments in technology and emissions reduction reflect a proactive alignment with evolving ESG priorities.

EOG Resources is among the most efficient and technologically advanced shale producers in the United States, with a high-quality, low-decline asset portfolio concentrated in top-tier regions like the Delaware Basin and Eagle Ford. Renowned for its superior well productivity and disciplined capital allocation, the company consistently generates strong free cash flow across various commodity price environments. Backed by a solid balance sheet and prudent financial strategy, EOG maintains a robust shareholder return framework. Its emphasis on innovation, cost efficiency, and emissions reduction further enhances its long-term value proposition in a rapidly evolving energy sector.

Both stocks mentioned above are the key operators in the Oil and Gas industry space. Let us dive deeper and closely compare the fundamentals of the two stocks to determine which is a better investment option for investors.

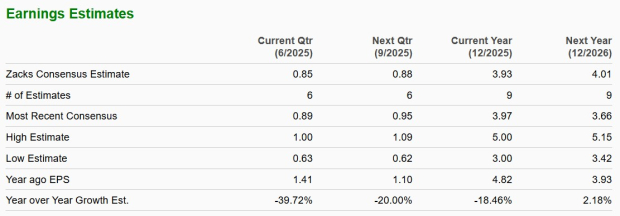

The Zacks Consensus Estimate for Devon Energy’s earnings indicates a year-over-year decline of 18.48% for 2025 and growth of 2.18% for 2026. Long-term (three to five years) earnings growth per share is pegged at 2.5%.

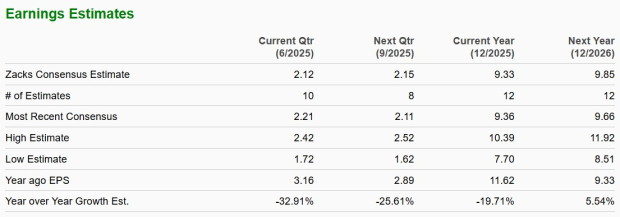

The Zacks Consensus Estimate for EOG Resources’ earnings indicates a year-over-year decline of 19.71% for 2025 and growth of 5.54% for 2026. Long-term (three to five years) earnings growth per share is pegged at 1.3%.

ROE is an essential financial indicator that evaluates a company’s efficiency in generating profits from the equity invested by its shareholders. It demonstrates how well management is utilizing the capital provided to increase earnings and deliver value. DVN’s current ROE is 21.9% compared with EOG’s ROE of 22.35%, both outperforming the industry’s ROE of 16.74%.

Dividends are regular payments made by a company to its shareholders and represent a direct way for investors to earn a return on their investment. They are an important indicator of a company’s financial health and stability, often signaling strong cash flow and consistent earnings.

Currently, the dividend yield for Devon Energy is 3.08%, while the same for EOG Resources is 3.54%. The dividend yields of both companies are higher than the S&P 500’s yield of 1.6%.

Capital expenditure is critically important in the oil and gas industry as it drives exploration, development, and maintenance of energy assets essential for long-term production and revenue growth. The companies invest in infrastructure and technology to improve efficiency and reduce environmental impact. The decline in interest rates and the possibility of further decline in interest rates in the second half of this year will be beneficial for the oil and gas companies. Devon Energy plans to invest in the range of $3.7-$3.9 billion in 2025 and has been making strategic investments to upgrade and expand assets.

EOG Resources’ 2025 capital expenditures are projected to be between $5.8 billion and $6.2 billion. This estimate covers exploration and development drilling, facilities, leasehold acquisitions, capitalized interest, dry hole costs, and other property, plant and equipment.

Devon Energy’s debt to capital currently stands at 36.24% compared with EOG Resources’ debt to capital of 10.50%. DVN’s current ratio at the end of the first quarter of 2025 was 1.08 compared with EOG’s 1.87, which shows both companies have enough liquidity to meet near-term debt obligations.

Devon Energy currently appears to be cheaper compared with EOG Resources on trailing 12-month Enterprise Value/Earnings before Interest Tax Depreciation and Amortization (EV/EBITDA).

Devon Energy is currently trading at 3.44X, while EOG is trading at 4.82X, compared with their industry’s 10.52X.

Devon has a multi-basin portfolio and focuses on domestic high-margin assets that hold significant long-term growth potential. From its domestically focused assets, Devon Energy gains from established supply chains, lower transportation costs and a stable regulatory environment.

EOG Resources’ extensive reach to key shale resources will support its long-term production growth.

Both companies are strong performers in the oil and gas industry. Our pick for the time being is Devon Energy, given its multi-basin domestic assets, along with its Zacks Rank #3 (Hold) and cheaper valuation, prevails over EOG Resources’ Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-15 | |

| Feb-15 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite