|

|

|

|

|||||

|

|

Surging global interest in commercial satellite deployment for communications and climate monitoring is driving demand for space stocks like Rocket Lab USA RKLB and Planet Labs PBC PL, both of which have a niche in offering next-generation satellite solutions. Increasing government investment in advanced space-based capabilities for defense purposes has also been playing the role of a growth catalyst for these companies.

While Rocket Lab specializes in providing end-to-end space solutions, including reliable launch services, spacecraft, satellite components, and on-orbit management, Planet Labs focuses on Earth imaging and analytics.

As declining launch costs and technological advancements have made space more accessible these days, investors are showing increased interest in space stocks for significant upside. With both Rocket Lab and Planet Labs being well-positioned to capitalize on this investment trend, one might be uncertain as to which one of them is a better choice for their portfolio. To resolve this, let’s delve deeper.

Recent Achievements: Rocket Lab ended first-quarter 2025 with a solid performance, buoyed by a significant 32% year-over-year increase in its revenues (worth $123 million). Moreover, its Electron small spacecraft launch vehicle successfully delivered over 200 spacecraft to orbit for government and commercial customers across 59 successful missions through March 31, 2025, since its maiden launch in 2017.

Among RKLB’s more recent achievements, worth mentioning is its partnership with the U.S. Air Force in May 2025, involving the launch of its new medium-lift reusable rocket Neutron for a Rocket Cargo mission. This partnership reflects the U.S. Department of Defense’s (DoD) confidence in the company as a reliable provider of next-gen platforms for medium launches and advanced space logistics. Last month, Rocket Lab got selected by the U.S. Air Force to participate in its Enterprise-Wide Agile Acquisition Contract, a $46 billion contract designed for the rapid acquisition of innovative technologies, engineering services, and technical solutions to bolster the Air Force’s capabilities. Such contract wins should boost RKLB’s future revenue growth.

Financial Stability: Rocket Lab ended the first quarter with a cash and cash equivalent of $428 million. Its current debt was $20 million, while its long-term debt totaled $419 million. So, we may safely conclude that the company holds a moderate solvency position, which should allow it to continue investing in innovative space technologies to support the manufacturing of components, sub-systems, and assemblies across the full range of its launch vehicles and spacecraft family.

Challenges to Note: A key risk to investing in Rocket Lab lies in its high operating expenses, caused by investments in innovations like the Neutron launch vehicle, Electron’s first-stage recovery, advanced spacecraft capabilities and an expanded portfolio of components. These expenses often offset revenue gains, leading to losses, as evident from its recent quarterly reports.

Moreover, the space industry is highly capital-intensive and subject to long development cycles, with uncertain timelines for launch vehicle readiness (such as the upcoming Neutron rocket), which could delay revenue streams and dampen investor sentiment for the stock.

Recent Achievements: Planet Labs ended fiscal 2025 (Jan. 31, 2025) with a record year-over-year revenue improvement of 11% to $244.4 million. Its fiscal full-year adjusted gross margin also improved a solid 600 basis points to 60%. The company launched more than 70 satellites last fiscal year, including its first Tanager hyperspectral satellite and second Pelican high-resolution satellite.

Among the company’s more recent achievements, worth mentioning is its seven-figure contract with the German Federal Ministry of the Interior and Community, and the German Federal Agency for Cartography and Geodesy, in May 2025, to provide its data products.

In April 2025, PL signed a multi-year contract with EMDYN, which will enable the latter to use Planet’s near-daily global satellite imagery and taskable high-resolution SkySat satellites to monitor subtle activity across large geographical regions, such as border movements, infrastructure development, or maritime patterns, and capture fleeting, high-resolution imagery of events as they unfold. These contracts should duly boost PL’s top-line performance in the next few years.

Financial Stability: Planet Labs ended fiscal 2025 with cash and cash equivalents of $229 million. Both its current and long-term debts, as of Jan. 31, 2025, were nil. So, we may safely conclude that the company holds a solid solvency position, which should allow it to continue investing in its agile space missions, including advancing core spacecraft technologies, automated mission operations for PL’s satellite fleet and ground stations, payload prototypes and development, as well as engineering operations to drive potential scale efficiencies.

Challenges to Note: Planet Labs, which is still in a growth phase, is yet to achieve sustained bottom-line profitability. Ongoing high R&D expenses, with the space industry being a highly capital-intensive one, might adversely impact its financial performance and operational stability.

Moreover, the company has faced internal pressures (as reflected by substantial workforce reductions) — a 10% layoff in August 2023, followed by a further 17% cut in June 2024. The cost-cutting measures may point to underlying organizational or strategic hurdles. These might also affect PL’s operational efficiency and disrupt ongoing projects.

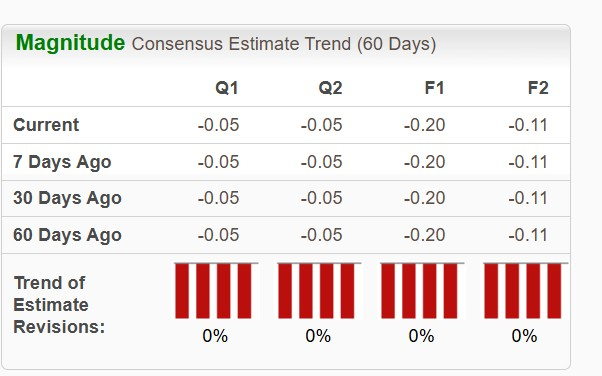

The Zacks Consensus Estimate for Rocket Lab’s 2025 sales suggests a surge of 32.8% from the year-ago quarter’s reported figure, while that for its loss per share implies a solid improvement. The company’s near-term bottom-line estimates reflect mixed movement over the past 60 days.

The Zacks Consensus Estimate for Planet Lab’s 2025 sales implies a year-over-year improvement of 10.3%, while that for its loss suggests no change. The stock’s near-term bottom-line estimates remained unchanged over the past 60 days.

RKLB (up 54.1%) has outperformed PL (down 6.6%) over the past three months and has done the same in the past year. Shares of RKLB and PL have surged 588% and 116.9%, respectively, in a year.

PL is trading at a forward sales multiple of 4.18X, below RKLB’s forward sales multiple of 18.88X.

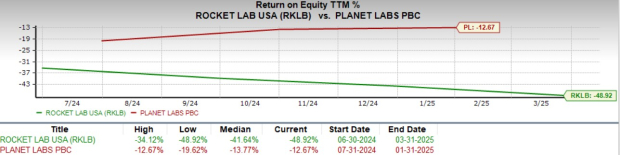

The image below, reflecting a negative Return on Equity (ROE) for RKLB and PL, suggests that neither space company is generating profits from its equity base very efficiently.

While both Rocket Lab and Planet Labs operate in high-growth segments of the space economy, the former appears better positioned to capitalize on near-term opportunities. Although Planet Labs trades at a more attractive valuation, Rocket Lab's stronger revenue momentum and outperformance in stock price suggest that it currently offers more upside potential for investors seeking exposure to the evolving space sector.

Given the negative ROE for both Rocket Lab and Planet Labs, it's clear that profitability remains an ongoing challenge. In light of this, a cautious, wait-and-see strategy may be prudent as investors await stronger signs of financial stability and earnings visibility. However, Rocket Lab’s upward earnings revisions for 2025 and 2026 suggest growing confidence in its future performance, making it a reasonable candidate to retain in one’s portfolio. On the other hand, Planet Labs’ stagnant near-term estimates may prompt investors to consider trimming or exiting their positions in the stock.

RKLB carries a Zacks Rank #3 (Hold), while PL holds a Zacks Rank #4 (Sell) at present. You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-17 | |

| Feb-17 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

AXA DCP partners with Planet Labs for near-real-time disaster monitoring

PL +5.26%

Life Insurance International

|

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite