|

|

|

|

|||||

|

|

Hims & Hers Health, Inc. HIMS announced that eligible customers can now access six months of prescription-only Wegovy at a new, affordable price. The company, via this offer, aims to make proven obesity care and treatments more accessible, affordable and connected for Americans.

The latest product availability is expected to significantly boost HIMS’ business across the nation.

Following the announcement, shares of the company lost nearly 8% till yesterday’s closing.

Historically, the company has gained a top-line boost from its various product launches. Although the latest product availability is likely to be beneficial for HIMS’ top-line growth going forward, the stock declined overall.

Hims & Hers currently has a market capitalization of $11.94 billion. It has an earnings yield of 1.4%, favorable than the industry’s negative yield. In the last reported quarter, HIMS delivered an earnings surprise of 66.7%.

Effective May 22, 2025, new customers eligible for Wegovy on the Hims & Hers platform can access their care for $549 per month for six months. The company aims to ensure that customers have a longer window to access the required affordable care. Included in that price is access to HIMS’ holistic approach to weight loss, powered by the latest technology.

Hims & Hers expects to continue to offer access to its full breadth of weight loss treatment options, including other medications, oral kits, protein, nutrition kits and clinically-backed care plans.

Management believes that the latest offer is another step forward to bring people closer to the care and treatments they need.

Per a report by Data Bridge Market Research, the global weight management market was valued at $329.83 billion in 2024 and is anticipated to reach $488.42 billion by 2032 at a CAGR of approximately 5%. Factors like the growing cases of obesity due to sedentary lifestyles and the increasing adoption of genomic and personalized healthcare solutions are likely to drive the market.

Given the market potential, the latest product availability is expected to be a significant milestone for Hims & Hers and boost its business.

This month, Hims & Hers announced its first-quarter 2025 results, wherein it witnessed robust improvement in the top and bottom lines and strength in its Online revenue channel. The increase in subscribers and monthly online revenue per average subscriber during the quarter was also recorded.

Last month, Hims & Hers announced a long-term collaboration with Novo Nordisk designed to make proven obesity care and treatments more accessible, affordable and connected for Americans. As a first step, Americans can now access NovoCare Pharmacy directly through the HIMS platform, with a bundled offering of all dose strengths of Wegovy and a Hims & Hers membership. At a single, unified price starting at $599 per month, individuals may be prescribed Wegovy, alongside Hims & Hers’ holistic approach to care, powered by the latest technology.

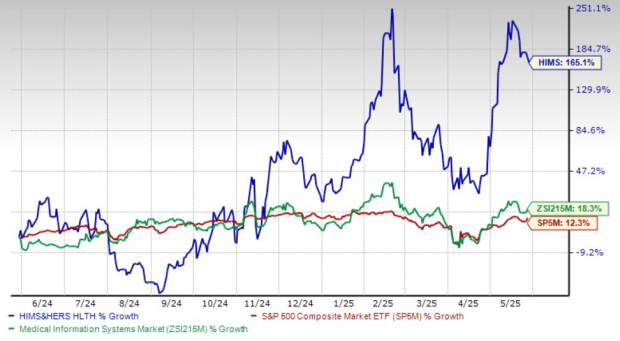

Shares of the company have surged 165.1% in the past year compared with the industry’s 18.3% rise and the S&P 500’s gain of 12.3%.

Currently, HIMS carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks in the broader medical space are HealthEquity, Inc. HQY, Cencora, Inc. COR and Integer Holdings Corporation ITGR.

HealthEquity, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 20.3%. HQY’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 12.8%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

HealthEquity’s shares have gained 28.7% against the industry’s 18.4% decline in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 6%.

Cencora has rallied 33.3% against the industry’s 18.4% decline in the past year.

Integer Holdings, sporting a Zacks Rank of 1 at present, has an estimated long-term growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

Integer Holdings’ shares have lost 1.3% compared with the industry’s 12.2% plunge in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite