|

|

|

|

|||||

|

|

In the rapidly evolving landscape of artificial intelligence (AI) and defense technology, two companies have emerged as notable players - BigBear.ai Holdings Inc. BBAI and Palantir Technologies Inc. PLTR. Both firms specialize in providing AI-driven analytics and solutions to the government and defense sectors, leveraging cutting-edge technologies to enhance decision-making and operational efficiency.

BigBear.ai focuses on delivering predictive analytics and autonomous systems, catering to various defense and intelligence agencies. Palantir, on the other hand, offers comprehensive data integration and analysis platforms, serving a broad spectrum of government and commercial clients. The commonality between these companies lies in their commitment to harnessing AI for national security and defense applications.

Given the increasing emphasis on AI in defense strategies and the substantial government investments in this domain, comparing BigBear.ai and Palantir becomes particularly relevant for investors seeking exposure to this sector.

Let's dive deep and closely compare the fundamentals of the two stocks to determine which one is a better investment now.

BigBear.ai is a smaller pure-play in the defense/intelligence AI arena. The company has carved out a niche providing “decision intelligence” solutions to U.S. government and military clients. It has scored several key government contracts that showcase its capabilities – for example, a 3.5-year, $13.2 million sole-source award to enhance the Pentagon’s ORION analytics platform for force management. BigBear.ai’s suite of AI tools (with modules like Observe, Orient, and Dominate) ingests data, identifies patterns, and predicts outcomes at the network edge. These technologies are used in simulations and planning for complex military scenarios, though on a far smaller scale than Palantir’s deployments. The recent appointment of a new CEO – former DHS acting secretary Kevin McAleenan – in January 2025 stirred optimism that BigBear.ai’s Washington connections could translate into new contract wins.

This niche focus led to significant contract wins and a swelling backlog of orders. At the end of first-quarter 2025, BigBear’s contract backlog stood at $385 million, leaping 30% from a year ago, indicating a solid pipeline of future revenue from government projects.

Additionally, the company significantly improved its balance sheet, ending the quarter with $108 million in cash, more than double its cash balance at the end of 2024. The reduction of debt from $200 million to $142 million—primarily through equity conversions—has provided greater financial flexibility and reduced interest burden, enabling BigBear to better weather macro uncertainty and continue funding strategic growth initiatives.

A key challenge in first-quarter 2025 stemmed from delays in federal procurement processes. These delays created temporary variability in revenue recognition and underutilization of available resources, pushing up SG&A costs. Management highlighted that while such delays are typical in government contracting, they had a meaningful short-term impact on the company’s bottom line, contributing to a wider adjusted EBITDA loss. Additionally, while revenue rose modestly, the company’s financials were impacted by higher non-cash expenses, including increased stock-based compensation and derivative fair value adjustments.

Palantir Technologies is a far larger and more established player at the intersection of AI and defense. The company built its reputation with Gotham, a platform for U.S. intelligence and defense agencies that integrates vast data sets to enable real-time decision-making. Alongside Gotham, Palantir’s commercial-oriented Foundry platform and its new Artificial Intelligence Platform form a comprehensive suite that bridges government and enterprise AI needs. This end-to-end AI strategy, from data integration and preparation to advanced analytics, gives Palantir a formidable competitive edge.

Palantir continually aligns its technology with defense priorities; for example, it’s working on the Pentagon’s high-profile Open DAGIR initiative to modernize mission planning with AI, showcasing its ability to upgrade military operations with cutting-edge data solutions. This month, Palantir announced an extension of its Army Project Maven work that brought the total value of that program to over $1 billion, marking Palantir’s first billion-dollar contract. This underscores the company’s revenue visibility in defense AI at scale, far beyond what a smaller firm like BigBear can achieve. Furthermore, Palantir is expected to be a key beneficiary of the Trump administration's "Golden Dome" missile defense initiative, highlighting its integral role in national defense projects.

Palantir has also been rapidly expanding its commercial footprint, applying its AI prowess to industries like healthcare, finance, manufacturing, and logistics.

Importantly, Palantir is now a profitable and fast-growing business. In the first quarter of 2025, Palantir’s revenue surged 39% year over year to $884 million, handily beating expectations. U.S. revenue alone jumped 55%, reflecting strong uptake of its AI solutions domestically. The company has posted multiple quarters of GAAP profitability, with adjusted earnings of 13 cents per share (up from 8 cents a year prior). Off the back of robust demand, Palantir raised its full-year 2025 outlook – now guiding for $3.89–3.90 billion in revenue (about up 36% year over year), well above its initial forecasts. In other words, Palantir’s fundamental trajectory is decidedly upward, fueled by booming AI adoption across both its defense and commercial segments. The company’s financial position is also a source of strength – Palantir sits on $5.4 billion in cash (as of March 31) and carries no debt, giving it ample flexibility to invest in R&D or acquisitions to maintain its edge.

Palantir faces challenges, including sustaining its growth rate as a larger company and managing its heavy reliance on government contracts, which exposes it to political and budgetary risks.

Despite its innovative offerings, BigBear.ai stock’s performance has been underwhelming in 2025, with a year-to-date (YTD) decline of 7% and below the Zacks Computer and Technology sector’s 1.3% decline. However, the stock has shown signs of recovery, gaining about 21.4% over the past month.

In 2025, Palantir's stock has experienced significant growth, with a YTD increase of 63.6% and a modest gain of 4.4% over the past month.

BBAI is trading at a 6.87X forward 12-month price-to-sales (P/S) ratio, higher than its three-year median of 1.9X and higher than the Zacks Computer and Technology sector’s 6.25X. It may need clear signs of improving execution or a shift in federal spending trends to regain bullish momentum.

Palantir’s valuation has become very stretched after the massive run. Palantir trades at about 66.85X, far above BBAI and the sector.

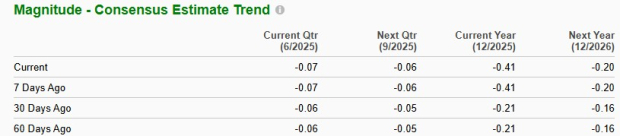

Over the past 30 days, the Zacks Consensus Estimate for PLTR has increased, while for BBAI stock, the loss per share has widened for 2025, as you can see below. The estimated figure indicates 43.9% growth for PLTR. On the other hand, the estimated figure for BBAI indicates a narrower loss from $1.10 per share a year ago.

For BBAI Stock

For PLTR Stock

While BigBear.ai offers a compelling niche in defense-focused AI, its smaller scale, inconsistent financials, and exposure to procurement delays make its growth path less predictable. The company's Zacks Rank #4 (Sell) hints at near-term pessimism. In contrast, Palantir's superior fundamentals, diversified revenue base, and execution strength position it as the more robust investment. After weighing the fundamentals, Palantir — a Zacks Rank #3 (Hold) company — appears to hold the better upside potential right now, albeit with some valuation-induced caution. All things considered, investors looking for exposure to the AI-defense theme would be better served by Palantir’s proven growth and resilience at this point, as it currently offers a more compelling risk-reward profile than its smaller rival. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 6 hours | |

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| 14 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite