|

|

|

|

|||||

|

|

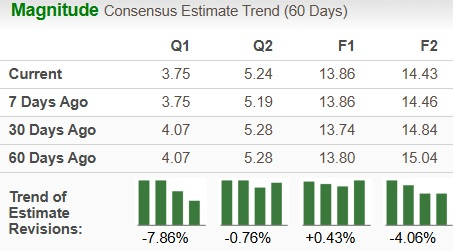

Toll Brothers, Inc.’s TOL earnings estimate for fiscal 2025 has trended up 0.9% to $13.86 per share from $13.74 per share in the past 30 days. Analysts’ sentiments are likely to have been bullish thanks to the company realizing benefits from its diversified luxury product offerings, the balanced portfolio of build-to-order and spec homes and its strategy of prioritizing sales base and margin. These trends, along with the company’s 9% dividend hike and favorable long-term housing market demographics, are likely to have catalyzed the optimistic sentiments. (read more: Toll Brothers Q2 Earnings & Revenues Beat Estimates, Home Sales Up Y/Y)

Given the ongoing risky trends in the housing market, this upward movement of this homebuilding company stands tall among other peer homebuilders, including Tri Pointe Homes, Inc. TPH, KB Home KBH and Lennar Corporation LEN. The earnings estimate trend for fiscal 2025 has moved down for Tri Pointe by 0.6% to $3.08 per share and KB Home by 4.2% to $7.05 in the past 30 days, and Lennar by 2.9% to $10.15 per share in the past 60 days.

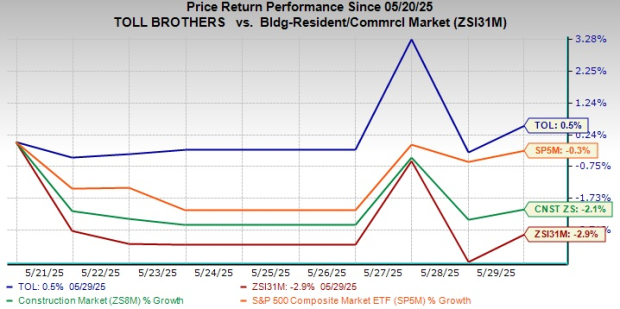

Since its second-quarter fiscal 2025 earnings release, TOL stock has inched up 0.5%, outperforming the Zacks Building Products - Home Builders industry, broader Construction sector and the S&P 500 index. Even though the share price performance of the company did not move up significantly, the positive trend compared with the declining trends of the industry, sector and the S&P 500 index is encouraging for investors to look into. Notably, in the past month, TOL has gained 3.8% against the industry’s 2.2% decline

Although the long-term housing market demographics are favorable and the company’s in-house revenue and margin boosting strategies are boding well, the ongoing market uncertainties surrounding high mortgage rates, inflationary pressures and ambiguous tariff-related risks are hovering over Toll Brothers. Despite ongoing efforts to enhance its profitability, these lingering headwinds can negate the positive impacts of its business strategies.

Let’s delve deeper into understanding the factors driving TOL’s momentum as well as pressuring its growth.

Toll Brothers mainly offers luxury homes to luxury communities in prosperous suburban areas with easy access to major cities. Thanks to these aspects, its tremendous brand, broad range of home price points and unique build-to-order model lend it a competitive advantage compared with other homebuilders. Moreover, it enjoys greater pricing power than other homebuilding companies, leading it to the strategy of widening price points to include more affordable luxury homes and increasing the supply of spec homes while growing market share.

Despite the ongoing affordability issues in the housing market, the company has been witnessing strong demand in the luxury home market thanks to its diversified luxury product offerings, the balanced portfolio of build-to-order and spec homes and its strategy of prioritizing sales base and margin. Furthermore, these strategies are supported by the types of customers the company caters to, mainly the move-up and empty-nester segments, who tend to be wealthier, have greater financial flexibility and a majority have equity in their existing homes.

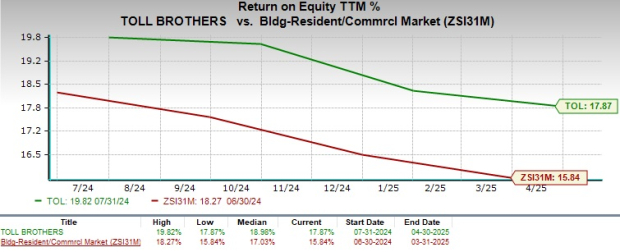

The company strategically balances between build-to-order and spec methods to ensure business profitability amid uncertain market conditions. A balanced approach helps Toll Brothers to respond effectively to changes in demand, especially in a fluctuating economic environment, while allowing it to meet diverse market needs. With this strategic operating model, the company is now primarily focusing on its return on equity (ROE), turning inventory and accurately balancing pace and price. Already mid-way through fiscal 2025, TOL is well-positioned for the remainder of fiscal 2025 and the upcoming year with its inventory of spec homes per community and the gross margin spread between its spec and build-to-order homes.

Through a stable liquidity position, Toll Brothers aims to maintain shareholder value by returning cash to shareholders through regular share repurchases and dividend payments. This aspect can be substantiated by its recent dividend hike announcement during its second-quarter fiscal 2025 earnings release. On March 11, 2025, the company announced a 9% hike in its quarterly dividend payment to 25 cents per share (or $1 annually) from 23 cents.

Furthermore, during the first six months of fiscal 2025, the company bought back 1.832 million shares at an average price of $109.80 per share, totaling about $201.2 million. It now expects to repurchase $600 million worth of common stock, up from $500 million expected earlier in fiscal 2025. These moves highlight the company’s stable financial position and commitment to reward shareholders.

The company’s trailing 12-month ROE reflects its growth potential and focus on maintaining shareholder value. As evidenced by the chart below, TOL’s ROE is significantly better than the industry. This indicates that the company is efficiently using its shareholders’ funds, along with generating profit with minimum capital usage.

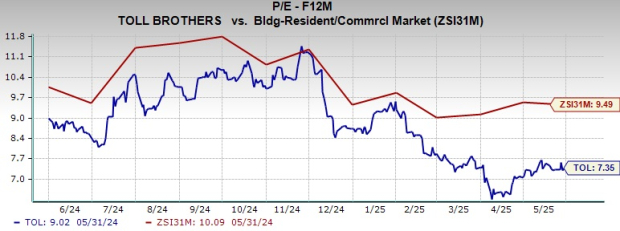

The company’s current valuation is enticing for investors to look into it. TOL stock is currently trading at a discount compared with its industry peers on a forward 12-month price-to-earnings (P/E) ratio basis. The discounted valuation indicates an attractive option for investors looking for a suitable entry point.

Persisting Affordability Concerns: The United States’ housing market continues to face affordability concerns as homebuyers navigate between high mortgage rates and home ownership. Per Freddie Mac, the 30-year fixed mortgage rate for the week ending May 29, 2025, stands at 6.89%, with the 52-week average for the past year being at 6.7%. The mortgage rate settling around the high range between 6% and 7% is the new normal, which the homebuyers are still getting adjusted to.

Macro Uncertainties: The Fed putting a pause to interest rate cuts, which is currently at a benchmark between 4.25% and 4.5%, has raised concerns in the market. The Fed remains cautious due to the possible economic impacts from the full implementation of the new tariff regime, which is expected to uplift inflationary pressures in the economy.

The tariffs are expected to elevate homebuilding costs and cause supply-chain inefficiencies, once fully implemented, deepening the risks engulfing the housing market. Although Toll Brothers does not expect to face any immediate supply-chain disruptions from tariffs as such, it continues to monitor developments closely to make necessary adjustments to address any challenges in the long term.

As discussed above, Toll Brothers enjoys a competitive advantage in the homebuilding industry due to its specialization in diversified luxury home offerings to a customer base that is on the wealthier side. Approximately 24% of its buyers pay in all cash (up from its long-term average of approximately 20%), which is proving to be a huge support for the company in ensuring profitability in the current uncertain macro environment.

However, partially offsetting these tailwinds come the market’s lingering sticky inflation and the ongoing tariff-related risk discussions, which are taking a toll on the company’s prospects.

Thus, by considering both sides of the coin, it is prudent for existing investors to retain this Zacks Rank #3 (Hold) company’s shares for now, whereas new investors might want to wait for a more favorable entry point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite