|

|

|

|

|||||

|

|

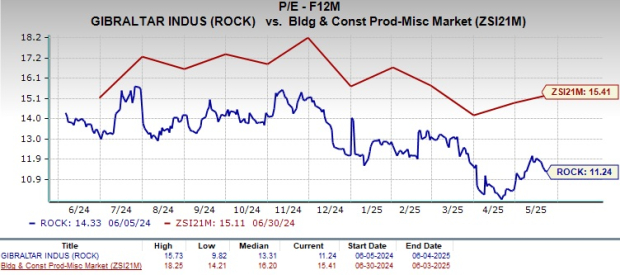

Gibraltar Industries, Inc.’s ROCK current valuation looks promising for investors. The stock is currently trading at a discount compared with the Building Products - Miscellaneous industry peers with a forward 12-month price-to-earnings (P/E) ratio of 11.24X. The stock’s current valuation is also below the broader Construction sector’s average of 17.71X and the S&P 500 index’s valuation of 21.82X.

The company’s focus on optimizing its business portfolio, expanding its margins and ensuring shareholder value is encouraging for its prospects. These tailwinds are likely to act as a catalyst in driving ROCK’s performance in the upcoming period, making it attractive for investors to add it to their portfolio. Although the ongoing macro risks surrounding tariffs, housing market softness and sticky inflation are concerning, the company is strongly navigating through them and outshining in the market.

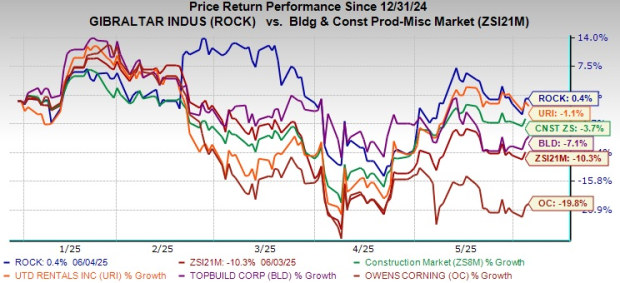

So far this year, ROCK’s share price performance has witnessed a rise of 0.5% against the industry’s and the sector’s declining trends. As evidenced from the chart below, even though the shares of the company did not move up significantly, the comparative positive trend induces a sense of optimism.

Moreover, Gibraltar also outperformed a few of its peers, including United Rentals, Inc. URI, Owens Corning OC and TopBuild Corp. BLD, year to date. During the said time frame, the share price performance of United Rentals, Owens Corning and TopBuild tumbled 1.1%, 19.8% and 7.1%, respectively.

Ensuring Portfolio Management: One of the primary focuses of the company is portfolio optimization and management. Through various inorganic and organic initiatives, it engages in enhancing its business portfolio to be able to offer better products to its customers. ROCK ensures sustainable investment of human and financial capital to provide profitable growth while expanding customer relations and market reach.

On March 31, 2025, the company completed two metal roofing acquisitions in the Residential segment for around $90 million in cash. The acquisition further expands its presence in the residential and light commercial metal roofing market. On Feb. 11, 2025, the company acquired Texas-based Lane Supply, with strong engineering and manufacturing capabilities serving national accounts across the United States. This $120 million strategic buyout has expanded its Agtech segment’s structures business, indicating accretive growth in 2025 and beyond.

Expanding Margins: Gibraltar is diligently working on expanding its margins through strategic in-house initiatives. Through solid execution and effective price/cost management, 80/20 initiatives and favorable business mix, the company has positioned itself well for expanding its margins in the remainder of 2025 and beyond.

In the first quarter of 2025, its adjusted operating margin expanded 120 basis points (bps) and the adjusted EBITDA expanded 170 bps year over year. Given the current market dynamics, Gibraltar has planned a balanced approach toward key focus areas for 2025. It aims to drive growth and improve margins through pricing, productivity under the 80/20 model, and by shifting toward higher-margin projects and channels.

Promising 2025 Outlook: Owing to the incremental benefits from the recently acquired businesses and the favorable market fundamentals, ROCK expects an upbeat performance in 2025, indicating notable year-over-year growth.

For the year, the company expects total net sales to be between $1.4 billion and $1.45 billion, indicating year-over-year growth between 6.9% and 10.7%. Adjusted earnings per share (EPS) are expected to be between $4.80 and $5.05, reflecting 12.9-18.8% year-over-year growth range.

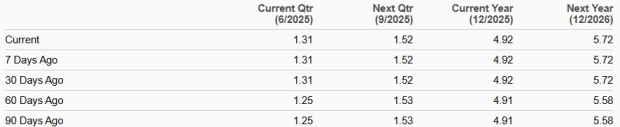

The favorable market fundamentals are likely to have led to bullish analysts’ sentiments, resulting in an upward revision in ROCK’s 2025 earnings estimates in the past 60 days. The 2025 EPS estimates have moved up 0.2% to $4.92, indicating 15.8% year-over-year growth. Moreover, the earnings estimates for 2026 have also moved up during the same time frame by 2.5%, reflecting 16.3% year-over-year growth.

EPS Trend

Per the above discussion, Gibraltar is well-positioned to navigate through the ongoing market uncertainties with support from its in-house capabilities, especially focusing on margin expansion and portfolio management. The incremental benefits from recently acquired businesses, the effective implementation of its 80/20 initiatives and the upbeat 2025 view compared with last year are encouraging for the investors.

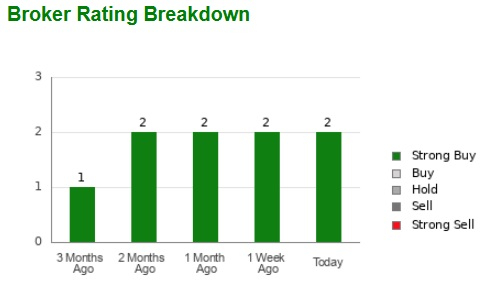

Analysts’ optimism regarding ROCK stock is reflected in the two of the two recommendations pointing at a "Strong Buy”.

Thus, by weighing both sides of the coin, it can be deduced that investors can consider adding this Zacks Rank #2 (Buy) stock to their portfolio for now. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite