|

|

|

|

|||||

|

|

In the dynamic world of fresh produce, Mission Produce Inc. AVO and Limoneira Company LMNR stand out as two uniquely positioned players competing for a slice of the farm-to-table value chain. Both companies operate in the high-demand, health-conscious fruit markets. Mission Produce is a global avocado heavyweight and Limoneira is a vertically integrated citrus grower with a growing avocado footprint. While the two companies share similarities in being farm-focused, vertically integrated and export-driven, their core business models, market reach, and growth strategies diverge significantly.

AVO dominates the avocado supply chain with global sourcing, distribution and ripening infrastructure, which fuels its market leadership across North America, Europe and Asia. In contrast, LMNR leverages its vast California land holdings and farming expertise to grow lemons, oranges and avocados, but it remains more concentrated geographically and is exposed to agricultural cycles. AVO emphasizes global logistics and scale, and LMNR is focused on diversified farming and real estate value.

As consumer demand for fresh, healthy produce surges and weather volatility challenges growers, the question emerges: Which company is better positioned to capture long-term value? This face-off breaks down how AVO and LMNR stack up in terms of market share, operating strategy, financial health and growth potential.

Mission Produce continues to reinforce its leadership in the global avocado market. As one of the largest players in the industry, it commands a significant market share in fresh Hass avocados, supplying more than 25 countries through a tightly integrated network that includes sourcing from more than 20 growing regions and five state-of-the-art packing facilities.

In second-quarter fiscal 2025, the company reported a 28% year-over-year increase in revenues to $380.3 million, driven by strong pricing despite flat volumes. Mission Produce sold more than 166 million pounds of avocados for $2.00 per pound, up from $1.59 last year, which is a testament to its pricing power and category resilience.

Strategically, AVO is not just selling fruit — it is building an ecosystem. Its vertically integrated model supports year-round supply, while its global Marketing & Distribution segment remains the primary growth engine. The company’s mango business is gaining share rapidly, helping diversify its product mix, and operations in the U.K. are showing strong customer traction post-investment.

AVO's target demographic spans health-conscious consumers and premium retailers, and the brand’s expansion into mangos and blueberries positions it to serve adjacent high-growth produce categories. Meanwhile, digital tools like “Mission Control” ensure end-to-end traceability, ripening optimization and seamless fulfillment.

Financially, Mission Produce is balancing growth with discipline. Adjusted EBITDA was $19.1 million in the fiscal second quarter, and adjusted net income stood at $8.7 million despite higher SG&A and temporary pressures from tariffs and facility closures. The company also executed $5.2 million in share repurchases, signaling confidence in its valuation. As demand grows and global supply chains evolve, AVO’s multi-crop portfolio, international farming scale and tech-enabled operations provide a differentiated, defensible position in the more than $15-billion global avocado market.

Limoneira, a legacy name in U.S. agriculture, is reshaping its business model through strategic consolidation and operational sharpening. Despite a challenging second-quarter fiscal 2025, with revenues falling 21% year over year to $35.1 million and a loss per share of 20 cents, the company is taking bold steps to strengthen its market position.

LMNR’s landmark move of partnering with Sunkist Growers to transition citrus sales and marketing operations looks promising. The deal is set to save $5 million annually and expand access to top-tier foodservice and retail clients, boosting efficiency and stabilizing margins. While not as dominant in avocados as Mission Produce, LMNR remains one of the largest avocado growers in the United States, with plans to expand by 2,000 acres by fiscal 2027.

What sets Limoneira apart is its diversified asset base. Beyond citrus and avocados, it is advancing real estate, monetizing water rights and shedding non-core assets to unlock value. Its portfolio spans lemons, oranges, avocados and wine grapes, serving retail, foodservice and quick-serve channels. Unlike AVO’s global logistics model, LMNR leans on land-based integration, packing efficiency and deep grower ties across California and Arizona.

Although digital innovation is not at the forefront of LMNR’s strategy, its growth pipeline is increasingly aligned with technology-driven efficiencies, focused on streamlining operations, lowering costs and shifting toward higher-margin channels. In second-quarter fiscal 2025, the company reported an adjusted EBITDA loss of $167,000, hit by industry headwinds and transitional costs.

However, management expects a rebound in the second half as lemon pricing improves and the Sunkist partnership begins to deliver synergies. With maturing avocado plantings, monetization of real estate and water assets, and a more efficient citrus platform, Limoneira is positioning itself as a compelling turnaround play, bridging traditional agriculture with sustainable, land-backed value creation for long-term investors.

The Zacks Consensus Estimate for Mission Produce’s fiscal 2025 sales and EPS implies year-over-year declines of 6.6% and 32.4%, respectively. EPS estimates have been unchanged in the past 30 days. AVO’s annual sales and earnings are slated to decrease 3.2% and 6% year over year, respectively, in fiscal 2026.

The Zacks Consensus Estimate for Limoneira’s fiscal 2025 sales and EPS suggests year-over-year declines of 4.7% and 74.2%, respectively. EPS estimates have been unchanged in the past 30 days. LMNR’s annual sales and earnings are slated to increase 12.7% and 68.75% year over year, respectively, in fiscal 2026.

Mission Produce and Limoneira have experienced stable estimates in the past 30 days. Additionally, EPS estimates for both companies suggest year-over-year declines in fiscal 2025.

In the past three months, the AVO stock had the edge in terms of performance, having recorded a total return of 16%. This has noticeably outpaced the benchmark S&P 500’s return of 9.2% and LMNR’s 15.2% decline.

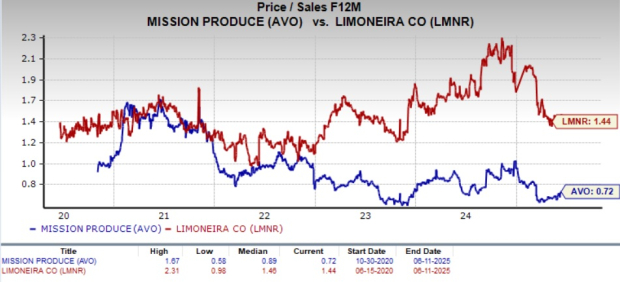

From a valuation perspective, Mission Produce trades at a forward price-to-sales (P/S) multiple of 0.72X, which is below its 5-year median of 0.89X. Moreover, the AVO stock trades below Limoneira’s forward 12-month P/S multiple of 1.44X and a 5-year median of 1.46X.

At current levels, AVO appears attractively priced relative to LMNR, offering a compelling case for value-focused investors seeking exposure to the fresh produce sector with a stronger growth and earnings profile. Despite short-term margin compression, Mission Produce maintains industry leadership in global avocado distribution, supported by a vertically integrated supply chain, broad international reach, and a growing presence in adjacent categories like mangos and blueberries.

In contrast, LMNR is undergoing a strategic transformation that, while promising long-term, brings more near-term uncertainty. With top-line pressure, a transition of citrus sales to Sunkist, and avocado volumes impacted by alternate bearing cycles, LMNR's recovery story may take longer to materialize. For investors prioritizing scale, category leadership and global distribution capabilities, AVO presents a clearer and more immediate path to value creation.

Mission Produce emerges as the stronger investment case, thanks to its solid stock performance, attractive valuation and clear growth trajectory. While both companies are exposed to the same broader produce market, AVO’s scale, global distribution network and diversified product mix give it a competitive edge. Its ability to maintain volume stability, expand into new categories like mangos and blueberries, and leverage technology to optimize margins positions it well for continued momentum.

Moreover, AVO’s consistent earnings potential and growth initiatives reflect a business model that aligns with investor optimism. From operational execution to shareholder returns, the company demonstrates resilience and discipline in a volatile agricultural landscape.

While LMNR has long-term promise with its land-based assets and strategic shifts, AVO offers a more immediate and well-rounded opportunity for investors seeking exposure to fresh produce with both defensive strength and growth upside. AVO and LMNR currently carry a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-26 | |

| Feb-24 | |

| Feb-23 | |

| Feb-22 | |

| Feb-18 | |

| Feb-16 | |

| Feb-16 | |

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-04 | |

| Jan-28 | |

| Jan-28 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite