|

|

|

|

|||||

|

|

Carvana CVNA and AutoNation AN are both major names in U.S. auto retail, but they’ve built their businesses on very different foundations. For growth-focused investors, understanding these business models is key to deciding which stock offers stronger upside ahead.

Carvana operates entirely online, selling used vehicles through a digital-first model that removes the need for traditional dealerships. AutoNation, on the other hand, runs a large network of physical stores, selling both new and used cars while expanding its digital presence alongside. As both companies navigate evolving consumer behavior, supply chain shifts, and growing tariff concerns, let's find out which could be a better growth play now.

Carvana has steadily grown into the second-largest used car retailer in the United States, leveraging a fully digital platform that aims to simplify and streamline the car-buying process. Its focus on technology allows it to operate without the heavy physical footprint that traditional auto retailers maintain, giving it more flexibility as market conditions shift. The company’s highly visible car vending machines serve more as a marketing tool than core infrastructure, as most of the customer experience happens online.

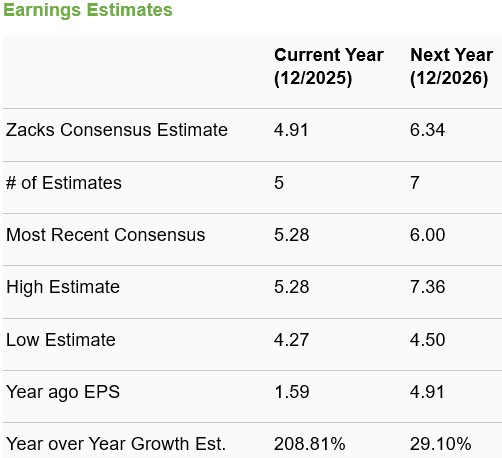

Over the past year, Carvana’s operating performance has strengthened meaningfully. The company has exceeded earnings expectations for four consecutive quarters, consistently selling more than 100,000 retail units per quarter. In the last reported quarter, earnings per share more than doubled compared to a year earlier, with retail unit sales rising nearly 46% year over year. Management expects both quarterly and full-year growth to remain strong in 2025.

Operational efficiency improvements have been central to Carvana’s turnaround. The company has reduced much of its reconditioning and transportation functions, optimized staffing levels, and applied proprietary logistics software to better manage inventory flow. These measures have supported margin expansion. Adjusted EBITDA reached a record $488 million in the latest quarter, while adjusted EBITDA margin climbed to 11.5%, well above industry norms. Gross profit per unit improved 8% year over year, reflecting both operational discipline and pricing power.

Tariff-related uncertainty, which poses a risk for much of the auto industry, may provide a relative advantage for Carvana. As tariffs drive up the price of new vehicles, some consumers may shift toward used cars, benefiting Carvana’s model. CEO Ernie Garcia has suggested that Carvana’s value positioning could gain further traction if pricing spreads between new and used cars widen.

The company’s balance sheet remains the key area of caution. As of March 31, 2025, Carvana carried $5.26 billion in long-term debt against $1.8 billion in cash. Its debt-to-capital ratio of 0.75 is significantly higher than that of its peers, creating added financial leverage risk. However, for growth investors willing to tolerate some balance sheet risk, Carvana’s scaling ambitions remain highly attractive.

Management remains focused on scaling further. Carvana has outlined long-term goals of reaching 3 million units sold annually with EBITDA margins of 13.5% within the next 5 to 10 years, signaling confidence in its platform’s scalability.

Take a look at the consensus EPS estimates for CVNA below.

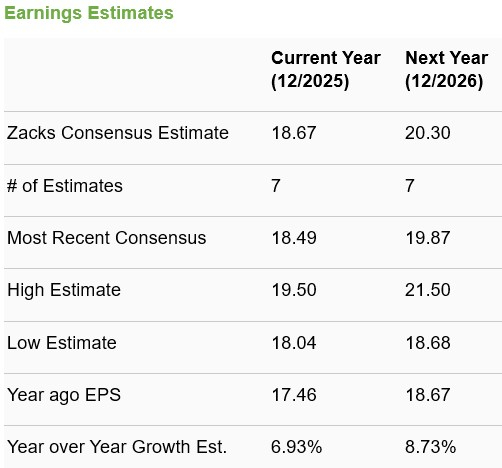

AutoNation approaches auto retail from a more diversified base, combining its broad physical dealership network with digital initiatives. The company sells both new and used vehicles, while also generating steady income from higher-margin services like repairs, financing, and fleet management. This multi-channel model gives AutoNation a more balanced revenue stream, helping it absorb market shifts and economic cycles more effectively.

The company’s finance arm has become a meaningful contributor. Expanded loan penetration across nearly all franchise locations has driven improved profitability, while delinquency rates remain low. AutoNation’s acquisition of CIG Financial has further enhanced its financing operations. Digitally, the rollout of AutoNation Express and a minority stake in TrueCar reflect the company’s efforts to strengthen its online presence while leveraging its large dealership footprint. AutoNation continues to grow its store base as well. In March 2025, it acquired two Colorado dealerships, adding over $200 million in annualized revenues.

However, AutoNation faces several challenges. Roughly half of its revenues are tied to new vehicle sales, making it more vulnerable to tariff-related cost pressures. Higher input costs could force AutoNation to offer greater discounts or incentives to sustain sales volume, compressing margins in the process. In its last reported quarter, gross profit per new vehicle sold declined 15.8%.

Profitability has also come under pressure. EBITDA margins remain below 6%, roughly half of Carvana’s level. Cost efficiency has weakened, with SG&A as a percentage of gross profit climbing from under 60% in 2021-2022 to roughly 67% currently. Management expects this elevated cost structure to persist in the near term.

That said, AutoNation remains active in returning capital to shareholders. The company repurchased 2.9 million shares for $460 million in 2024, followed by another $254 million in buybacks early in 2025. As of April 23, 2025, it had $607 million remaining under its current repurchase authorization. From a balance sheet perspective, AutoNation holds $3.96 billion in non-vehicle debt, with a long-term debt-to-capital ratio of 0.58 — more moderate than Carvana’s leverage but still notable.

Take a look at the consensus EPS estimates for AN below.

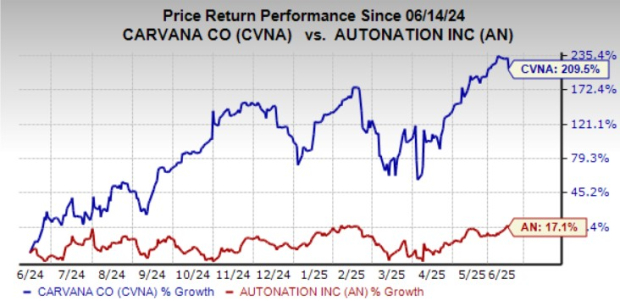

Over the past year, Carvana shares have rocketed more than 200%, while AutoNation stock has gained 17%.

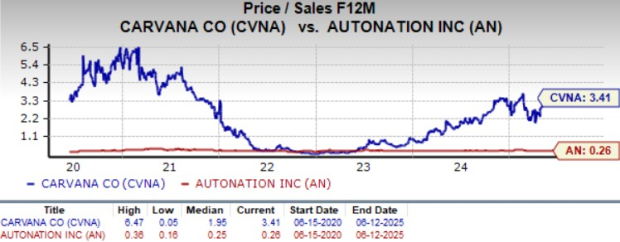

Carvana is trading at a forward sales multiple of 3.41, quite above its median of 1.95X, over the last five years. AN’s forward sales multiple sits at 0.26, compared with its median of 0.25X over the last five years.

Sure, Carvana seems pricey. But its valuations also reflect its high growth expectations and improving profitability. If management continues to execute, these valuations may prove justified for investors seeking high-growth exposure.

Both Carvana and AutoNation bring strength to the table, but Carvana stands out as the stronger pick for investors looking ahead.

AutoNation’s diversified model provides stability, but rising tariffs, shrinking margins, and higher operating costs are starting to weigh on its near-term growth potential. AN currently carries a Zacks Rank #3 (Hold) and has a Growth Score of B.

In contrast, Carvana’s digital-first, used-car-only approach is well-suited for an environment where affordability is becoming increasingly important. The company is showing solid momentum — from strong sales growth and improving margins to record EBITDA performance — all while steadily executing on operational improvements. While its debt load is worth monitoring, Carvana’s long-term plan to scale sales to 3 million units with industry-leading profitability points to meaningful upside.

Backed by stronger earnings growth expectations, a solid price momentum and a Zacks Rank #1 (Strong Buy) with a Growth Score of A, Carvana offers growth-oriented investors a more attractive growth story in the auto retail landscape.

You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 9 hours | |

| 9 hours | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite