|

|

|

|

|||||

|

|

Reddit RDDT and Nextdoor KIND operate community-driven social platforms, offering investors exposure to both global and localized engagement. RDDT facilitates interest-based conversations across diverse subject matter, while KIND connects neighbours through local updates and utility.

Per a Technavio report, the social networking market is expected to grow by $312.3 billion from 2024 to 2029, witnessing a CAGR of 21.6%, supported by rising Internet penetration and increased demand for targeted social media advertising. Both Reddit and Nextdoor are positioned to benefit from this market expansion as advertisers seek platforms with strong user engagement and community trust.

RDDT or KIND - Which of these Social Networking stocks has the greater upside potential? Let’s find out.

Reddit is benefiting from strong advertiser adoption and enhanced user engagement. In the first quarter of 2025, revenues jumped 61% year over year to $392.4 million, driven by higher impressions, improved ad load and increased investment from performance advertisers. Advertising revenues contributed $358.6 million (up 61% year on year), beating the Zacks consensus estimate by 5.87%.

User metrics have been showing significant expansion across the platform. During the first quarter of 2025, Daily Active Uniques were 108.1 million, while Weekly Active Uniques were 401.3 million. Both metrics increased 31% year over year. Mobile app usage grew 45% year on year, supporting higher engagement levels across Reddit’s ecosystem of over 100,000 communities.

Reddit continues to strengthen its platform through AI-led features aimed at improving content discovery. Reddit Answers, the generative AI search experience, reached one million weekly users and integration into core search results is expected to enhance content relevance and user experience. Global expansion into the U.K. and Australia is a key catalyst.

RDDT has upgraded its business-facing toolkit, Reddit Pro, with features that simplify onboarding, profile setup and campaign management. These enhancements help advertisers surface relevant community conversations and improve visibility across paid and organic placements.

Backed by strong top-line growth, expanding user metrics and product innovation, Reddit remains well-positioned to capture incremental advertiser spending and drive commercial adoption.

Nextdoor is focusing on building advertiser momentum, enhancing its product experience and maintaining user growth. In the first quarter of 2025, revenues increased 2% year over year to $54 million, driven by higher spending from large advertisers and improving traction in alternative demand channels. However, the figure lagged the Zacks Consensus Estimate by 1.3%.

User metrics reflected steady expansion. Weekly Active Users (WAUs) increased 6% year over year to 46.1 million. Platform WAU’s (users engaging with KIND’s owned and operated surfaces) grew 5% year over year to 22.5 million, supported by increased engagement across key surfaces and improved feed personalization.

Nextdoor continues to advance its product portfolio through the NEXT redesign initiative, which is focused on improving content discovery and platform usability. In the first quarter, the company onboarded over 3,000 local publishers and introduced real-time alert systems for weather and safety updates, expanding the relevance of community content.

Nextdoor launched AI-powered discovery tools such as Faves and enhanced personalization systems, reinforcing its position as a trusted neighbourhood platform. These initiatives are aimed at increasing engagement depth and supporting long-term monetization opportunities.

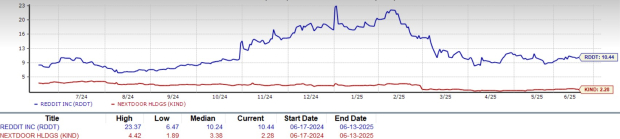

In the year-to-date period, shares of Reddit and Nextdoor have lost 27.7% and 35.8%, respectively. The dip in RDDT and KIND’s share price can be attributed to the challenging macroeconomic environment. A broader market weakness in the tech sector and persistent fear over mounting tariffs have added to the pressure.

Valuation-wise, both RDDT and KIND shares are currently overvalued as suggested by a Value Score of F.

In terms of the forward 12-month Price/Sales, RDDT shares are trading at 10.46X, which is higher than KIND’s 2.28X.

The Zacks Consensus Estimate for RDDT’s 2025 earnings is pegged at $1.21 per share, unchanged over the past 30 days, indicating a 136.34% rise year over year.

Reddit Inc. price-consensus-chart | Reddit Inc. Quote

The consensus estimate for KIND’s 2025 loss is pegged at 20 cents per share, unchanged over the past 30 days, but narrower than the year-ago quarter’s loss of 25 cents per share.

Nextdoor Holdings, Inc. price-consensus-chart | Nextdoor Holdings, Inc. Quote

While both Reddit and Nextdoor stand to benefit from the booming social networking market, Reddit appears better positioned with robust revenue growth, an expanding product portfolio and growing adoption of AI-driven tools. Strong user metrics, improving profitability and growing international traction are helping RDDT gain momentum with advertisers and deepen community engagement across its platform.

Meanwhile, Nextdoor is still in the early stages of scaling its platform. Despite efforts to improve product experience, onboard local publishers and reduce costs, revenue growth remains modest and losses persist.

Currently, Reddit carries a Zacks Rank #3 (Hold), while Nextdoor has a Zacks Rank #4 (Sell), making RDDT a relatively stronger pick at this point.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 hours | |

| Mar-08 | |

| Mar-08 | |

| Mar-08 | |

| Mar-07 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-05 | |

| Mar-04 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite