|

|

|

|

|||||

|

|

Wix.com Ltd. WIX recently acquired Base44, an innovative AI-powered platform that empowers users to build fully functional custom software solutions using natural language – no coding required. The buyout not only bolsters Wix’s AI portfolio but also redefines the future of application development.

The technology landscape is undergoing a fundamental transformation. Traditional development models are shifting to intent-driven software creation, an approach where users simply express what they want, and intelligent systems handle execution. This initiative, referred to as “vibe coding,” is gaining strong traction in the market. As the demand rises for tools that transform ideas into reality using natural conversation and intuition instead of coding, Wix aims to make the digital space more open, creative and user-friendly than ever.

Base44’s core innovation lies in its fully automated, chat-based development environment. The platform allows users to build scalable, production-ready applications just by conversing with it. Its B2B traction with clients like eToro and SimilarWeb strengthens the platform’s viability and real-world applicability. The acquisition by Wix is likely to augment Base44’s reach, user adoption and innovation.

From setting up databases and managing authentication to handling infrastructure and deployment, Base44 streamlines the process of software creation.

The integration of Base44 into the Wix AI ecosystem significantly expands the company’s portfolio of intelligent creation tools. Wix has been gradually embedding AI across its platform, from AI website generators to intelligent design and content creation tools. With Base44, Wix positions itself as not only a website builder but a comprehensive digital creation platform.

Wix.com Ltd. price-consensus-chart | Wix.com Ltd. Quote

Under the terms of the deal, Wix acquired Base44 for an initial consideration of roughly $80 million, with additional earn-out payments extending through 2029 based on performance milestones. Wix expects to incur around $25 million in retention bonus payments for Base44 employees in 2025, supporting talent retention and product continuity.

The company expects an inconsequential contribution to 2025 bookings and revenues, highlighting the deal's long-term implications. These expenses will be excluded from non-GAAP and free cash flow metrics, helping investors better understand the company’s core operating performance.

Base44 will retain its identity and continue operating as a distinct product and business unit within Wix. This will allow the Base44 team to maintain product authenticity and innovation while tapping into Wix’s robust resources.

Wix is doubling down on strategic AI investments across its platform, focusing on WIX Studio, commerce tools and generative AI. WIX Studio now has more than 2 million accounts, with 75% from new Partners, making it a top choice for agencies and professionals. The company is embedding AI assistants to boost efficiency and conversion rates. In May 2025, it launched the Model Context Protocol Server, enabling developers to build solutions using tools like Claude and Cursor.

Wix has launched Wixel, a next-gen visual design platform that combines top AI models, a simple UI and advanced features. It lets anyone create high-quality photo and video content in just a few clicks, no design experience needed. Wixel supports Wix’s mission to empower creators by removing barriers. Similar to its impact on website building in 2006, Wix now aims to reshape digital design. The company has also partnered with Microsoft to integrate Wixel’s design tools into Microsoft Copilot.

It recently announced the acquisition of Hour One, a pioneer in generative AI media creation. This move strengthens Wix’s position at the forefront of AI-driven digital experiences, enhancing its capabilities in advanced web and visual design. Bringing this technology in-house allows the company to maintain greater control over front-end innovations, reduce third-party dependencies and manage costs more effectively.

Amid the ongoing macroeconomic uncertainty, Wix has taken a cautious stance on its full-year outlook, especially for its Business Solutions unit. Commerce and GPV are more sensitive to consumer trends and economic shifts. While easing forex pressure offers some short-term relief, it doesn’t offset larger risks. Though current fundamentals look stable, the environment remains fragile and could change quickly.

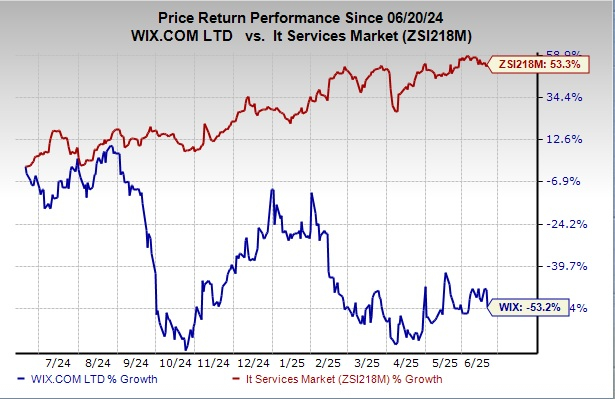

WIX currently carries a Zacks Rank #3 (Hold). Shares of the company have declined 53.2% in the past year against the Computers - IT Services industry's growth of 53.3%.

Some better-ranked stocks from the broader technology space are Juniper Networks, Inc. JNPR, Arista Networks, Inc. ANET and Ubiquiti Inc. UI. JNPR presently sports a Zacks Rank #1 (Strong Buy), while ANET and UI carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Juniper is leveraging the 400-gig cycle to capture hyperscale switching opportunities inside the data center. The company is set to capitalize on the increasing demand for data center virtualization, cloud computing and mobile traffic packet/optical convergence. Juniper also introduced new features within the AI-driven enterprise portfolio that enable customers to simplify the rollout of their campus wired and wireless networks while bringing greater insight to network operators. In the last reported quarter, it delivered an earnings surprise of 4.88%.

Arista delivered a trailing four-quarter average earnings surprise of 11.82% and has a long-term growth expectation of 14.81%. Arista currently serves five verticals, namely cloud titans (customers that deploy more than 1 million servers, cloud specialty providers, service providers, financial services and the rest of the enterprise. It supplies products to a prestigious set of customers, including Fortune 500 global companies in markets such as cloud titans, enterprises, financials and specialty cloud service providers.

Ubiquiti’s effective management of its strong global network of more than 100 distributors and master resellers improved its visibility for future demand and inventory management techniques. In the last reported quarter, Ubiquiti delivered an earnings surprise of 33.3%. Its highly flexible global business model remains well-suited to adapt to the changing market dynamics to overcome challenges while maximizing growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-07 | |

| Feb-07 | |

| Feb-07 | |

| Feb-07 | |

| Feb-07 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 |

Dow Jones Tops 50,000 As Apple, Boeing, JPMorgan Flash Buy Signals; Is AI Trade Reviving?

ANET +6.85%

Investor's Business Daily

|

| Feb-06 |

Insurance Leader Hamilton Breaks Out Amid Stock Market Volatility

ANET +6.85%

Investor's Business Daily

|

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite