|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Cal-Maine Foods, Inc. CALM and Tyson Foods TSN are leading U.S. producers in protein-based food products, eggs for CALM and meat (chicken, beef, pork) for TSN. Both operate in the essential food sector with exposure to commodity price swings and consumer staple demand.

Ridgeland, MS-based Cal-Maine, with a market capitalization of $4.6 billion, is the nation’s largest producer and distributor of fresh shell eggs. Its diverse offerings include conventional, cage-free, organic, brown and ready-to-eat egg products catering to a broad range of consumer preferences.

Springdale, AR-based Tyson, with a market capitalization of $19.4 billion, is a well-known food company and recognized leader in protein. It operates in four reportable segments- Beef, Pork, Chicken, and Prepared Foods - and has a portfolio of iconic products and brands. Its wide distribution network serves grocery stores, restaurants, institutions, and international markets through various channels.

As consumer focus on a protein-rich diets grows, both companies are well-positioned to gain. We compare the fundamentals, growth potential and risks associated with CALM and TSN to determine which stock presents a more compelling investment opportunity.

In third-quarter fiscal 2025 (ended March 1, 2025), CALM reported earnings per share of $10.38, a significant improvement from earnings of $3.00 in the year-ago quarter. Revenues surged 102% year over year to $1.42 billion, driven by higher net average selling price of shell eggs and increased total dozens sold.

Farm production costs per dozen were 5.7% lower year over year, due to more favorable commodity pricing for key feed ingredients. Feed costs per dozen were down 9.6% year over year, mainly owing to lower prices for soybean meal.

Egg prices had reached record highs due to the supply disruption caused by the outbreaks of the highly pathogenic avian influenza (HPAI) across poultry farms across the United States, impacting supply. However, egg prices have eased recently with lower occurrences HPAI being reported.

The demand for eggs remains strong, as it is being valued as the cheapest source of high-quality protein and increasingly favored for healthy eating. Also, demand for cage-free and pasture-raised eggs is on the rise, driven by consumer preference for ethical and sustainable production methods.

Backed by a debt-free balance sheet and a $250 million credit line (plus $200 million accordion feature), Cal-Maine is well-positioned to fund investments on organic and bolt-on growth focused on cage-free and prepared egg products.

Notably, the company is on track to complete $60 million in capital projects by the end of this year, which will add production capacity for 1.1 million cage-free layer hens and 250,000 pullets.

Recent strategic acquisitions have bolstered capacity and expanded its product portfolio to include value-added egg products. Investments include Meadowcreek Foods (hard-cooked eggs) and Crepini Foods (including egg wraps and protein pancakes), aiming to broaden retail reach. Cal-Maine recently acquired Burlington, WI-based Echo Lake Foods, a producer of ready-to-eat egg and breakfast products, marking its entry into the growing value-added egg segment. Also, the acquisition of certain assets and the retail feed sales business of Deal-Rite Feeds, Inc will help CALM in reducing feed costs and logistical complexity.

In the second quarter of fiscal 2025 (ended March 29, 2025), Tyson Foods’ revenues were reported at $13 billion as higher average sales prices were offset by overall lower volumes.

While volumes continued to increase in the Chicken segment for the second consecutive quarter, it was offset by lower volume in Beef, Pork and Prepared Foods segments. Increased pricing in the Beef, Pork and Prepared Foods segments were partially offset by lower prices in the Chicken segment.

However, cost of sales was up 2% due to higher input costs, particularly cattle and hog prices, as well as raw materials impacting Prepared Foods. Only the Chicken segment saw cost relief from lower feed prices and its adjusted operating income almost nearly doubling year over year. TSN’s adjusted earnings per share were 92 cents, marking a 48% increase from prior year aided by operational efficiency.

The Chicken segment remains a top performer, benefiting from lower costs, improved efficiencies and rising volumes. Conversely, the Beef segment continues to face pressure amid an unfavorable cattle cycle.

With strong consumer demand for protein, Tyson is making targeted investments to modernize and expand capacity while enhancing its iconic brands to boost reach and drive innovation. The company is also focused on operational excellence by striving to improve efficiency and reducing waste—particularly in Prepared Foods. It also continues to manage its debt prudently, with a current debt-to-capital ratio of 0.33.

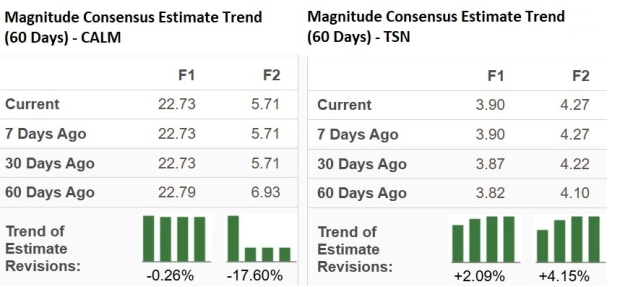

The Zacks Consensus Estimate for Cal-Maine’s fiscal 2025 earnings is $22.73 per share, indicating a year-over-year upsurge of 299.5%. The estimate for fiscal 2026 of $5.71 indicates a 74.9% decline. EPS estimates for both fiscal 2025 and 2026 have been trending south over the past 60 days.

The Zacks Consensus Estimate for Tyson’s fiscal 2025 earnings is $3.90 per share, indicating a year-over-year rise of 25.81%. The 2026 estimate of $4.27 implies growth of 9.5%. Both the estimates for fiscal 2025 and fiscal 2026 has moved up in the past 60 days.

(Find the latest earnings estimates and surprises on Zacks Earnings Calendar.)

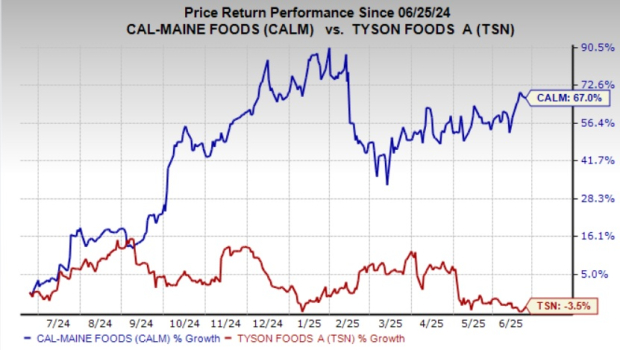

In the past year, Cal-Maine stock has gained 67% against Tyson’s 3.5% decline.

Cal-Maine is currently trading at a forward 12-month earnings multiple of 17.79X. Meanwhile, Tyson Foods is trading at a forward 12-month earnings multiple of 13.23X.

Both Cal-Maine and Tyson are actively expanding production capacity and diversifying product offerings to meet growing consumer demand for protein. However, Cal-Maine faces near-term headwinds from easing egg prices, which could pressure its results. In contrast, Tyson is benefiting from improved performance in its Chicken segment, which has shown strong operational efficiency gains.

From a valuation standpoint, Tyson appears more attractive, boasting a cheaper valuation and a Value Score of A. TSN stock’s Zacks Rank #3 (Hold), combined with upbeat earnings growth projections and upward estimate revisions, makes it the more compelling investment option at this time. Cal-Maine has a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-19 | |

| Feb-19 | |

| Feb-14 | |

| Feb-13 | |

| Feb-12 | |

| Feb-10 | |

| Feb-10 | |

| Feb-07 | |

| Feb-06 | |

| Feb-06 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite