|

|

|

|

|||||

|

|

Toast Inc. TOST and Lightspeed Commerce Inc. LSPD are leading providers of point-of-sale (POS) solutions. Toast is primarily restaurant-focused, while Lightspeed caters to restaurants and retail, positioning them as direct competitors in the hospitality tech space.

This makes the comparison intriguing for investors looking to invest in the POS space, which is expected to witness a CAGR of 8.1% between 2025 and 2030 and reach $181.47 billion, per a Grand View Research report.

Let’s deep dive and find out which POS stock offers greater upside in this fast-growing market.

Increasing location growth and net additions bodes well. It ended with approximately 140,000 total customer locations globally at the end of the first quarter, reflecting 25% year-over-year growth. It reported more than 6,000 net locations in the first quarter. Management expects to post record net adds in the current quarter, and 2025 is now expected to top 2024’s full-year net additions. TOST has only 10% penetration into its 1.4 million location TAM, thereby offering a substantial long-term expansion opportunity.

Apart from increasing locations and market share in its core U.S. restaurant business, Toast is making progress in three new growth vectors: enterprise, international, and food & beverage retail. Wins like Applebee’s and Topgolf reflect that its enterprise momentum is strong. It has set a target to cross 10,000 locations by the end of 2025 across these three new growth areas. To boost its international footprint, Toast has added loyalty, e-mail marketing, and guest book to its product offerings and consequently has managed to double guest attach rate over the past year for the most recent locations that went live.

Toast’s AI-powered tools are positioning it to stay ahead of the curve in restaurant technology. Sous Chef, its AI assistant, is designed to support restaurant operators. Currently, in pilot testing, it’s showing promising early results and continues to improve with customer feedback. Building on this, it has developed ToastIQ, an AI-powered intelligence engine that combines restaurant expertise, data and AI to enhance its platform. Early adopters, such as Mission Boathouse in Massachusetts and Felipe’s Taqueria, have experienced a positive impact. TOST also enhanced reporting, payroll and accounting tools and introduced a Benchmarking tool to help restaurants manage costs and gain insights. This transition to a full-stack solutions provider bodes well.

Management highlighted that it was closely monitoring the macro environment and emphasized restaurants' ability to navigate macro challenges. Despite Toast’s confidence, the restaurant industry is still highly sensitive to consumer spending, labor inflation and supply chain volatility. A consumer downturn or cost pressures could reduce restaurant spend on technology, thereby impacting TOST’s performance.

Decline in Gross Payment Volume or GPV per location is another problem, as it implies lower average transaction volumes. TOST’s overall GPV surged 22% year over year to $42 billion in the first quarter, but GPV per location declined 3% year over year. TOST added that it expects GPV per location to remain down in a similar range in the current quarter. Higher costs and competitive pressure from various small and big players who are also vying for a larger share of this lucrative market are other headwinds.Subscription revenue was up 38% driven by improved ARR to revenue conversion, but expects subscription revenue growth to “return to more normalized levels” in the latter half of 2025.

Unlike TOST, Lightspeed has a presence across retail, hospitality and golf businesses. Fiscal 2025 revenues surged 18% and crossed $1 billion in annual revenues for the first time.

Lightspeed’s strategic pivot toward North American Retail and European Hospitality, two verticals with high potential, bodes well. In the last reported quarter, customer locations in these growth markets increased more than 3% year over year, while GTV for these customers rose 6%, despite the pivot only ramping up in December 2024.

Lightspeed is heavily investing in innovation to enhance its platforms, allocating 35% more in product development in fiscal 2026 than in fiscal 2025. Within retail, some of the innovations include a generative AI-powered web builder, omni gift cards, sales visualization, improved operational control and online reach for clients (including seasonal trends and inventory planning tools). For Hospitality, key innovations include Google integration with “order anywhere,” advanced production instructions and consolidated items features.

Lightspeed Payments continues to be a significant growth driver. In the last reported quarter, Transaction-based revenues were up 14% to $157.8 million, while GPV increased 40%. Software ARPU rose 11%, driven by a shift toward high GTV customers, cost optimization and higher new module adoption. Margin-rich initiatives like capital programs (Lightspeed Capital) delivered gross margins above 90%. Overall, gross profit grew 12% year over year.

Nonetheless, persistent macroeconomic headwinds and demand uncertainty continue to be an overhang. In the last quarter, GTV was flat at $20.6 billion, due to same-store sales softness across rest of world markets. Moreover, Lightspeed’s revenue guidance of 10% to 12% growth for the current fiscal year is less than the 18% growth it delivered in fiscal 2025. Lightspeed also faces intensifying competition in both of its core verticals. In North America retail, Block and Toast are all expanding in POS and payment integration. In European hospitality, regional players offer strong competition.

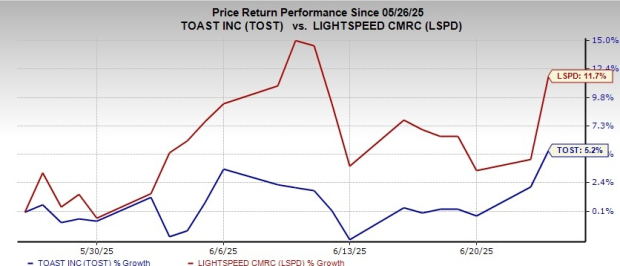

LSPD shares have appreciated 11.7% while TOST stock has gained 5.2%.

Valuation-wise, both TOST and Lightspeed are overvalued, as suggested by the Value Score of F.

In terms of Price/Book, TOST shares are trading at 13.28X, higher than LSPD’s 1.04X.

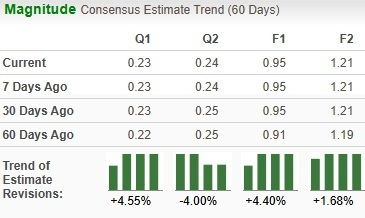

Analysts have marginally revised their earnings estimates upward for TOST’s bottom line for the current year.

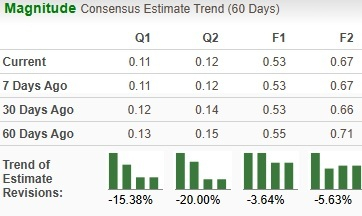

For LSPD, there is a marginal downward revision for the current year.

TOST and LSPD currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While both Toast and Lightspeed face macro and competitive challenges, Lightspeed offers a more diversified revenue base across retail, hospitality, and golf, reducing reliance on any one segment like Toast’s restaurant-heavy model, making it a slightly more compelling investment option.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-10 | |

| Feb-10 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite