|

|

|

|

|||||

|

|

TransMedics Group, Inc. TMDX is well-poised for growth in the coming quarters, courtesy of its strength in OCS technology. The optimism, led by solid first-quarter 2025 results, is expected to contribute further. However, concerns due to gross margin pressure and U.S transplant volume headwinds persist.

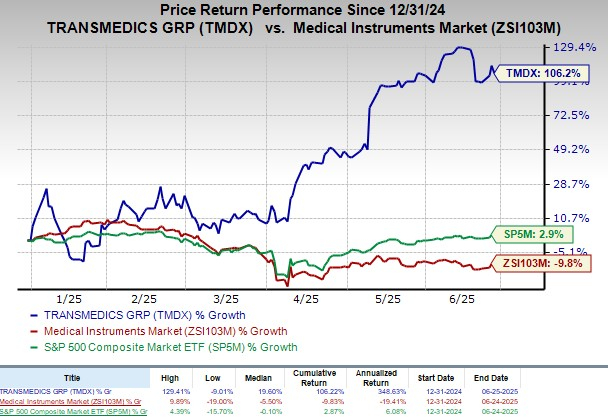

This Zacks Rank #3 (Hold) company has skyrocketed 106.2% in the year-to-date period against a 9.8% decline of the industry. The S&P 500 has witnessed 2.9% growth in the said time frame.

The renowned organ transplant therapy provider has a market capitalization of $4.49 billion. TransMedics’ earnings yield of 1.4% compares favorably with the industry’s (3.3%). The company’s earnings surpassed the Zacks Consensus Estimate in three of the trailing four quarters, missing once, with the average surprise being 39.1%.

NOP Boosting OCS Growth Further: Complementing its technological edge, TransMedics’ National OCS Program (“NOP”) offers a fully integrated, end-to-end organ procurement and delivery service, accelerating adoption by streamlining logistics and clinical execution. The NOP manages OCS perfusion, provides procurement surgeons and clinical specialists, and operates a proprietary transportation network, including 21 aircraft (22 by 2025-end), which supported 78% of all air transport missions, up from 75% in the fourth quarter of 2024.

By centralizing expertise and ensuring timely, controlled delivery, the NOP overcomes cold storage limitations. It extends organ viability, enabling more than 76% of liver transplants and many heart and lung surgeries to occur during daytime hours. With nearly 7,500 transplants performed in the United States and 12% of national heart and liver transplant growth in 2023 attributed to OCS and NOP, TransMedics continues to scale rapidly, which was indicated in the first quarter transplant logistics revenues of $26.1 million, up 80% year over year and 20% sequentially.

OCS Innovation Fuels TransMedics’ Market Leadership: TransMedics' Organ Care System (“OCS”) is transforming organ transplantation by replacing traditional cold storage with an advanced method that keeps donor organs alive using warm, oxygenated and nutrient-rich blood. This breakthrough approach reduces ischemic damage, enables real-time monitoring and improves the utilization of organs, particularly hearts and lungs from circulatory death donors, that would typically be discarded.

As the only FDA-cleared portable system offering warm perfusion for heart, lung and liver transplants, OCS enhances consistency in care, lowers complication rates and raises the standard for organ preservation. These advantages solidify TransMedics’ leadership in the high-value transplant sector, where competition remains minimal.

Solid Q1 Results: TransMedics exited first-quarter 2025 with better-than-expected results. The solid top and bottom-line performances and the uptick in Transplant Logistics services revenues were encouraging. The strength of both revenue sources was also impressive. The expansion of the operating margin bodes well.

Management confirmed that TransMedics plans to open a new disposables manufacturing facility in Mirandola, Italy. This will likely provide an alternate disposable manufacturing source to ensure business continuity at its Andover facility. TMDX is also planning to launch two new heart and lung clinical programs later in the year to further catalyze its growth in 2026 and beyond. These look promising for the stock.

U.S. Transplant Volume Headwinds: TransMedics' growth is challenged by systemic inefficiencies and shifting U.S. transplant policies. While 2024 saw record transplant volumes, changes like the 2020 liver allocation policy have strained hospital budgets by increasing transport costs and reducing volumes at some centers, curbing demand for high-end solutions like the OCS. Ongoing reforms, such as the OPTN Modernization Initiative and heightened CMS oversight, add regulatory complexity and uncertainty. Coupled with ethical controversies and a fragmented transplant system, these issues risk undermining procedural consistency and public confidence, potentially slowing OCS adoption despite its long-term promise.

Gross Margin Under Pressure: TransMedics faced mounting gross margin pressure in the first quarter of 2025 due to an increasingly unfavorable revenue mix, as rapid growth in lower-margin service offerings, particularly aviation logistics, continued to erode profitability. Overall gross margin declined 45 basis points year over year, while service gross margin dropped sharply by 632 basis points, highlighting the cost-heavy nature of scaling logistics operations.

With services making up a larger share of revenues, management acknowledged limited room for margin improvement in 2025. Compounding this, scheduled aviation fleet maintenance in the second half of the year is expected to add cost burdens and introduce performance volatility, further constraining the company's ability to improve margins.

TransMedics is witnessing a stable estimate revision trend for 2025. In the past 30 days, the Zacks Consensus Estimate for its 2025 earnings has remained stable at $1.89 per share.

The Zacks Consensus Estimate for the company’s second-quarter 2025 revenues is pegged at $147.4 million, indicating a 28.9% improvement from the year-ago quarter’s reported number.

Some better-ranked stocks in the broader medical space that have announced quarterly results are CVS Health Corporation CVS, Integer Holdings Corporation ITGR and AngioDynamics ANGO.

CVS Health, carrying a Zacks Rank of 2 (Buy), reported first-quarter 2025 adjusted earnings per share (EPS) of $2.25, beating the Zacks Consensus Estimate by 31.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Revenues of $94.59 billion outpaced the consensus mark by 1.8%. CVS Health has a long-term estimated growth rate of 11.4%. Its earnings surpassed estimates in each of the trailing four quarters, with an average surprise of 18.1%.

Integer Holdings reported first-quarter 2025 adjusted EPS of $1.31, beating the Zacks Consensus Estimate by 3.2%. Revenues of $437.4 million surpassed the Zacks Consensus Estimate by 1.3%. It presently holds a Zacks Rank #2.

Integer Holdings has a long-term estimated growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

AngioDynamics, currently carrying a Zacks Rank #2, reported a third-quarter fiscal 2025 adjusted EPS of 3 cents in contrast to the Zacks Consensus Estimate of a 13-cent loss. Revenues of $72 million beat the Zacks Consensus Estimate by 2%.

ANGO has an estimated fiscal 2026 earnings growth rate of 27.8% compared with the S&P 500 composite’s 10.5% rise. AngioDynamics’ earnings surpassed estimates in each of the trailing four quarters, with the average surprise being 70.9%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 7 hours | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite