|

|

|

|

|||||

|

|

Toast, Inc. TOST posted a standout first-quarter 2025, with revenue rising 24.4% year over year to $1.34 billion and adjusted EBITDA reaching $133 million, with about a 32% margin. This significant margin improvement stems from solid gross-profit growth and strict cost discipline, prompting investors to wonder whether Toast can maintain margins exceeding 30% as it continues to scale.

Management attributed the strong profitability to disciplined expense management. Excluding bad-debt charges and credit-related expenses, operating costs rose only around 12%, mainly due to increased spending on sales and marketing to hire representatives and amplify brand efforts. Research and development and general and administrative expenses remained mostly flat. The company emphasized that this disciplined approach is fueling healthy top-line growth while investing only in areas with high return on investment. Free cash flow turned positive—$69 million against a $33 million loss a year ago.

Meanwhile, Toast’s platform expansion is underway. Annual recurring revenues reached $1.7 billion, a 31% year-over-year rise, while the platform now operates in approximately 140,000 locations, reflecting 25% year-over-year growth. It reported more than 6,000 net locations in the first quarter. Management expects to post record net adds in the current quarter, and 2025 is now expected to top 2024’s full-year net additions. TOST has only 10% penetration into its 1.4 million location TAM, thereby offering a substantial long-term expansion opportunity.

The company is leveraging this scale to roll out new services, including its AI-powered analytics engine, ToastIQ, and broader fintech products that add revenues without proportionate cost increases. The addition of a $350 million revolving credit facility gives the company further flexibility to pursue growth aggressively.

Driven by these developments, Toast raised its full-year outlook to around $550 million in EBITDA, with a 31% margin, an increase of five points from 2024 (the prior view was $510-$530 million at a 30% margin). It now expects 25-27% growth in fintech and subscription gross profit, up from the prior 23-25% range. Toast remains on track for strong growth and rising profitability while continuing to invest in key long-term priorities.

However, management highlighted that it was closely monitoring the macro environment and emphasized restaurants' ability to navigate the challenges. Although Toast remains confident, the restaurant industry remains highly vulnerable to shifts in consumer spending, rising labor costs and supply chain disruptions. Any downturn in consumer demand or increase in operating costs could lead restaurants to cut back on technology investments, which will negatively impact TOST’s performance.

Block XYZ, formerly known as Square, offers financial and marketing services through its comprehensive commerce ecosystem, which helps sellers start, run and grow their businesses. Block’s Square for Restaurants POS platform competes directly with TOST’s offerings. In the first quarter of 2025, adjusted EBITDA was $812.8 million, up 15.3% year over year. The adjusted operating income was $466.3 million in the reported quarter, with an operating margin of 8.1%, expanding 200 basis points on a year-over-year basis.

For the second quarter of 2025, Block expects gross profit of $2.45 billion, suggesting year-over-year growth of 9.5%. Adjusted operating income is expected to be $450 million with an operating margin of 18%. For 2025, XYZ expects a gross profit of $9.96 billion, indicating growth of 12% from the 2024 reported figure. Adjusted operating income is now expected to be $1.9 billion, with an operating margin of 19%.

Lightspeed Commerce LSPD, a Montreal-based cloud commerce platform that serves both retail and restaurant sectors, recorded a strong financial turnaround in the fourth quarter of fiscal 2025. The company reported total revenues of $253.4 million, marking a 10% year-over-year increase, and achieved adjusted EBITDA of $12.9 million, up from $4.4 million in the same quarter last year. For the full fiscal year, Lightspeed posted $1.08 billion in revenues, an 18% jump over the previous year, and $53.7 million in adjusted EBITDA, reversing a $1.3 million loss in fiscal 2024.

Gross margins improved to 44%, while subscription gross margins rose to 81%, supported by cost optimization and price adjustments. For fiscal 2026, the company expects continued profitability, with full-year adjusted EBITDA guidance of between $68 million and $72 million and projected revenue growth of 10–12%. For the first quarter of 2026, Lightspeed forecasts gross profit growth of around 13% and adjusted EBITDA of $14-$16 million.

Shares of TOST have gained 61.4% in the past year compared with the Zacks Internet-Software industry's growth of 34.3%.

From a valuation standpoint, TOST trades at a forward price-to-sales of 3.12X, lower than the industry’s average of 5.76X.

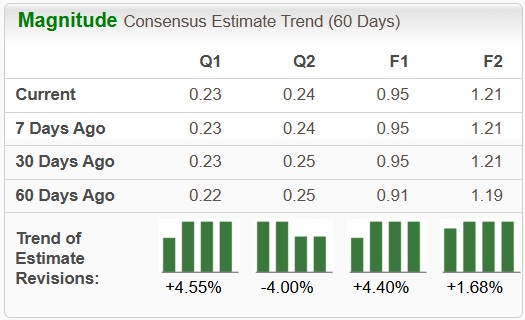

The Zacks Consensus Estimate for TOST’s earnings for 2025 has been on the rise over the past 60 days.

TOST currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 7 hours | |

| 11 hours | |

| 11 hours | |

| 13 hours | |

| 19 hours | |

| 20 hours | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite