|

|

|

|

|||||

|

|

Intuitive Surgical ISRG recently received CE mark approval for its latest da Vinci 5 Surgical System. This approval authorizes the system’s use across adult and pediatric patients in Europe for a broad range of endoscopic procedures, including abdominopelvic and thoracoscopic surgeries in urology, gynecology, and general laparoscopy. The approval marks a major regulatory step, expanding the clinical reach of Intuitive Surgical’s most advanced surgical platform to date.

Building on the foundation of the da Vinci Xi Surgical System, the da Vinci 5 introduces enhanced integration, refined ergonomics, and next-generation capabilities to support surgeon precision and patient outcomes. With this approval, Intuitive Surgical strengthens its leadership in robotic-assisted surgery and continues to advance its mission to make surgery less invasive and more effective.

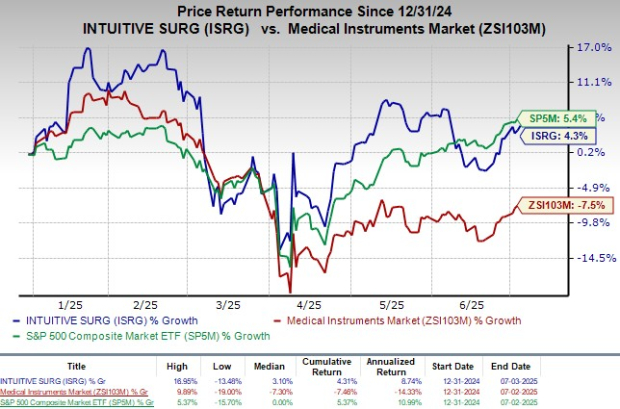

Following the announcement, the company's shares traded flat until yesterday’s closing. Shares have risen 4.3% in the year-to-date period against the industry’s 7.5% decline. The S&P 500 has gained 5.4% in the same time frame.

The CE mark approval for da Vinci 5 positions Intuitive Surgical to accelerate adoption across European markets, unlocking a sizable revenue opportunity in both system placements and recurring income from instruments, accessories, and service contracts. This expansion enhances Intuitive Surgical’s competitive moat in robotic-assisted surgery while aligning with hospital needs for surgical efficiency, workforce sustainability, and value-based care.

ISRG currently has a market capitalization of $193.76 billion. It has an earnings yield of 1.45%, higher than the industry’s negative 2.88%. In the last reported quarter, ISRG delivered an earnings surprise of 5.85%.

The da Vinci 5 Surgical System introduces over 150 design and performance enhancements, making it Intuitive Surgical’s most sophisticated multiport robotic-assisted platform to date. Among its core innovations are first-of-its-kind Force Feedback-enabled technology and the most realistic 3D vision system in the company’s portfolio, both engineered to improve surgical precision and patient outcomes.

The system also features a newly designed ergonomic surgeon console to support long-term career sustainability. Surgeons gain greater autonomy with fingertip control of integrated components, while care teams benefit from a universal user interface and streamlined workflows. These upgrades are designed to enhance consistency, reduce setup time, and facilitate faster adoption across surgical teams.

Intelligent computing is a key differentiator, with da Vinci 5 offering 10,000 times more processing power than earlier generations. The system integrates advanced sensors and software that deliver real-time, actionable insights to help surgeons quantify and improve their performance. This data-driven approach supports continuous improvement and performance benchmarking, particularly valuable as hospital systems seek to optimize surgical efficiency and outcomes.

Intuitive Surgical’s da Vinci family of surgical systems comprises a range of multi-port and single-port platforms, designed to meet varying clinical and operational needs. The lineup consists of the da Vinci X and da Vinci Xi systems, widely adopted for their versatility and reliability, alongside the da Vinci SP system, which enables single-port access for narrow or deep anatomical areas.

With the addition of da Vinci 5, the company now offers its most advanced platform, incorporating intelligent computing, ergonomic upgrades, and real-time data capabilities. This comprehensive portfolio allows hospitals and surgeons to choose solutions tailored to their procedural mix and workflow preferences, reinforcing Intuitive Surgical’s leadership in robotic-assisted surgery.

Per a report by Grand View Research, the global surgical robots market size was estimated at $4.31 billion in 2024 and is projected to reach $7.42 billion by 2030, registering a CAGR of 9.42% from 2025 to 2030.

Industry growth is driven by technological innovation, increasing investments from global and regional players, and a rise in chronic conditions and joint replacement procedures.

Currently, ISRG carries a Zacks Rank #2 (Buy).

Some other top-ranked stocks in the broader medical space are Hims & Hers Health, Inc. HIMS, Cencora, Inc. COR and Integer Holdings Corporation ITGR.

Hims & Hers, carrying a Zacks Rank #2 at present, has an estimated long-term growth rate of 36.5%. HIMS’ earnings surpassed estimates in two of the trailing four quarters, missed once and met in the other, the average surprise being 19.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hims & Hers’ shares have surged 99.2% compared with the industry’s 37.1% growth in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 6%.

Cencora’s shares have rallied 23.9% against the industry’s 16.9% decline in the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

Integer Holdings’ shares have gained 4.9% against the industry’s 13% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite