|

|

|

|

|||||

|

|

Stereotaxis STXS recently announced the publication of initial clinical results from its MAGiC catheter in the Journal of Interventional Cardiac Electrophysiology. The study, titled “First In-Human Results of the MAGiC Robotic Magnetic Navigation Radiofrequency Ablation Catheter,” marks the first peer-reviewed clinical evidence supporting the safety and efficacy of the MAGiC catheter. These results reflect the successful completion of the initial patient cohort in an ongoing prospective, multi-center study evaluating the performance of the catheter in treating cardiac arrhythmias.

The MAGiC catheter is the world’s first robotic, fully integrated radiofrequency ablation catheter designed for use with Stereotaxis' Robotic Magnetic Navigation system. The publication highlights the catheter’s consistent navigation accuracy, effective lesion formation, and strong safety profile across multiple clinical sites and operators. This milestone strengthens Stereotaxis’ growing body of clinical validation and supports the company’s broader vision to modernize endovascular intervention through innovative robotic solutions.

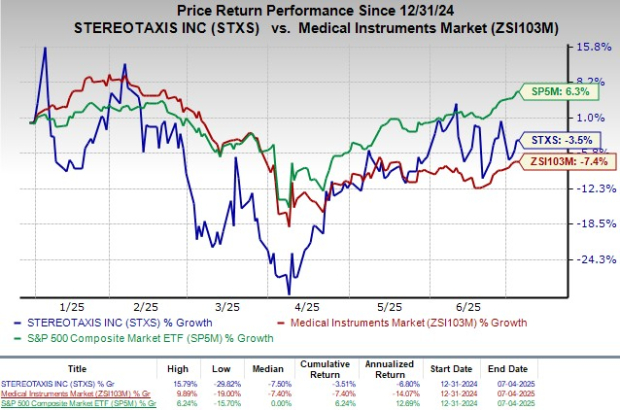

Following the announcement, the company's shares traded flat until yesterday’s closing. Shares have lost 3.5% in the year-to-date period compared with the industry’s 7.4% decline. The S&P 500 has gained 6.3% in the same time frame.

The publication of first-in-human clinical results for the MAGiC catheter provides strong validation of Stereotaxis’ technology, enhancing physician confidence and accelerating the adoption of its robotic system. As the first peer-reviewed data confirming both safety and efficacy, this milestone supports commercial momentum ahead of broader regulatory clearances, strengthens the company’s credibility in the electrophysiology market, and positions Stereotaxis to gain share in the high-growth, innovation-driven cardiac ablation segment.

Meanwhile, STXS currently has a market capitalization of $189.2 million.

The MAGiC catheter study is a prospective, multi-center, single-arm clinical trial evaluating the catheter’s performance in treating a broad range of arrhythmias in all four chambers of the heart. Initial analysis of 67 patients revealed a strong acute efficacy rate of 94%, with an average skin-to-skin procedure time of 83 minutes and a 1.5% rate of procedure-related adverse events. No adverse events were linked to catheter malfunction. Approximately 100 patients have been enrolled to date, with ongoing follow-up to assess long-term efficacy over one year.

Study authors, with combined experience in over 6,500 robotic procedures using earlier-generation magnetic catheters, reported several performance improvements with MAGiC. These included enhanced catheter stability without the use of support sheaths, steady tip temperatures during ablation, and low irrigation rates that benefit patients with poor cardiac or renal function. The catheter also enabled more efficient and potentially more effective lesion formation. These advancements highlight MAGiC’s clinical value in improving the safety, precision, and efficiency of robotic ablation procedures.

Per a report by Future Market Insights, the global market for robotic catheterization systems is estimated to be worth $54.4 million in 2025 and is projected to reach $190.2 million by 2035.

The growing demand for minimally invasive procedures is a key driver for the robotic catheterization systems market. With patients and healthcare providers prioritizing faster recovery, lower complication risks, and cost-effective treatments, minimally invasive surgeries are becoming the preferred option.

STXS carries a Zacks Rank #3 (Hold) at present.

Some better-ranked stocks in the broader medical space are Hims & Hers Health, Inc. HIMS, Cencora, Inc. COR and Integer Holdings Corporation ITGR.

Hims & Hers, carrying a Zacks Rank #2 (Buy) at present, has an estimated long-term growth rate of 36.5%. HIMS’ earnings surpassed estimates in two of the trailing four quarters, missed once and met in the other, the average surprise being 19.6%. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Hims & Hers’ shares have surged 99.2% compared with the industry’s 37.1% growth in the past year.

Cencora, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 12.8%. COR’s earnings surpassed estimates in each of the trailing four quarters, the average surprise being 6%.

Cencora’s shares have rallied 23.9% against the industry’s 16.9% decline in the past year.

Integer Holdings, carrying a Zacks Rank of 2 at present, has an estimated long-term growth rate of 18.4%. ITGR’s earnings surpassed estimates in three of the trailing four quarters and missed once, the average surprise being 2.8%.

Integer Holdings’ shares have gained 4.9% against the industry’s 13% decline in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Mar-02 | |

| Mar-02 | |

| Mar-02 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite