|

|

|

|

|||||

|

|

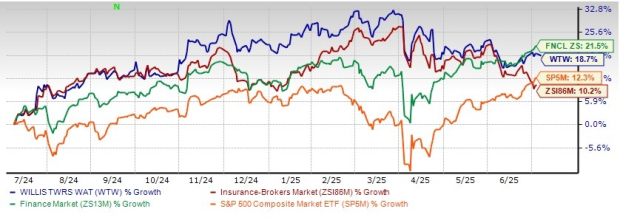

Shares of Willis Towers Watson Public Limited Company WTW have gained 18.7% in the past year, outperforming its industry and the Zacks S&P 500 composite’s growth of 10.2% and 12.3%, respectively. It, however, underperformed the Finance sector’s return of 21.5%.

The insurer has a market capitalization of $30.27 billion. The average volume of shares traded in the last three months was 0.7 million.

Willis Towers’ bottom line surpassed earnings estimates in each of the last four quarters, the average being 15.99%.

WTW shares are trading below the 50-day and 200-day moving averages, indicating a bullish trend.

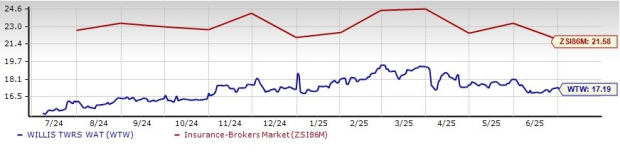

WTW shares are trading at a price to forward 12-months earnings of 17.17X, lower than the industry average of 21.58X. Its pricing, at a discount to the industry average, gives a better entry point to investors. Shares of other insurers like Brown & Brown, Inc. BRO and Arthur J. Gallagher & Co. AJG are trading at a multiple higher than the industry average, while Marsh & McLennan Companies, Inc. MMC is trading at a discount.

The Zacks Consensus Estimate for Willis Towers’ 2026 earnings per share and revenues indicates an increase of 14.1% and 5.3%, respectively, from the corresponding 2025 estimates.

The insurer has a solid surprise history. It surpassed earnings estimates in three of the last four quarters and missed in one, the average beat being 5.12%.

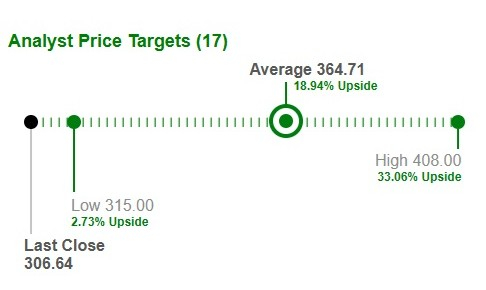

Based on short-term price targets offered by 17 analysts, the Zacks average price target is $364.71 per share. The average suggests a potential 18.9% upside from the last closing price.

Three of the 10 analysts covering the stock have lowered estimates for 2025, while three analysts have lowered the same for 2026 over the past 60 days. The Zacks Consensus Estimate for 2025 earnings has moved down 0.8% in the past 60 days, while the same for 2026 has moved down 0.7% in the same time frame.

Willis Towers’ growth strategy encompasses a focus on improving operating margins, increasing free cash flow conversion and driving sustainable revenue growth. Focus on core opportunities with the highest growth and return, which include gaining market share in Risk and Broking and Individual Marketplace, should spur long-term growth and return more value to shareholders.

Well-performing Health, Wealth & Career and Risk & Broking segments, driven by solid customer retention levels, growing new business and geographic diversification, continue to fuel the top line. Most of the company's operating regions experienced revenue growth for 15 straight quarters.

Strategic acquisitions have expanded its geographical footprint in the last few years in countries like Italy, Canada, the United Kingdom and France, as well as ramped up its product portfolio.

Willis Towers has been improving its liquidity while maintaining a solid balance sheet. A solid balance sheet and steady cash flow are expected to help the company engage in capital deployment for buybacks, dividend payouts, debt repayments, acquisitions and investments that drive and support growth.

Banking on its capital position, WTW distributes wealth to shareholders in the form of dividend hikes and share repurchases. Its dividend has witnessed a six-year CAGR (2019-2025) of 5.7%. The insurer expects share repurchases to total approximately $1.5 billion in 2025, subject to market conditions and other relevant factors.

Despite the upside potential, Willis Towers’ expenses have been rising over the last several quarters. Higher salaries and benefits, other operating expenses, and transaction and transformation, as well as increased consulting and compensation costs related to the Transformation program, result in the contraction of margins. Willis Towers estimates to deliver expansion in margin over the long term.

WTW’s trailing 12-month ROE of 20.5% is weak when compared with the industry average of 27.3%, reflecting its inefficiency in using shareholders' funds.

Willis Towers boasts a strong product portfolio and has a solid track record of strategic acquisitions, as well as favorable growth estimates. The Health, Wealth & Career and Risk & Broking segments should continue to witness significant growth from increases in most lines of business. A robust capital position over the years reflects its financial flexibility.

Given the escalating expenses and poor return on equity, it is better to stay cautious about this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-14 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite