|

|

|

|

|||||

|

|

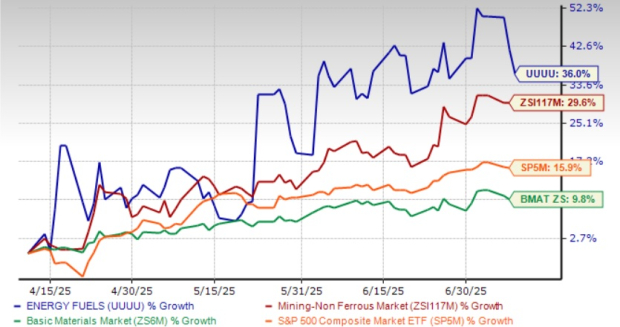

Energy Fuels UUUU has gained 36% in the past three months against the non-ferrous mining industry’s 29.6% fall. The Zacks Basic Materials sector has gained 9.8%, while the S&P 500 has risen 15.9% in the same time frame.

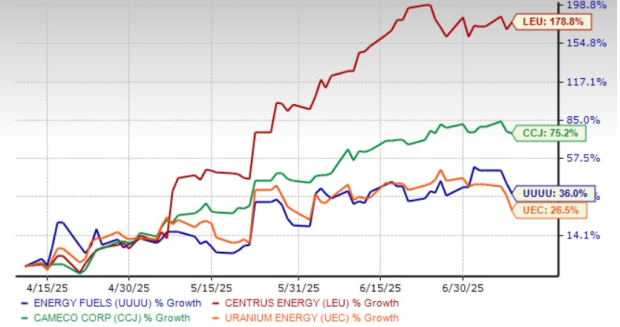

Looking at UUUU peer performances - Centrus Energy LEU has gained 178.8% in the past three months, while Cameco CCJ has gained 75.2%, faring better than Energy Fuels. Meanwhile, Uranium Energy UEC has underperformed Energy Fuels with a 26.5% gain in the past three months.

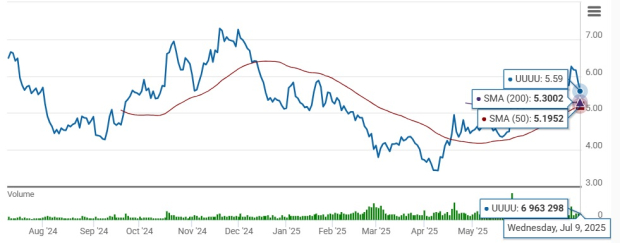

Energy Fuels has been trading above the 200-day simple moving average (SMA) and the 50-day SMA, indicating a bullish trend.

With Energy Fuels stock riding high, investors may rush to add it to their portfolio. However, before making a decision, it would be prudent to take a look at the reasons behind the surge, the company’s growth prospects and risks (if any) in investing.

Solid Results at Pinyon Plain Mine: Energy Fuels recently reported that the Pinyon Plain mine produced 230,661 pounds of uranium in June, taking the second quarter’s production tally to 638,700 pounds. The impressive output is due to its exceptional ore grades, which averaged 3.51% in June and 2.23% for the second quarter.

The mine’s production and drill results to date indicate that it is set to be the highest-grade uranium deposit mined in U.S. history. It holds considerable exploration upside, with Energy Fuels currently extracting ore from only about 25% of the vertical extent of the target zone.

Upbeat Sales Outlook: During the second quarter, Energy Fuels sold 50,000 pounds of uranium on the spot market for an average price of $77.00 per pound. Backed by its upbeat production numbers, the company expects higher uranium sales over the next few quarters. This includes 140,000 pounds of uranium in the third quarter and 160,000 pounds of uranium in the fourth quarter under its existing portfolio of long-term utility contracts.

In 2026, Energy Fuel expects to sell between 620,000 and 880,000 pounds of uranium under its existing long-term contracts. It is planning opportunistic sales of uranium in 2025 and 2026 and intends to enter into new long-term sales contracts.

Fast-Tracking Projects: UUUU recently announced that it is expediting the permitting process for the Roca Honda project in New Mexico and resumed permitting efforts on the EZ Complex in northern Arizona, which consists of two closely located "breccia pipe" deposits, similar to the Pinyon Plain mine. Also, the May 2025 Technical Report for the Bullfrog Project in Utah confirmed higher uranium resources. The project, currently in the permitting phase, has indicated mineral resources of 10.5 million pounds of uranium and inferred mineral resources of 3.4 million pounds.

As of March 31, 2025, UUUU had $214.61 million of working capital, including $73 million of cash and cash equivalents, $89.64 million of marketable securities, and $20.37 million in trade and other receivables. Both Energy Fuels and Uranium Energy have debt-free balance sheets. This is commendable compared with Cameco’s debt-to-capital ratio of 0.13 and Centrus Energy’s 0.68.

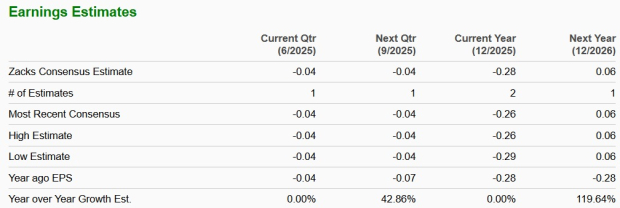

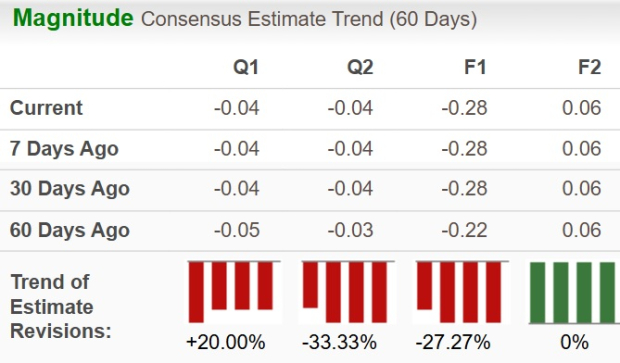

The Zacks Consensus Estimate for Energy Fuels’ 2025 loss is pegged at 28 cents per share. The bottom-line estimate for 2026 is pegged at earnings of six cents per share.

The 2025 estimate for UUUU has undergone negative revisions, while the same for 2026 remains unchanged.

Uranium prices have been under pressure earlier this year due to oversupply and uncertain demand. Uranium futures have fallen to $74.5 per pound as a pause in fresh buying by holding funds allowed utilities to set lower bids. Prices are down 14.6% in a year.

Prices had hit a seven-month high of $79 on June 27, driven by the news that the Sprott Physical Uranium Trust plans to purchase approximately $200 million worth of physical uranium. The U.S. government’s initiative to quadruple domestic nuclear energy capacity by 2050, along with rising energy needs from AI data centers, had also lifted sentiment.

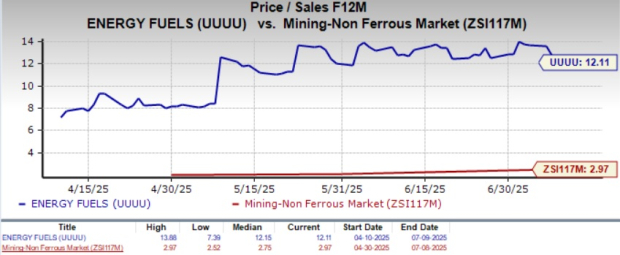

Energy Fuels is trading at a forward price/sales of 12.11X, well above the industry average of 2.97X. The company’s Value Score of F suggests that the stock is not so cheap and has a stretched valuation at this moment.

Meanwhile, Centrus Energy and Cameco are cheaper alternatives than UUUU, with price/sales of 6.78X and 11.97X, respectively. Uranium Energy is trading at a higher P/S of 32.78.

The increasing demand for uranium and REEs in clean energy technologies and the push for supply chains independent of China is a growth opportunity for UUUU. The White Mesa Mill in Utah being the only U.S. facility able to process monazite and produce separated REE materials gives the company an edge. Backed by its debt-free balance sheet, Energy Fuels is ramping up uranium production while developing significant REE capabilities. Taking UUUU’s current production levels and development pipeline into account, it has the potential to produce 6 million pounds of uranium per year.

Considering the premium valuation, volatility in uranium prices, downward earnings revisions activity and projected loss for the current year, selling UUUU stock would be prudent at present. Energy Fuels stock currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite