|

|

|

|

|||||

|

|

Guidewire Software GWRE stock has appreciated 36.4% in the past six months, significantly outperforming the Zacks Internet Software industry's growth of 17.3%. San Mateo, CA-based Guidewire is a provider of software solutions for property and casualty insurers.

GWRE closed last session at $231.25. The stock is trading 12.1% down from its 52-week high of $263.20. The recent rally has sparked a familiar dilemma, is it time to stay invested for further upside, or book profits after a strong run?

Let us dive into GWRE’s pros and cons and determine the best course of action for your portfolio.

Momentum in Guidewire Cloud is a tailwind. GWRE is experiencing increasing demand for its cloud platform as insurers transition from legacy systems to cloud-based solutions. The company has strategically built out its cloud ecosystem. This now consists of 26,000 Guidewire-focused practitioners across 38 system integrators. The company reported 17 deal wins in the fiscal third quarter of 2025. Out of these deals, 14 were for various InsuranceSuite Cloud applications and three InsuranceNow deals. It closed seven core system deals with Tier 1 insurers and three with Tier 2 insurers.

The company's focus on enhancing the Guidewire Cloud platform with new capabilities, including digital frameworks, automation, tooling and other cloud services, is expected to boost sales of subscription-based solutions in the long haul.

In the last reported quarter, the company announced its first sale of Guidewire Industry Intelligence, a pre-built predictive model embedded into ClaimCenter workflow. This solution is trained and validated using anonymized data available on Guidewire’s cloud deployments. This not only represents a new revenue opportunity but is a value addition for insurers looking to make data-driven claims decisions.

Management’s efforts to drive cloud operations efficiency to boost cloud margins remain an additional tailwind. Non-GAAP gross margin expanded to 65.5% from 62.6% on a year-over-year basis. The subscription and support segment’s gross margin increased to 70.6% from 65.6% on a year-over-year basis, attributed to higher-than-expected revenues and increases in cloud infrastructure platform efficiency, along with $4 million in credits received from its cloud service provider. Services’ non-GAAP gross margin was 12.9% against negative 10.3% in the year-ago quarter.

For the fiscal fourth quarter, non-GAAP operating income is estimated in the range of $52-$60 million. Non-GAAP operating income for fiscal 2025 is estimated between $187 million and $195 million compared with $175-$185 million expected previously.

Guidewire Software, Inc. price-consensus-eps-surprise-chart | Guidewire Software, Inc. Quote

Driven by strong collections, Guidewire generated $32.4 million in cash from operations in the quarter under discussion while free cash flow was nearly $27.8 million. As of April 30, 2025, cash and cash equivalents and short-term investments were $1,243.7 million, with $673.7 million of long-term debt. The company’s ability to generate positive cash flow while continuing to invest in growth initiatives provides a solid foundation for expansion.

Driven by strong revenue performance in the fiscal third quarter, Guidewire expects total revenues for fiscal 2025 to be between $1.178 billion and $1.186 billion compared with earlier guidance of $1.164 billion to $1.174 billion. Subscription revenues are now forecasted to be $660 million, while subscription and support revenues are expected to be $724 million. Services revenues are expected to be approximately $215 million.

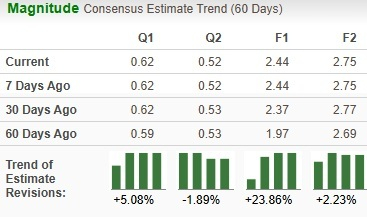

In the past 60 days, analysts have revised significantly upwards estimates for the current year.

Higher costs remain a concern for Guidewire, especially amid weakness prevailing over global macroeconomic conditions. In the fiscal third quarter, total operating expenses increased 12.1% year over year to $178.2 million. Increasing costs can put downward pressure on the company’s profitability, especially if the revenue performance weakens.

Guidewire increasing global footprint, with new customers primarily coming from diverse markets such as Japan, Brazil, Belgium and other international regions, presents a forex as well as integration risks. Strengthening the U.S. dollar could further exacerbate these challenges. Also, these initiatives involve execution risk, especially in regions with different regulatory requirements. If integration delays arise, these could weigh on operating margins or delay expected revenue contributions.

GWRE stock is also not so cheap, as its Value Style Score of F indicates a stretched valuation at this moment. The stock is trading at a premium with a forward 12-month price/sales of 14.58X compared with the industry’s 5.88X.

Guidewire’s strong cloud momentum, expanding margins and solid cash position make it a fundamentally sound company with long-term growth potential. With shares still below their 52-week high, there may be room for moderate gains.

However, with a Zacks Rank #3 (Hold), GWRE appears to be treading in the middle of the road and new investors could be better off if they trade with caution. The stock is also trading at premium valuation metrics and investors could wait for a better entry point to capitalize on its long-term fundamentals. Consequently, it might not be prudent to bet on the stock at the moment.

Some better-ranked stocks worth consideration with the same industry space are Freshworks Inc. FRSH, Automatic Data Processing, Inc. ADP and F5, Inc. FFIV. While FRSH sports a Zacks Rank #1 (Strong Buy), ADP and FFIV presently hold a Zacks Rank #2 (Buy) each. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for FRSH’s 2025 earnings is pegged at 57 cents per share. FRSH earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 37.3%. Its shares have gained 20.4% in the past year.

The Zacks Consensus Estimate for ADP’s fiscal 2026 EPS is pegged at $10.92, unchanged in the past seven days. ADP’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 3.45%. Its shares have surged 30.9% in the past year.

The Zacks Consensus Estimate for FFIV’s fiscal 2025 EPS is pegged at $14.58, up 3 cents in the past seven days. FFIV’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, with the average surprise being 10.95%. Its shares have gained 74% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 3 hours | |

| 3 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-24 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite