|

|

|

|

|||||

|

|

Teva Pharmaceutical Industries Limited’s TEVA shares have risen 21.6% in three months. Over the past few quarters, Teva has successfully launched several biosimilars and other high-value, complex generics, with many more in the pipeline. The company’s newer branded drugs, such as Austedo, Uzedy and Ajovy, are experiencing strong sales growth. Teva has implemented cost-cutting measures to improve its operating profits while reducing debt burden. All these factors have played a key role in the stock’s price appreciation in the past three months.

Let's discuss these factors in detail to understand how to play TEVA stock at present.

The company is seeing continued market share growth of its two newest branded drugs, Austedo and Ajovy. Though Teva is seeing slightly slower growth of Ajovy in the U.S. market, it expects sales to benefit from continued patient growth and launches in additional countries in Europe and international markets.

For Austedo, Teva expects to achieve annual revenues of more than $2.5 billion by 2027. The Austedo franchise got a boost from the launch of Austedo XR, a new once-daily formulation of Austedo. Teva expects to launch Austedo in European markets in 2026.

Uzedy (risperidone) extended-release injectable suspension, a long-acting subcutaneous atypical antipsychotic injection for the treatment of schizophrenia in adults, was launched in May 2023 in the United States. In 2025, Uzedy sales are expected to be approximately $160 million.

The company has also made decent progress with its branded pipeline, which includes olanzapine, a long-acting subcutaneous injectable (LAI) for treating schizophrenia and duvakitug, its anti-TL1A therapy for inflammatory bowel diseases (IBD), ulcerative colitis (UC) and Crohn’s disease (CD). Teva has partnered with Sanofi SNY for duvakitug to maximize the value of the asset. Teva and Sanofi will equally share the development costs globally. Teva’s partner, Sanofi, plans to advance duvakitug, into phase III trials for both UC and CD in the fourth quarter of 2025. The company expects to file a new drug application to seek approval for olanzapine in the second half.

Teva anticipates generating more than $5 billion in revenues from its branded products by 2030.

Over the past few quarters, Teva has successfully launched several biosimilars and other high-value complex generics, including Novo Nordisk’s Victoza, Roche’s cancer drugs Rituxan (Truxima) and Herceptin (Herzuma), AbbVie’s Humira (Simlandi), J&J’s JNJ Stelara (Selarsdi), Novartis’ Sandostatin LAR and AstraZeneca’s Soliris (Epysqli).

Teva has a decent pipeline of biosimilars, with some being developed in partnership with Alvotech, including high-value complex generics like Simlandi and Selarsdi. These are the first two biosimilars to be launched in the United States under the Teva and Alvotech strategic partnership, which includes five biosimilars.

TEVA expects to launch seven (including Simlandi and Selarsdi) biosimilars in the United States and four in Europe between 2025 and 2027. Biosimilar versions of Amgen’s AMGN Prolia, Regeneron’s Eylea and J&J’s Simponi are under review in the United States, and those of Amgen’s Xgeva, Simponi and Prolia are under review in the EU. A biosimilar of Novartis’ Xolair is in late-stage development.

Teva’s U.S. generics/biosimilars business looks stable now, much more than it has been in years. Its U.S. generics/biosimilars business rose 15% in the United States in 2024, driven by new product launches. Teva expects continued growth in its U.S. generics business in 2025, driven by complex product launches like Victoza, Forteo and others, as well as upcoming launches of Symbicort, Saxenda and biosimilars Simlandi and Selarsdi.

The company aims to double its global biosimilars sales by 2027 from approximately $400 million in 2024, supported by five product launches expected by then.

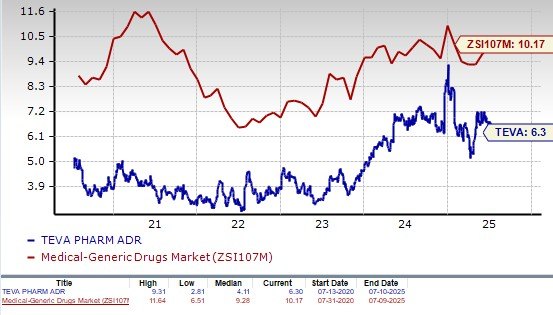

Teva stock has lost 25% so far this year compared with the industry’s 9.5% decline.

The stock is trading at an attractive valuation relative to the industry. Going by the price/earnings ratio, the company shares currently trade at 6.30 on a forward 12-month basis, lower than 10.17 for the industry. However, the stock is trading above its 5-year mean of 4.11.

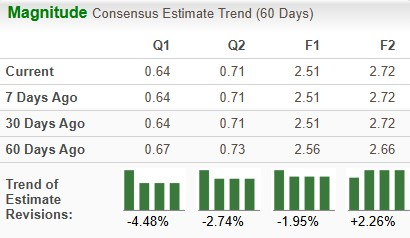

The Zacks Consensus Estimate for earnings has declined from $2.56 per share to $2.51 for 2025 but risen from $2.66 to $2.72 for 2026 over the past 60 days.

Teva’s revenues have suffered significantly since it lost exclusivity for key multiple sclerosis medicine, Copaxone, in 2015. The company also faces competitive pressure for some of its key branded drugs. It also has a high debt load and faces some price-fixing charges. The company may face a revenue cliff for lenalidomide capsules (the generic version of Bristol-Myers’ Revlimid) in 2026, as well as headwinds in 2027 related to the IRA Medicare Part D negotiation for Austedo.

However, its newer drugs, Austedo, Uzedy and Ajovy, and stable generics business are reviving top-line growth.

With the nationwide settlement of the costly opioid litigations, new product launches, stability in the generics segment with contributions from biosimilars, and a robust pipeline of biosimilars and branded products, the path for Teva’s long-term growth is becoming clearer. The company is saving costs and improving margins through the optimization of operations for efficiency while also lowering thedebt on its balance sheet. Teva expects an adjusted operating margin of 30% by 2027 through cost savings and the continued growth of its branded drugs.

In the past few months, Fitch, Moody's and S&P have upgraded their respective credit outlook for Teva, reflecting improved growth prospects.

TEVA’simproving branded and biosimilar pipeline and the prospect of growth in sales and profits are good enough reasons to stay invested in this Zacks Rank #3 (Hold) stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 5 hours | |

| 6 hours | |

| 19 hours | |

| Feb-27 | |

| Feb-27 |

These Stocks Lead Dow Jones In February. Hint: It's Not AI Companies.

AMGN JNJ

Investor's Business Daily

|

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 |

Novavax Stock Hits Over 1-Year High: Is Sanofis Flu-COVID Shot The Post-Pandemic Growth Driver?

SNY

New feeds test provider finance

|

| Feb-27 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite