|

|

|

|

|||||

|

|

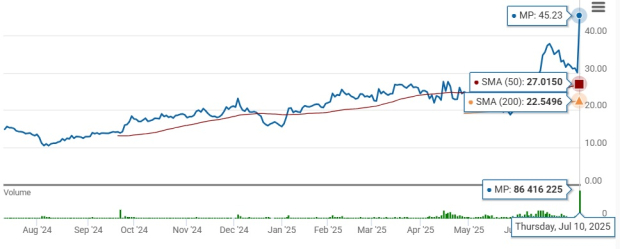

MP Materials MP stock hit a 52-week high of $48.12 yesterday before closing the session lower at $45.23. The stock’s gain has been fueled by the news that MP has entered into a public-private partnership with the United States Department of Defense (DoD) to fast-track the development of a domestic rare earth magnet supply chain.

MP Materials shares have gained 190% so far this year compared with the industry’s 15.9% growth. Meanwhile, the Zacks Basic Materials sector and the S&P 500 have gained 13.7% and 6.2%, respectively.

MP Materials has outperformed other names in the rare earths space, like Idaho Strategic Resources IDR, Lynas LYSDY, and Energy Fuels UUUU, which have advanced 58.8%, 50.7% and 26.9% respectively, year to date.

MP Materials stock is trading above its 50-day and 200-day moving averages, indicating solid upward momentum and price stability. This reflects a positive market sentiment and confidence in the company's financial health and long-term prospects.

While this rally may tempt investors, it is important to assess the underlying drivers and their sustainability, as well as the company’s growth prospects and potential risks, before making any investment decision.

The company has secured a multibillion-dollar investment package and long-term commitments from DoD, which will enable it to expand its production capacity and play a pivotal role in reducing the United States’ reliance on foreign sources, particularly China. MP will construct the second domestic magnet manufacturing facility (the 10X Facility). Slated to begin commissioning in 2028, it will take MP Materials’ total U.S. rare earth magnet manufacturing capacity to an estimated 10,000 metric tons. It will cater to both the defense and commercial sectors.

Under the 10-year agreement, DoD has established a price floor commitment of $110 per kilogram for MP Materials’ products stockpiled or sold, providing protection from market volatility. Also, DoD has committed that 100% of the magnets produced at the 10X Facility will be purchased by defense and commercial customers for 10 years, ensuring stable and predictable cash flow. DoD is positioned to become MP Materials’ largest shareholder. MP Reported

MP Materials reported record (neodymium and praseodymium) NdPr production of 563 metric tons in the first quarter, a 330% surge from the year-ago quarter. Sales volumes for NdPr were up 246% year over year to 464 metric tons, attributed to the shift to production of midstream products, mainly NdPr oxide.

REO production increased 10% year over year to 12,213 metric tons on higher recoveries from the continued implementation of Upstream 60K optimizations. Due to company’s ramp-up in midstream operations, a major part of the REO production was used to produce separated rare earth products rather than being sold as rare earth concentrate. Sales volumes, thus, plunged 33%, resulting in a $10 million decline in rare earth concentrate revenues.

The Magnetics segment made its first metal deliveries in March.

MP Material’s first-quarter total revenues of $60.8 million marked a 25% year-over-year increase. Despite higher revenues, MP reported a loss of 12 cents per share in the first quarter, wider than the year-ago quarter’s loss of four cents on increased production costs.

The cost of sales surged 37% due to higher production costs. Selling, general and administrative expenses were up 14% on higher employee headcount to support downstream expansion.

In April, MP Materials halted rare earth concentrate shipments to China in response to Chinese tariffs and export controls, cutting off a revenue stream. MP is, meanwhile, focusing on ramping production and selling separated rare earth products to markets outside China, including Japan and South Korea.

The company’s production and selling of more separated products at Mountain Pass will lead to higher costs in 2025. This reflects higher production costs associated with separated rare earth products compared with rare earth concentrate. Its ramp-up of output of magnetic precursor products will also lead to higher costs.

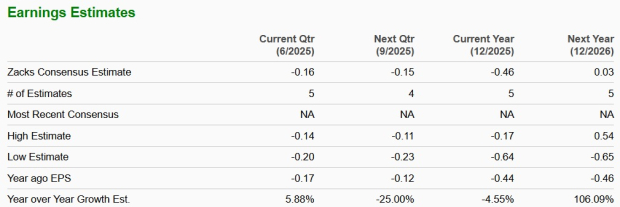

The Zacks Consensus Estimate for MP Materials’ 2025 earnings is pegged at a loss of 46 cents per share.

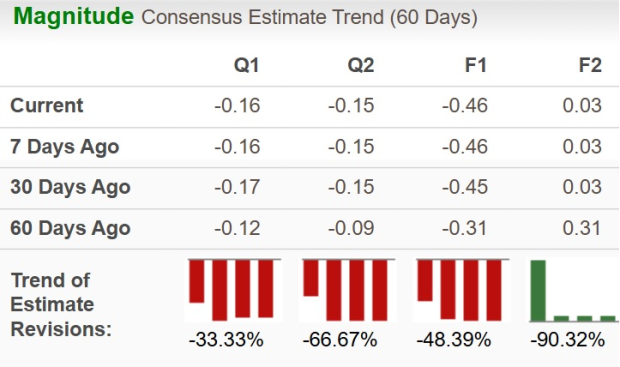

However, the bottom-line estimate for 2026 is pegged at earnings of three cents per share. The estimates for 2025 and 2026 have moved down over the past 60 days, as shown below.

MP is trading at a forward 12-month price/sales multiple of 22.00X, a significant premium to the industry’s 1.24X. It has a Value Score of F.

Energy Fuels, Idaho Strategic Resources and Lynas are comparatively cheaper options than MP, trading at 14.06, 7.86 and 9.99, respectively.

MP Materials is the United States’ only fully integrated rare earth producer with capabilities spanning the entire supply chain, from mining and processing to advanced metallization and magnet manufacturing. REEs are critical inputs across many existing and emerging clean-tech applications, including electric vehicles and wind turbines, as well as robotics, drones and defense applications. The market is currently dominated by China, and there has been an increasing focus on developing domestic REE capabilities in the United States.

As of Dec. 31, 2024, MP Materials’ total proven and probable reserves were estimated at 2.04 million short tons of REO contained in 29.69 million short tons of ore at Mountain Pass, with an average ore grade of 5.97%. Based on this, combined with the production ramp-up of its midstream operations, the estimated mine life is 29 years. MP expects to extend this lifespan through further exploration and enhanced processing, which could lead to revisions in reserve estimates over time.

The company is making investments to boost its production capacity. Also, the DoD deal offers price and revenue stability in the long run. Investors holding MP shares should continue to do so to benefit from the solid long-term fundamentals of rare earth products. However, considering its premium valuation, loss of revenue stream and expected loss for the current year, accompanied by downward estimate revision activity, new investors can wait for a better entry point. MP Materials currently carries a Zacks Rank #3 (Hold).

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 7 hours | |

| 8 hours | |

| Feb-17 | |

| Feb-17 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite