|

|

|

|

|||||

|

|

The Goldman Sachs Group, Inc. GS is scheduled to release second-quarter 2025 earnings on July 16 before the opening bell.

In the first quarter of 2025, Goldman's results benefited from solid growth in the Global Banking & Markets division. Yet, the decline in investment banking (IB) business and the rise in expenses were concerning.

Goldman has an impressive earnings surprise history. The company’s earnings outpaced the Zacks Consensus Estimate in the trailing four quarters, with an average earnings surprise of 20.74%.

Earnings Surprise History

Let us see how GS is expected to fare in terms of revenues and earnings this time around.

The Zacks Consensus Estimate for second-quarter 2025 revenues is pegged at $13.50 billion, calling for a 6.1% rise from the year-ago quarter's reported figure.

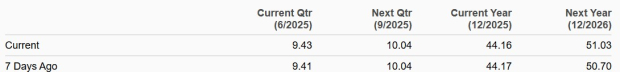

In the past seven days, the consensus estimate for quarterly earnings has been revised upward to $9.43 per share. The projection suggests a rally of 9.4% from the year-ago quarter's reported figure.

Estimate Revision Trend

Market-Making Revenues: The second quarter saw solid client activities and market volatility, driven by tariff-induced market uncertainty. Additionally, volatility was high in equity markets and other asset classes, including commodities, bonds and foreign exchange. Therefore, Goldman's market-making revenues are likely to have witnessed a rise in the quarter to be reported.

IB Fees: Global mergers and acquisitions (M&As) in the second quarter of 2025 were impressive than previously expected. Markets plunged in early April after Trump announced sweeping tariffs, rattling business confidence.

But as trade demands eased and policy direction became clearer, deal-making activities resumed in the last month of the quarter. Goldman’s leadership in the IB space is also likely to have supported advisory fees to some extent.

The IPO market in the second quarter saw a resurgence, with a significant increase in the number of IPOs and the amount of capital raised. This was driven by several factors, including strategic tariff pauses and positive economic data, which resulted in a rebound in market sentiment. Further, global bond issuance volume was decent. As such, GS’s leadership position in worldwide announced and completed M&As, equity and equity-related offerings, and common stock offerings is likely to have provided it an edge over its peers, offering support to the company’s quarterly IB revenues.

The Zacks Consensus Estimate for IB revenues is pegged at $1.99 billion, suggesting a 14.8% rise from the year-ago quarter’s actual.

Net Interest Income (NII): Despite an uncertain macroeconomic backdrop because of Trump’s tariff plans, the lending scenario was impressive in the second quarter. Per the Fed’s latest data, the demand for overall loans was solid in the second quarter. This is likely to have aided Goldman's loan growth.

In the second quarter, the Federal Reserve kept interest rates unchanged at 4.25-4.5%. This is likely to have offered some support to Goldman’s NII as the funding/deposit costs stabilized.

The Zacks Consensus Estimate for NII is pegged at $2.87 billion, suggesting a 28.3% rise from the year-ago quarter’s actual.

Expenses: Goldman’s investments in technology and market development expenses for business expansion and a rise in transaction-based expenses due to higher client activity are anticipated to have led to increased expenses in the to-be-reported quarter.

Our proven model does not predict an earnings beat for Goldman this time. The combination of a positive Earnings ESP and Zacks Rank #1 (Strong Buy), 2 (Buy), or 3 (Hold) increases the odds of an earnings beat. That is not the case here, as you can see below.

Goldman has an Earnings ESP of 0.00%. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

GS carries a Zacks Rank #3 at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

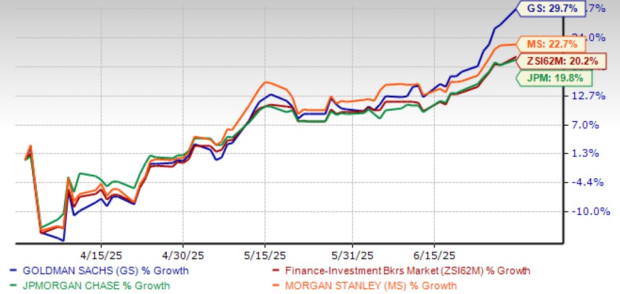

In the second quarter of 2025, Goldman's shares outperformed the industry and its close peers, JPMorgan JPM and Morgan Stanley MS. JPM rose 19.8% and MS rallied 22.7% during the same time frame.

Price Performance

JPMorgan is slated to announce quarterly numbers on July 15, whereas Morgan Stanley is expected to come out with its performance details on July 16. Stay up-to-date with all quarterly releases: See Zacks Earnings Calendar.

Let us look at the value GS offers investors at the current levels.

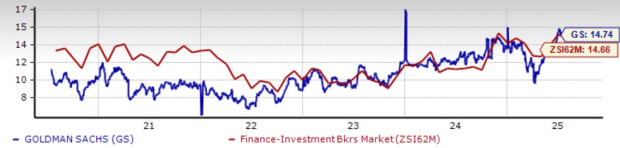

Currently, Goldman is trading at 14.74X forward 12-month price/earnings (P/E). Meanwhile, the industry’s forward earnings multiple sits at 14.66X. The company’s valuation looks somewhat expensive compared with the industry average.

Price-to-Earnings F12M

Its peer, JPMorgan, is trading at a forward 12-month P/E of 14.91X while Morgan Stanley is trading at 15.94X.

GS’s efforts to refocus on the IB and trading businesses provide a solid base for growth in the upcoming period. The company plans to ramp up its lending services to private equity and asset managers, and aims to expand internationally. Goldman Asset Management — a unit of GS — intends to expand its private credit portfolio to $300 billion in five years, positioning it for long-term growth.

The company’s strong liquidity position supports its capital distribution activities. Following the clearing of the Federal Reserve’s 2025 stress test, GS plans to hike its dividend by a whopping 33.3% to $4 per share. In the past five years, the company has hiked dividends four times, with an annualized growth rate of 22.04%. Currently, its payout ratio sits at 28% of earnings.

While Goldman’s solid fundamentals and strong prospects remain promising, investors should not rush to buy the stock. The company’s rising expenses and premium valuation warrant caution at the moment.

To get clarity and possibly an appealing entry point, those interested in adding the GS stock to their portfolios may be better off waiting until after the quarterly results are released. Also, they should keep an eye on macroeconomic factors that are likely to influence the company’s performance. Those who already own the GS stock can consider retaining it because it is less likely to disappoint over the long term.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours |

Stock Market Today: Nasdaq Jumps Ahead Of Nvidia Earnings; Goldman Leads Bank Bounce (Live Coverage)

GS

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 5 hours | |

| 6 hours | |

| 6 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite