|

|

|

|

|||||

|

|

According to the World Economic Forum, AI’s computational power needs are soaring, doubling roughly every 100 days. Data center power was just 88 gigawatts in 2022. However, thanks to the buildout of massive data centers (used to train large language models like ‘ChatGPT’) by big tech juggernauts like Alphabet (GOOGL), Microsoft (MSFT) and Meta Platforms (META) that number is expected to increase to more than 300 GW by the end of the decade.

It’s no secret to investors that the United States and China have the most significant economic and defense rivalry globally. Each year, the rivalry intensifies, and the AI revolution will only escalate the stakes. Artificial Intelligence is such a groundbreaking technology that whichever country wins the AI race, likely wins the race for superior defense, a robust economy, and global domination.

In past cycles, America’s free market capitalist system has proven to be the best framework for producing technology and new innovations. The US dominated the internet boom, software, and several other industries. While most Wall Street analysts agree that the US is off to an early and slight lead in the AI race, China is hot on their heels. In addition, one critical element threatens the United States’ AI supremacy: energy.

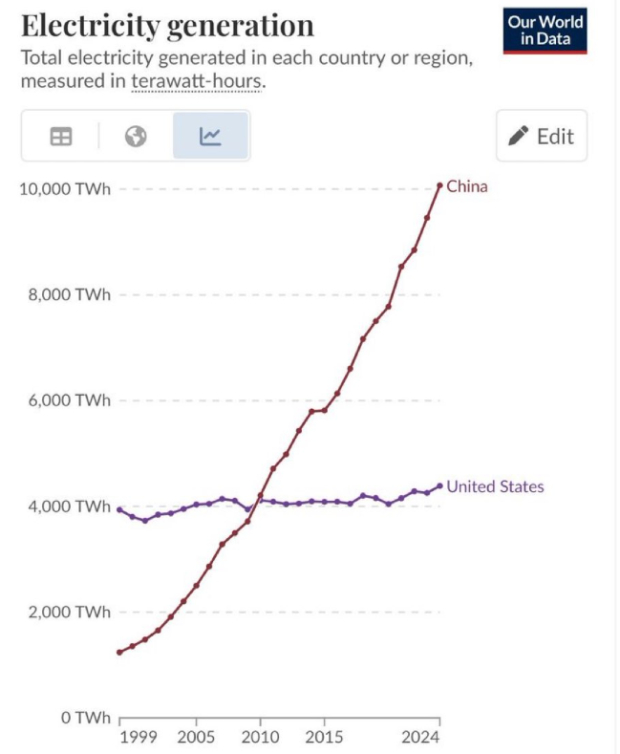

Last year, China generated more than 10k terawatt-hours (TWh) of electricity, dominating the US. China currently produces more than the combined output of the US, EU, and India. Meanwhile, China isn’t slowing down its production and continues to produce energy at a blistering pace, with forward projections suggesting that China will produce the equivalent of the US power grid each year!

The massive and multi-faceted ‘Big Beautiful Bill’ was recently signed into law by President Trump. Nuclear will benefit dramatically from the bill for two reasons:

· US Debt will Soar: The Congressional Budget Office estimates that the BBB will add $3.4 trillion to the US deficit over the next decade. With the deficit set to soar, the US will have no choice but to fully embrace AI and “grow the country out of debt.” (More on that later)

· Solar Subsidies will be Removed: The loss of solar subsidies in the BBB will lead to a natural market force toward cheap and clean nuclear power.

US Energy Secretary Chris Wright sent nuclear-related stocks soaring Monday after he posted to social media a message that read:

“Let’s talk nuclear energy: the energy-dense, always-ON energy source that we’ve smothered for decades with regulatory red tape. Under the Trump administration, you’re going to truly see the launch of the nuclear renaissance. The coming years will be HUGE.”

Several uranium, energy storage, and nuclear-related stocks spiked on heavy trading volume after the news, including Cameco (CCJ), Centrus Energy (LEU), NuScale Power (SMR), and Eos Energy Enterprises (EOSE). In addition, Oklo (OKLO), a small modular reactor company where Chris Wright once sat on the board of directors, continued its breathtaking multi-month advance and broke out of a powerful bull flag chart pattern.

Bottom Line

The race for AI supremacy is intrinsically linked to energy production capabilities. If the US wants to win the AI race, it will have to embrace nuclear in a big way.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 4 hours | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 | |

| Mar-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite