|

|

|

|

|||||

|

|

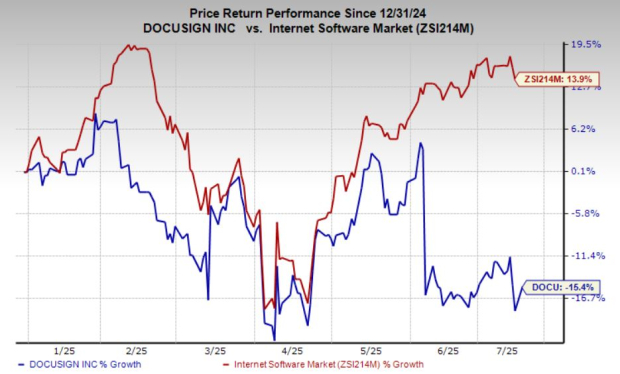

Docusign, Inc. DOCU has been under considerable selling pressure, with the stock declining 15.4% year to date. This drop is in stark contrast to the 14% rally in its industry and the 6% gain in the Zacks S&P 500 composite, highlighting relative underperformance.

However, looking at the bigger picture, DOCU shares have still gained 33% over the past year, suggesting that the current pullback may be a correction rather than a long-term downtrend.

Image Source: Zacks Investment Research

As of the latest close, the stock was priced at $76.21—approximately 29% below its 52-week high of $107.86. Moreover, it is trading below its 50-day moving average, signaling prevailing bearish sentiment among investors.

DOCU Below 50-day Moving Average

Given the recent weakness in DOCU shares, investors might view this as an attractive buying opportunity. But is now the right time to step in? Let’s take a closer look.

Docusign continues to enhance its Intelligent Agreement Management (IAM) platform, strengthening its integration capabilities with enterprise powerhouses like Microsoft MSFT and Salesforce CRM. These collaborations are not just cosmetic; they are core to the company's mission of optimizing agreement workflows and delivering AI-driven insights that improve the end-user experience.

By embedding itself more deeply into tools already familiar to business clients—such as Microsoft 365 and Salesforce’s CRM suite—Docusign enables seamless agreement management within platforms that enterprises use daily. This integration simplifies contract processes, accelerates decision-making, and creates a unified ecosystem where legal, sales, and procurement teams can collaborate efficiently.

The IAM platform’s growing synergy also highlights Docusign’s commitment to positioning itself as more than an e-signature solution—it's becoming a comprehensive digital agreement hub. Whether a user is drafting a contract within Microsoft Word or managing client pipelines in Salesforce, Docusign’s IAM helps ensure that documents move swiftly through automated, intelligent workflows. These platform partnerships also deepen customer reliance on DOCU’s services, anchoring it within critical enterprise infrastructure. As more businesses seek to modernize agreement processes, Docusign’s integrations with Microsoft and Salesforce are proving instrumental in extending reach, improving retention and reinforcing its competitive edge in the SaaS landscape.

DOCU solidified its leadership in the e-signature market with a strong first-quarter fiscal 2026 performance. It recorded $764 million in total revenues, an 8% year-over-year increase. Impressively, $746 million of that came from subscriptions, highlighting the stability of its SaaS model. Subscription growth, driven in part by Microsoft and Salesforce-aligned services, reflects how enterprises are deepening their usage of Docusign across contract lifecycles. Net revenue retention improved to 101%, suggesting that customers are spending more on the platform. Though billings growth slowed to 4%, it was more indicative of extended renewal cycles than weakening demand.

What stands out is Docusign’s profitability and capital discipline. The company generated $228 million in free cash flow in the first quarter, translating to a healthy 30% margin. As integrations continue to enhance customer value, the company has also committed to shareholder returns, expanding its buyback authorization. These strategic moves suggest that DOCU is not only focused on growth but also on delivering sustained value. With Microsoft and Salesforce reinforcing its relevance across enterprises, and strong free cash flows backing that momentum, Docusign remains well-positioned to maintain its dominance while evolving into a broader digital agreement ecosystem.

DOCU’s growth outlook appears somewhat tepid, with the Zacks Consensus Estimate for fiscal 2026 earnings at $3.54, slightly below the prior year’s figure. While a 7% earnings rebound is expected in fiscal 2027, the pace remains modest for a SaaS company striving to regain stronger momentum.

Revenue projections also indicate gradual progress, with sales expected to increase 6% in fiscal 2026 and 6.4% in 2027. This level of growth may not be sufficient to excite investors, especially amid increasing competition in the digital agreement space. Without a meaningful catalyst to accelerate earnings or revenues, DocuSign risks being viewed as a mature player with limited upside, rather than a high-growth software leader able to command premium valuations.

DocuSign has come under pressure this year, underperforming both its peers and the broader market. While the company continues to enhance its product offering through deeper integration with Microsoft and Salesforce, the stock’s recent weakness signals investor uncertainty. Despite strong profitability and consistent free cash flow, growth projections appear modest and do not reflect the high momentum often expected in the SaaS space. The stock is also exhibiting technical weakness, which may further weigh on sentiment. Given the current conditions, a hold approach is appropriate. Investors should wait for clearer signs of acceleration before reconsidering a buying position.

DOCU currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 25 min | |

| 1 hour | |

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 8 hours | |

| 8 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours | |

| 9 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite