|

|

|

|

|||||

|

|

MercadoLibre MELI has built its largest and most crucial market in Brazil, which now accounts for more than 50% of its total revenues. However, Trump’s 50% tariff on Brazilian imports has raised concerns. If the country’s economy takes a hit or the currency weakens, shoppers may cut back on spending, hurting MELI’s e-commerce and fintech growth in the region.

There’s also a chance Brazil could respond with its trade actions, which might raise costs or cause delays in deliveries. Since MELI relies on fast and efficient logistics, even small disruptions can impact its service and profits. The 50% tariff threat has added uncertainty, making investors question the stock’s short-term direction.

However, everything is not gloom and doom. S&P Global Ratings upgraded MercadoLibre to an investment-grade BBB rating, highlighting its strong business performance, improving profitability and careful financial management. It was noted that the company’s debt levels are expected to stay comfortably within safe limits. With the recent developments, investors may be wondering how to play the stock. Let’s delve deeper to know whether to buy, sell or hold the stock.

In fintech, MercadoLibre is facing rising pressure from Nubank NU, which hit nearly 100 million monthly active users in the first quarter of 2025. Nubank’s growth is fueled by low-cost digital banking and AI-driven credit models. With stronger user engagement and bundled services, Nubank is directly challenging MELI’s hold on payments and lending across Latin America.

In e-commerce and ads, Amazon AMZN and Sea Limited’s SE Shopee are expanding fast. Amazon is boosting its reach in Brazil and Mexico, strengthening logistics and ad tools for sellers. Shopee, backed by Sea Limited, is growing in Brazil with mobile-first, low-cost ad options. Both Amazon and Sea Limited are putting pressure on MELI’s dominance.

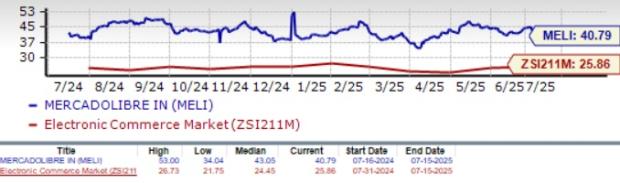

MELI is trading at a premium compared to the broader Zacks Internet – Commerce industry. As of the latest data, MELI’s forward 12-month Price/Earnings ratio hovers around 40.79X, above the industry’s 25.86X.

The Value Score of D further reinforces an unattractive valuation for the stock at the moment.

MELI shares have returned 13.2% over the past three months, underperforming the Zacks Retail-Wholesale sector and the Zacks Internet-Commerce industry’s growth of 14.3% and 26.4%, respectively.

The rise in MELI’s share price reflects its consistent financial performance and strong management, which have helped boost investor confidence. Backed by a solid liquidity position, the company continues to innovate and expand across its core segments. As of March 31, 2025, cash and cash equivalents were $2.98 billion and short-term investments were $741 million. Yet, the stock has lagged behind the broader industry and sector, reflecting investor wariness driven by mounting geopolitical risks and economic uncertainty in Brazil, its most critical market.

The Zacks Consensus Estimate for 2025 earnings is pegged at $47.75 per share, which has remained unchanged over the past 30 days, indicating 26.69% year-over-year growth.

The consensus mark for 2025 revenues is pegged at $27.35 billion, suggesting 31.66% year-over-year growth.

MercadoLibre’s earnings beat the Zacks Consensus Estimate in three of the trailing four quarters and missed once, with the average surprise of 22.59%.

MercadoLibre, Inc. price-consensus-chart | MercadoLibre, Inc. Quote

MercadoLibre is doubling down on digital advertising, aiming to make Mercado Ads a major growth engine. The platform helps sellers and brands reach millions using first-party data across Product, Brand, Display and Video Ads. With new features like automated creative tools and enhanced analytics, ad adoption is expected to rise.

The launch of Mercado Play, MELI’s free streaming app on more than 70 million smart TVs, adds a powerful video layer to its ad ecosystem. By tapping into Latin America’s large base of non-paying streamers, MELI is unlocking fresh ad inventory and deepening engagement beyond commerce. These efforts are set to boost engagement, attract more ad spend and drive long-term revenue growth for MELI.

Mercado Pago, MELI’s financial arm, has announced plans to apply for a banking license from Argentina’s Central Bank as part of its broader push to expand digital banking services across Latin America. Already active in Brazil and Mexico, this move supports its mission to build the region’s largest digital bank.

The license will help offer more products, improve user experience and maintain its 100% digital model. Mercado Pago has already transformed financial access in Argentina, enabling millions to save, pay, invest and get credit. The license is expected to boost top-line growth through expanded services.

Given the mixed signals, a hold stance for MELI stock appears prudent for now. While near-term risks like tariff uncertainty and rising competition may weigh on sentiment, MercadoLibre’s long-term story remains strong. The company is expanding into digital banking and advertising, both of which offer meaningful growth potential. Its solid credit rating and focus on innovation suggest resilience. Valuation is stretched, but steady revenue and profit growth projections offer support. Investors may want to wait for a better entry point while keeping an eye on macro developments in Brazil and execution across new verticals.

MELI currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 16 min | |

| 48 min | |

| 2 hours | |

| 3 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite