|

|

|

|

|||||

|

|

Walmart Inc. WMT and Dollar General Corporation DG are two of the biggest names in the U.S. retail sector, a cornerstone industry that plays a crucial role in consumer spending and the broader economy. Both companies operate thousands of stores nationwide, serving millions of shoppers daily, with a focus on affordability and convenience. However, their strategies diverge: Walmart dominates as a global retail giant offering everything from groceries to electronics, while Dollar General focuses on small-format stores serving rural and value-conscious markets.

As consumer habits evolve and economic pressures shift, both Walmart and Dollar General face unique challenges and opportunities. Investors closely monitor these companies as indicators of retail sector health and consumer resilience. In this article, we’ll take a closer look at how Walmart and Dollar General are currently positioned and evaluate which stock may offer a stronger case for investors right now.

Walmart continues to demonstrate operational strength through its diversified business model and steady execution across both physical and digital retail channels. The company has maintained a stronghold in the evolving global retail landscape by consistently driving customer engagement, whether in-store or online, through its broad multichannel capabilities.

One of the primary drivers behind this sustained momentum is Walmart’s robust omnichannel ecosystem. By integrating stores with digital infrastructure, Walmart has created a seamless shopping experience backed by data analytics, technology investments, and in-store operational enhancements. With a large portion of the U.S. population living near a Walmart store, the retailer leverages store-based logistics to offer rapid delivery and pickup services, enhancing convenience and driving higher customer satisfaction.

E-commerce remains a high-growth pillar. In the first quarter of fiscal 2026, Walmart’s global e-commerce sales surged 22%, led by strong adoption across all business segments, with United States e-commerce sales rising 21%, supported by fast fulfillment, robust marketplace activity, and growing advertising revenues. Sam’s Club U.S. stood out with a 27% e-commerce increase, underscoring the value of club-fulfilled delivery and pickup. International markets also contributed meaningfully, with a 20% e-commerce jump.

While Walmart maintains strong operational momentum, near-term headwinds are beginning to emerge. Tariff-related pressures remain a key concern, with management acknowledging that the company cannot fully sidestep the impact of heightened trade costs. On its last earnings call, leadership cautioned that a return to sharply elevated tariffs could significantly hinder year-over-year earnings growth. Reflecting the current uncertainty, Walmart also refrained from issuing earnings per share guidance for the second quarter of fiscal 2026, citing a highly unpredictable operating environment.

Dollar General is advancing its value-driven retail model with strategic investments that strengthen both operations and customer engagement. In the first quarter of fiscal 2025, the company improved its in-stock position and enhanced labor productivity, leading to consistent growth in both consumable and discretionary categories. Supply chain efficiencies are also improving, with better distribution center performance, reduced third-party warehouse use and a sharper focus on delivery precision through “on time and in full” metrics.

The retailer is also seeing a shift in shopper demographics. Traditionally focused on low-to-middle-income consumers, DG is now attracting a broader customer base, including higher-income shoppers who are trading down amid inflationary pressures. The company reported a four-year high in trade-in activity, with new customers making more visits and purchasing a wider mix of products.

Store growth and modernization are central to Dollar General’s long-term expansion plan. During the first quarter, DG added 156 new stores and accelerated its remodeling programs. Through Project Renovate and Project Elevate, the company is refreshing layouts and assortments, targeting enhanced shopper experience and stronger returns, especially in mature locations.

On the digital front, DG continues to expand its ecosystem. The DG Media Network grew advertising revenues by over 25%, while delivery partnerships with DoorDash and the company’s own same-day delivery platform now cover thousands of locations. By integrating digital services with its extensive store network, Dollar General is building a seamless value offering that aligns with shifting consumer expectations.

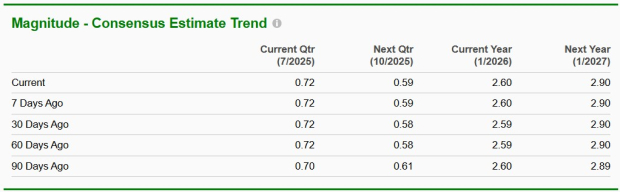

The Zacks Consensus Estimate for Walmart’s fiscal 2026 earnings per share (EPS) has increased by a cent to $2.60 over the last 30 days.

The EPS estimate for Dollar General’s fiscal 2025 has also moved up by a penny to $5.76 over the last 30 days. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

Over the past three months, Walmart shares have gained 2.3%, significantly underperforming the S&P 500 Index, which rose 18.6% during the same period. In contrast, Dollar General’s stock has surged 21.6%, outpacing both Walmart and the broader market.

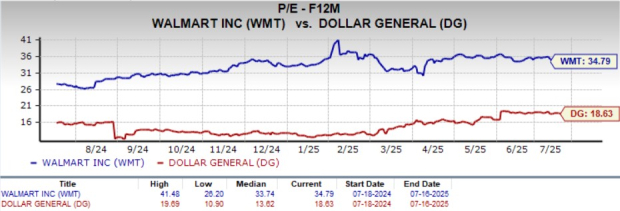

From a valuation standpoint, Walmart currently trades at a forward price-to-earnings (P/E) ratio of 34.79X. Meanwhile, Dollar General trades at a more modest forward P/E of 18.63X.

While both Walmart and Dollar General are key players in the retail sector, DG currently emerges as the more compelling choice for value-driven investors. With a lower valuation multiple, stronger recent stock performance, and strategic growth initiatives in place, Dollar General presents a more favorable risk-reward profile. Walmart’s global reach and robust omnichannel strategy provide long-term stability, but its premium valuation could limit its upside in the near term.

Dollar General currently carries a Zacks Rank #2 (Buy), while Walmart carries a Zacks Rank #4 (Sell). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours | |

| 5 hours | |

| 5 hours | |

| 5 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite