|

|

|

|

|||||

|

|

GE Vernova Inc. GEV is slated to report second-quarter 2025 results on July 23, before market open.

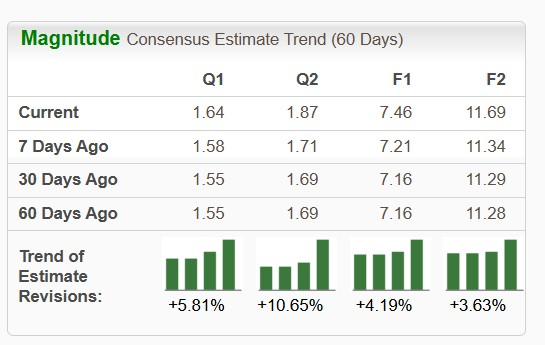

The Zacks Consensus Estimate for revenues is pegged at $8.79 billion, implying an improvement of 7.1% from the prior-year quarter’s reported figure. The consensus mark for earnings is pegged at $1.64 per share, suggesting a solid improvement of 131% from the year-ago quarter’s reported figure. The bottom-line estimate has also increased 5.8% in the past 60 days. (Find the latest EPS estimates and surprises on Zacks Earnings Calendar.)

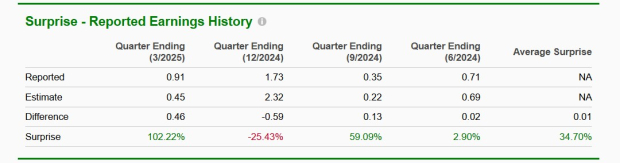

Earnings of GEV, a renowned renewable energy equipment and services provider, outpaced the Zacks Consensus Estimate in three of the last four reported quarters and missed in one, delivering an average surprise of 34.70%.

Our proven model predicts an earnings beat for GEV this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the chances of an earnings beat, which is the case here. You can uncover the best stocks to buy or sell before they are reported with our Earnings ESP Filter.

GEV has a Zacks Rank #3 and an Earnings ESP of +17.99% at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Mixed Segmental Sales Performance Expectation

Solid deliveries of GE Vernova’s gas power equipment, particularly heavy-duty gas turbines, must have boosted the top-line performance of its Power business segment. Also, increases in Gas Power and Steam Power services, driven by favorable volume and price, are likely to have contributed favorably to the Power segment’s revenues in the soon-to-be-reported quarter.

However, the divestiture of a portion of the steam business in the second quarter of 2024 might have weighed on the segment’s soon-to-be-reported quarter’s top line to some extent.

The top-line estimate for the Power segment is pegged at $4,623.9 million, indicating growth of 3.8% from the year-ago quarter’s reported numbers.

As more consumers switch to renewable sources of electricity, demand for large-scale transmission-related equipment to support this transition has been boosting demand for GEV’s Grid Solutions equipment, like switchgear and transformers. Increased sales volumes for these equipment must have bolstered GEV’s revenues from the Electrification business segment.

The top-line estimate for the Electrification unit is pegged at $2,113.5 million, implying an improvement of 18.1% from the year-ago quarter’s reported numbers.

Higher equipment deliveries and improved pricing for the onshore wind business can be projected to have boosted GEV’s Wind segment’s top line in the second quarter of 2025. However, a slower pace of production in the offshore business due to weak demand might have had some adverse impact on the overall revenue performance of this segment.

The consensus mark for the Wind segment’s revenues is pegged at $2,182.1 million, indicating an improvement of 5.8% from the year-ago quarter’s reported numbers.

Factors like favorable price, higher productivity and services volume, the company’s continued cost reduction initiatives, along with healthy margin growth backed by solid equipment orders, are likely to have boosted GEV’s second-quarter earnings. This, together with solid revenue expectations, must have favorably contributed to the company’s overall bottom-line performance.

However, additional expenses to support research and development, as well as capacity expansions at its nuclear and Gas Power businesses, might have had some adverse impact on GEV’s quarterly earnings.

Shares of GE Vernova have gained 42% in the past six months, outperforming the Zacks Alternative-Energy industry’s rise of 5% and the broader Zacks Oils-Energy sector’s loss of 7%. GEV has also outpaced the S&P 500’s growth of 3.9% in the same period.

GEV’s 6-Month Performance

GE Vernova also outpaced the share price performance of some of its other industry peers, such as Constellation Energy Corporation CEG and Bloom Energy BE, whose shares have gained 1.6% and lost 2.7%, respectively, over the past six months.

From a valuation perspective, GEV is trading at a premium compared to its industry. GEV’s forward 12-month price-to-earnings (P/E) is 58.38X, a premium to its peer group’s average of 17.24X. This suggests that investors will be paying a higher price than the company's expected earnings growth compared to its peers.

GEV’s Price-to-Earnings (Forward 12 Months)

Like GEV, its industry peers are also currently trading at a premium. While the forward 12-month P/E multiple for Constellation Energy is 29.10, the same for Bloom Energy is 38.57.

The rising global demand for electricity, fueled by the rapid expansion of data centers and increased energy consumption, has been significantly boosting the adoption of renewable energy sources. This trend has served as a key growth driver for renewable energy stocks such as GEV, CEG and BE.

GE Vernova, in particular, stands out for its established expertise in the electric power sector. With a technology base that includes around 55,000 wind turbines and 7,000 gas turbines, the company plays a pivotal role in generating approximately 25% of the world’s electricity. This strong operational foundation is likely to be reflected in its second-quarter results through robust revenue and earnings growth.

Nonetheless, GEV continues to grapple with headwinds in the offshore wind segment that could pose a concern for its investors.

GEV is not likely to disappoint with its second-quarter results, considering its favorable Zacks Rank and positive Earnings ESP. However, given the stock’s premium valuation, investors considering a new position might prefer to wait until the results are released on Wednesday for greater earnings clarity. That said, existing shareholders may choose to hold on, supported by the stock’s strong performance in the market and the recent upward revision of its second-quarter earnings estimate.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-25 | |

| Feb-25 |

Stock Market Today: Nasdaq Jumps Ahead Of Nvidia Earnings; Goldman Leads Bank Bounce (Live Coverage)

CEG

Investor's Business Daily

|

| Feb-25 | |

| Feb-25 | |

| Feb-25 | |

| Feb-25 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite