|

|

|

|

|||||

|

|

Set to report its quarterly results on Wednesday, July 30, Meta Platforms META stock could be the highlight of the Q2 earnings season.

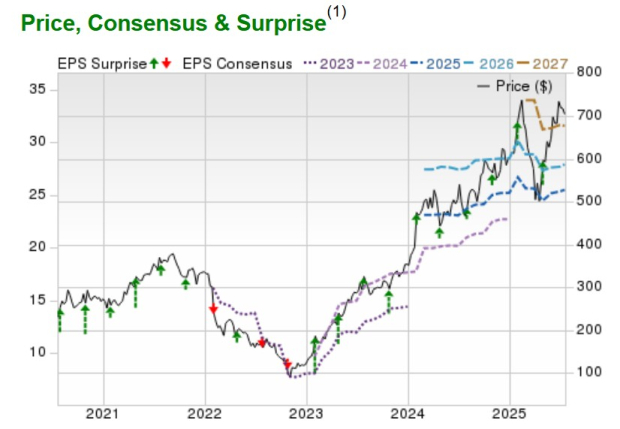

Notably, Meta has now surpassed the Zacks EPS Consensus for 10 consecutive quarters, as illustrated by the green arrows in the Price, Performance, and Surprise chart below, on the way to gains of more than +300% in the last three years.

Outperforming the broader market in 2025, META is up +20% year to date with its impressive EPS surprise streak expected to continue along with considerable expansion on the top and bottom lines.

Furthermore, Meta’s AI infrastructure expansion is a reason to believe the social media giant could steal the spotlight regarding standouts of the Q2 earnings season.

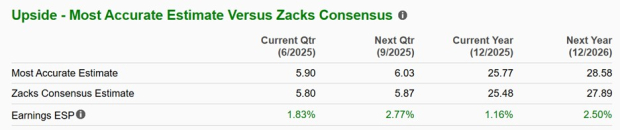

With Meta reaping major rewards from its aggressive push into generative AI, the company’s Q2 sales are thought to have increased 14% to $44.69 billion compared to $39.07 billion a year ago. Plus, Q2 earnings are expected to stretch 12% to $5.80 per share from EPS of $5.16 in the prior year quarter.

More intriguing, the Zacks ESP (Expected Surprise Prediction) suggests Meta could once again surpass earnings expectations with the Most Accurate and recent estimates among Wall Street having Q2 EPS pegged at $5.90 and nearly 2% above the underlying Zacks Consensus.

Of course, the benefiting metrics to support Meta’s AI expansion could help lead to a post-earnings pop. To that point, Meta has gone all out on a bold strategy that combines massive AI infrastructure investment, elite talent acquisition, and cutting-edge model development.

Supporting Meta’s push toward “superintelligence” are several AI data centers and systems that are on the horizon with the capability to enhance reasoning and coding, interacting at human-like levels.

Prometheus: A 1-gigawatt facility in Ohio, launching in 2026.

Hyperion: A 5-gigawatt campus in Louisiana, which is one of the world’s largest AI data centers.

Titan Clusters: Additional multi-gigawatt AI supercomputing data centers planned across North America and Europe.

It's noteworthy that Meta’s Advantage+ Ads use AI to optimize targeting and performance with minimal manual input. Leading to more advertising revenue for Meta is that advertisers are seeing higher ROI from the monetization of AI across Meta’s massive user base. Powering smart replies, content recommendation, and moderation, Meta AI is embedded in Facebook, Instagram, WhatsApp, and Messenger, reaching 700+ million monthly active users.

It’s also worth mentioning that Meta’s "LLaMA" large language models (LLMs) are open-source regarding their AI capabilities that understand and generate human-like processes, which has attracted developers and startups to build on the technology. Overlapping the scale of potential that Meta is creating is that AI chatbots and virtual assistants are being used for a variety of companionship roles, as friends, therapists, and even romantic partners…

Correlating with the strong YTD price performance for META, EPS revisions have continued to trend higher across the board for Meta's current reporting quarter (Q2), Q3, fiscal 2025 as a whole, and FY26. Even better, and indicative of more upside in Meta’s stock ahead of its Q2 report, is that these EPS revisions are nicely up in the last week.

Meta’s annual earnings are now expected to increase 7% this year and are projected to rise another 9% in FY26 to a whopping $27.89 per share. Most mind-blowing, following the pandemic, FY26 EPS projections would reflect 176% growth with Meta’s earnings at $10.09 a share in 2020.

Despite a lofty price tag of over $700 a share, Meta stock is still the second cheapest company among its “Magnificent 7” big tech peers in terms of P/E valuation.

At just under 28X forward earnings, META is only above Alphabet’s GOOGL 19.2X but is the next closest of the Mag 7 to the benchmark S&P 500’s average, with Tesla TSLA having the most stretched P/E premium among the group at 185.5X.

Bottom Line

Meta Platforms stock has continued to create the eustress that led to some investors taking profits too soon, and optimistically, META looks poised to keep running past $700 a share as its Q2 results approach next week.

Keeping this in mind, in addition to sporting a Zacks Rank #1 (Strong Buy) and landing the Bull of the Day, META checks an “A” Zacks Style Scores grade for Growth and Momentum.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 12 min | |

| 29 min | |

| 58 min |

This Viral AI Project Went From Side Hustle to Coveted Prize in Three Months

META

The Wall Street Journal

|

| 58 min |

Land Grab for Data Centers Is One More Obstacle to Much-Needed Housing

GOOGL

The Wall Street Journal

|

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 1 hour | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 3 hours | |

| 4 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite