|

|

|

|

|||||

|

|

Surging geopolitical instability, heightened military conflicts, and rising cybersecurity threats have prompted governments across the globe to significantly ramp up their defense budgets over the past decade. This has been fueling strong investor interest in defense stocks, placing defense giants like Lockheed Martin LMT and General Dynamics GD in the spotlight.

While Lockheed is well-known for its combat-proven fighter jets like F-35, missile defense systems, and space assets, General Dynamics’ portfolio spans commercial and defense aerospace, nuclear submarines and mission-critical IT services.

As nations worldwide are actively striving to modernize their military fleets, enhance deterrence, and secure digital infrastructure, both LMT and GD stand to benefit from the virtue of their scale, contracts and strategic positioning. Thus, for investors seeking exposure to the booming defense industry, choosing between these two stocks might be a challenge, as each brings distinct strengths to the field of long-term investing. To overcome this challenge, let’s dig deeper into the fundamental growth drivers, financial strength and risks (if any) of investing in these stocks.

Lockheed’s balance sheet shows weak solvency, with just $1.29 billion in cash against $3.12 billion in current debt and $18.52 billion in long-term debt as of June 29, 2025. Despite this, its strong operating cash flow of $1.61 billion in the first half of 2025 enabled generous shareholder returns. The company paid $1.57 billion in dividends, up 2.3% year over year, and repurchased 2.7 million shares worth $1.3 billion. While these moves reflect LMT’s strong commitment to shareholders, its high debt relative to cash raises concerns about the long-term sustainability of such payouts.

On the other hand, General Dynamics held $1.52 billion in cash versus $1.20 billion in current debt, as of June 29, 2025. This reflects the company’s strong short-term solvency and capacity to invest in product innovation, thereby promoting its long-term growth value.

GD’s operating cash flow surged a solid 170.5% year over year to $1.45 billion in the first half of 2025, supporting its shareholder-friendly moves. The company paid $785 million in dividends, as of June 29, up 4.7% from the prior-year level, and repurchased 2.4 million shares. This strong cash position and improved cash flow underscore GD’s financial strength and commitment to long-term shareholder value.

A key growth driver for both Lockheed and General Dynamics is the expansionary U.S. defense budget. In May 2025, the White House proposed a 13% hike in defense spending to $1.01 trillion for fiscal 2026. This includes $25 billion for the proposed Golden Dome missile defense system and $40 billion for the U.S. Space Force. Lockheed, a leader in missile defense and space systems, is well-positioned to benefit from this. The proposal also earmarks increased funding for naval shipbuilding and $15.1 billion for cybersecurity — both areas where General Dynamics has a strong presence.

Beyond the defense budget, General Dynamics gains additional momentum from its commercial aviation segment, particularly business jets. With global air traffic steadily rising, demand for GD-built jets like G700 aircraft is rising, boosting long-term revenue prospects.

On the contrary, Lockheed’s growth is supported by its innovative defense programs. The company is set to benefit from continued F-35 sustainment, increased PAC-3 missile production, growing demand for HIMARS and GMLRS systems, and modernization of the Trident II D5 ballistic missile. These programs reinforce Lockheed’s position as the largest defense contractor in the United States and support its long-term outlook.

Both Lockheed and General Dynamics face industry-wide challenges such as skilled labor shortages and critical parts scarcity due to ongoing global supply-chain issues. These have been further worsened by the recent U.S. tariffs on imports, including a 25% duty on steel and aluminum from most trade partners, risking limited availability of key aircraft materials and potential production delays for both stocks.

Beyond these common industry headwinds, LMT and GD also face company-specific challenges. Lockheed has encountered performance setbacks on certain classified contracts, resulting in occasional reach-forward losses in recent quarters. In contrast, General Dynamics, with exposure to the commercial aviation sector, is more vulnerable to supply disruptions than Lockheed. While both commercial and defense aerospace face component shortages, the impact is harsher on commercial aerospace due to its reliance on global supply chains and market volatility. The defense segment remains more resilient, backed by consistent government funding, providing some cushion against these industry headwinds.

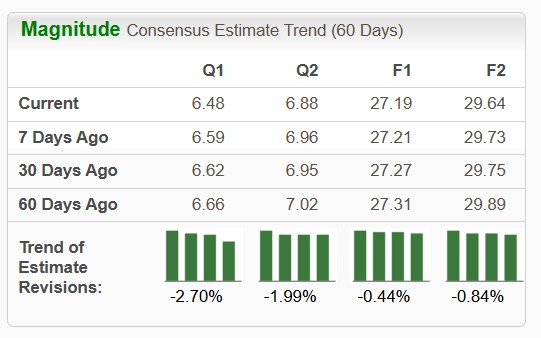

The Zacks Consensus Estimate for Lockheed’s 2025 sales suggests a rise of 4.6% from the year-ago quarter’s reported figure, while that for its earnings per share (EPS) implies a decline of 4.5%. The stock’s near-term bottom-line estimates have moved south over the past 60 days.

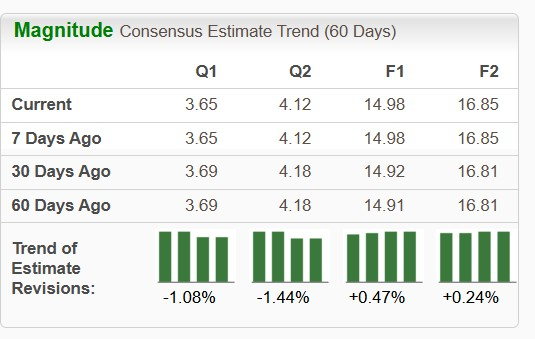

The Zacks Consensus Estimate for General Dynamics’ 2025 sales implies a year-over-year improvement of 5.9%, while that for its EPS suggests a 9.9% rise. Bottom-line estimates for 2025 and 2026 have moved north over the past 60 days, while the same for the third and fourth quarter of 2025 have gone down.

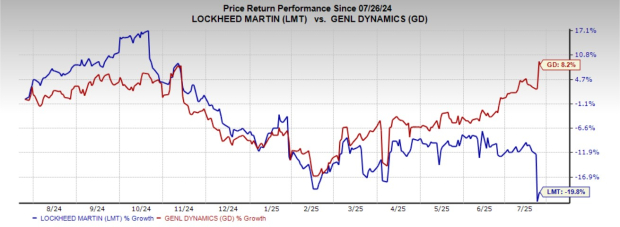

LMT (down 11.7%) has underperformed GD (up 15.5%) over the past three months and has done the same in the past year. Shares of LMT have lost 19.8%, while those of GD have gained 8.2% over the past year.

LMT is trading at a forward earnings multiple of 14.69X, below GD’s 19.60X.

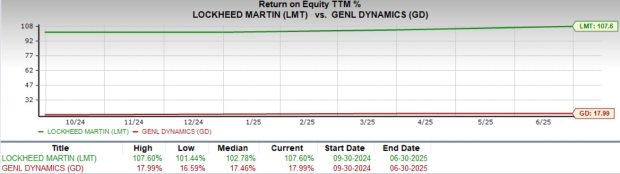

A comparative analysis of both these stocks’ Return on Equity (ROE) suggests that GD is less efficient at generating profits from its equity base than LMT.

A comparative analysis of both these stocks’ long-term debt-to-capital ratios implies that GD is less leveraged than LMT.

Both Lockheed and General Dynamics stand to benefit amid rising global defense budgets and heightened geopolitical risks.

While Lockheed boasts a robust defense portfolio and competitive valuation, its elevated debt levels and recent market underperformance raise caution, particularly in a fragile economic environment. On the other hand, General Dynamics appears better positioned in the near term, supported by stronger recent earnings, lower leverage, solid cash flow and a more stable stock performance.

Although both stocks hold a Zacks Rank #3 (Hold) at present, General Dynamics’ balanced exposure, financial resilience and operational momentum make it the safer and more attractive defense contender at present.

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-11 | |

| Feb-11 | |

| Feb-10 | |

| Feb-10 | |

| Feb-10 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-09 | |

| Feb-08 | |

| Feb-06 |

New U.S. Arms Export Policy Boosts Production of Weapons Important to Pentagon

LMT

The Wall Street Journal

|

| Feb-06 | |

| Feb-06 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite