|

|

|

|

|||||

|

|

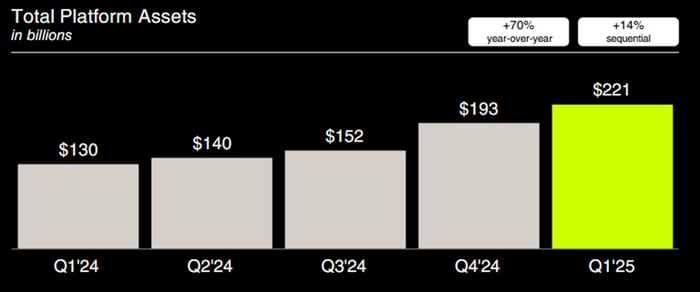

Robinhood has experienced substantial growth, with platform assets more than doubling since 2023.

The company has enhanced its trading platform and added services, including wealth management.

However, the stock has surged 334% in the past year, leaving the shares sitting today at a lofty valuation.

Robinhood Markets (NASDAQ: HOOD) has experienced an impressive surge over the past year, capturing investors with its remarkable turnaround. After facing scrutiny for its payment-for-order-flow business model and its role in the 2021 meme stock frenzy, the company is becoming a formidable player in the financial landscape.

Robinhood is adding customers and assets at an impressive rate, and it continues to do so as it upgrades its platform, grows the business, and expands the investments its customers can purchase. It's even diving into company tokens and prediction markets.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

However, the stock has skyrocketed by 173% since the start of the year. So, is now the time to buy? Let's take a closer look and find out.

A few years ago, Robinhood was a struggling company. It faced intense scrutiny from regulators and customers alike, and its growth stagnated. Fast forward to today, and it has kick-started growth, enhanced its platform, and is pursuing several avenues to drive growth.

One upgrade is Robinhood Legend. This browser-based platform, the company says, aims to be "the most state-of-the-art desktop platform for trading," as Robinhood seeks to persuade active traders to switch. The company has also expanded the products that customers can trade, including index options, futures, and event contracts that capitalize on the growing popularity of prediction markets.

The company also wants to tap into its young customer base and help fulfill their financial needs. In recent years, it has introduced services such as wealth management, advisory services, savings, and spending management, along with retirement accounts with matching contributions.

Robinhood's efforts have paid off big time. Since the end of 2023, platform assets have more than doubled, from $102.6 billion to $255 billion (as of May 31).

Image source: Robinhood.

Millennials and Gen Zers hold about 75% of Robinhood's funded accounts, and a massive wealth transfer over the coming decades could bode well for the company's very long-term asset growth. According to a wealth transfer report from Boston wealth management firm Cerulli Associates, these generations could inherit assets worth up to $124 trillion over the next 25 years.

Earlier this year, the company closed a roughly $300 million acquisition of TradePMR, giving it a foothold in professional advisory services as it seeks to expand its presence in wealth and asset management.

Robinhood is also expanding its presence in the cryptocurrency and digital asset space. It closed its acquisition of Bitstamp, a crypto exchange, in June, helping expand its crypto presence across the European Union and the United Kingdom.

The company also believes it is uniquely positioned to lead in tokenization, which involves transforming traditional financial assets, such as equities and private investments, onto blockchain technology to increase efficiency and liquidity. One of the recent announcements that stirred up discussion was its tokenization of OpenAI and SpaceX for European users, both of which are not publicly traded. The tokens track the private market valuations of these companies.

Robinhood believes this is the future. "These tokens give retail investors indirect exposure to private markets, opening up access, and are enabled by Robinhood's ownership stake in a special purpose vehicle," a company spokesperson said.

With the flurry of positive news, Robinhood stock has run up significantly. Over the last year, it has gained 334% and is up 173% year to date in 2025. The stock's surge has sent its valuation soaring. Today, it trades at a price-to-sales ratio (P/S) of 28.7, and 23.9 based on next year's projected sales. On an income basis, it is priced at 66.7 times forward earnings.

HOOD PE Ratio data by YCharts.

Robinhood is expected to incur higher expenses this year compared to last, and it estimates that its adjusted operating expenses for the year will be between $2.085 billion and $2.185 billion as it ramps up spending to invest in new products, features, and international expansion. This updated outlook also includes an additional $85 million of anticipated costs related to the TradePMR acquisition.

A lot is happening for Robinhood, and as a shareholder, I'm optimistic. Management has done a stellar job growing its business and building its asset base over the past several quarters. This effort is paying off, and the company is now looking to capitalize on its growing asset base through wealth management. It is also exploring more unique products, such as event contracts and asset tokenization, which could appeal to its younger user base.

One drawback is that the stock is expensive. If you do buy Robinhood today, you are paying a steep premium. With a beta of 2.3, the stock experiences more than twice the volatility of the benchmark S&P 500 index, making it vulnerable in the event of a downturn

You could consider buying some shares today. However, I think investors may be better off waiting for the share price to dip and become more reasonably valued before purchasing the stock.

Before you buy stock in Robinhood Markets, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Robinhood Markets wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $636,628!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,063,471!*

Now, it’s worth noting Stock Advisor’s total average return is 1,041% — a market-crushing outperformance compared to 183% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of July 21, 2025

Courtney Carlsen has positions in Robinhood Markets. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

| 1 hour | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-15 | |

| Feb-14 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 |

DraftKings Tanks On Q4 Results; Cathie Wood Unloads More Shares

HOOD +6.82%

Investor's Business Daily

|

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite