|

|

|

|

|||||

|

|

For investors looking at the tobacco sector, the choice often comes down to two industry giants: Altria Group, Inc. MO and Philip Morris International Inc. PM. While both generate substantial revenues from tobacco, they operate in distinct markets and are pursuing different strategies in their transition toward a smoke-free future.

Altria remains focused on the U.S. market, leveraging its dominant Marlboro brand while expanding into alternatives like NJOY and oral nicotine pouches. Philip Morris, on the other hand, generates most of its revenues internationally and has positioned itself as a global leader in reduced-risk products, led by its IQOS heated tobacco system. For investors, the comparison goes beyond brand familiarity; it's about fundamentals, growth potential and how effectively each company is navigating the evolving nicotine landscape.

Altria continues to demonstrate resilience amid long-term cigarette volume declines, largely through its consistent pricing power. In the first quarter of 2025, the company achieved a 10.8% net price realization in smokeable products, contributing to a 2.7% increase in adjusted operating income. This pricing strength remains a key lever supporting profitability during a time of shifting consumer demand.

Altria’s growth in smoke-free products, especially the oral nicotine pouch brand, on!, is another key contributor. In the first quarter, on! shipments rose 18%, and the brand grew its share of the oral tobacco category to 8.8%, while share within the nicotine pouch segment reached 17.9%. The success of the “It’s On!” marketing campaign significantly boosted brand visibility, driving a fivefold increase in consumer impressions.

In the e-vapor category, Altria remains committed to long-term participation despite recent setbacks. Following the temporary market withdrawal of its NJOY ACE product due to regulatory and patent challenges, the company is working to refine its product pipeline and re-enter the market with improved offerings tailored to consumer preferences. At the same time, Altria is advocating for regulatory reform and stronger enforcement to curb the rise of illicit disposable e-vapor products, which now account for over 60% of the U.S. market.

Still, Altria faces structural challenges. The cigarette industry faced significant headwinds during the first quarter of 2025, with shipment volumes under continued pressure. This decline is largely attributed to ongoing macroeconomic challenges and the rapid growth of illegal disposable e-vapor products. Adult smokers continue to experience economic strain due to the prolonged effects of inflation and constrained discretionary spending. Smokers, particularly low-income consumers, are feeling the pinch as inflation continues to outpace wage growth, limiting disposable income.

Philip Morris continues to build momentum behind its transformation strategy. The company’s smoke-free portfolio, led by IQOS, ZYN, and VEEV, is seeing strong global consumer adoption. Its multi-category model is helping expand its user base, with approximately 41.5 million adult users by the end of the second quarter of 2025. This approach supports growth across regions and allows the company to serve varied nicotine preferences under one cohesive platform.

IQOS remains the core driver of Philip Morris’ smoke-free growth engine. The brand saw accelerated growth in key markets, supported by commercial initiatives, regulatory normalization, and innovation through ILUMA and consumable extensions like LEVIA and DELIA. At the same time, ZYN regained momentum in the United States, following improved in-store availability, and VEEV strengthened its presence in Europe with increasing market share and consumer loyalty in the closed pod segment.

The strength of PM’s strategy lies in the execution across markets and product types. The company now offers smoke-free products in 97 markets, with nearly half providing more than one category. It is expanding capacity and scaling innovation globally, with strong early traction in travel retail and emerging regions like Indonesia, Egypt and the Philippines. Strategic brand positioning and consistent investment in innovation are helping PM convert more adult smokers and reinforce its leadership.

Despite this progress, challenges remain. Currency volatility weighed on the second-quarter performance, particularly due to exposure to the Swiss franc. Regulatory risks are also increasing, especially around nicotine pouch marketing and the recently proposed revisions to the EU Tobacco Excise Directive. While the company views the evolving regulatory environment as an opportunity, delays or restrictive measures could impact category expansion and market access in the near term.

The Zacks Consensus Estimate for Altria’s 2025 earnings per share (EPS) has remained unchanged at $5.37 over the last seven days.

The EPS estimate for Philip Morris for 2025 has moved up by a cent to $7.50 during this time.

Altria and Philip Morris have moved in opposite directions over the past month: Altria gained 2.1%, while Philip Morris dropped 11.6%, underperforming the broader S&P 500’s 3.4% rise.

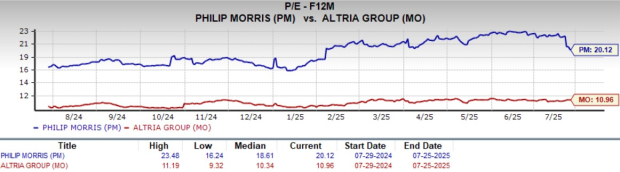

When it comes to valuation, Altria trades at a forward P/E of 10.96X, offering value appeal for income-focused investors seeking yield and stability. In contrast, Philip Morris commands a higher multiple of 20.12X, reflecting its global footprint and strong momentum in smoke-free products.

While both Altria and Philip Morris offer distinct value propositions within the tobacco space, Philip Morris appears better positioned for long-term growth as it aggressively pivots toward a smoke-free future with strong global traction across its reduced-risk portfolio. Its multi-category strategy, innovation-led execution, and expanding international presence give it a structural edge in an evolving industry landscape. Altria’s focus on domestic stability and pricing strength supports income-focused investors, but its growth path faces more headwinds, particularly from regulatory setbacks and macroeconomic pressure in the U.S. market. Considering the broader transition underway in the nicotine industry, Philip Morris seems to have more puff left heading into 2025.

MO and PM currently carry a Zacks Rank #3 (Hold) each. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 2 hours | |

| 3 hours | |

| 4 hours | |

| 4 hours | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-15 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-11 | |

| Feb-11 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite