|

|

|

|

|||||

|

|

Virtual healthcare is rapidly evolving, led by Hims & Hers Health, Inc. HIMS and Teladoc Health, Inc. TDOC. HIMS offers a consumer-centric, subscription-based platform providing access to personalized treatments across sexual health, mental wellness, dermatology and weight loss. Teladoc Health, a global virtual care leader, delivers integrated services spanning primary care, chronic condition management and mental health, with over 17 million visits in 2024.

While HIMS focuses on affordability and personalization through vertical integration, TDOC emphasizes broad clinical reach and enterprise partnerships. With both companies showing promise with rising digital health demand, the question arises: which stock is the better buy at this moment? Let's delve deeper.

HIMS (up 64.5%) has outperformed TDOC (up 11.9%) over the past three months. In the past year, Hims & Hers has rallied 165.6% against Teladoc Health’s decline of 14.3%.

Meanwhile, HIMS is trading at a forward 12-month price-to-sales (P/S) ratio of 4.89, above its median of 2.34X over the past three years. TDOC’s forward sales multiple sits at 0.57X, below its last three-year median of 1.02X. While TDOC appears cheap when compared with the Medical sector average of 2.23X, HIMS seems to be expensive. Currently, Hims & Hers and Teladoc Health stocks have a Value Score of D and B, respectively.

Hims & Hers continues to redefine healthcare access by delivering personalized, subscription-based treatments directly to consumers. The platform now supports over 2.4 million subscribers, up 38.4% year over year in first-quarter 2025. The company’s ability to combine telehealth consultations, diagnostics and pharmacy fulfillment under one digital roof enhances convenience, personalization and recurring revenue predictability — core strengths of its direct-to-consumer model.

The ZAVA acquisition significantly accelerates Hims & Hers' presence in Europe, granting immediate access to over 1.3 million ZAVA customers across the U.K., Germany, France and Ireland. Further expansion into Canada by 2026 signals intent to penetrate high-potential international markets. This geographic scaling enhances the total addressable market size and opens doors to more diversified revenue streams.

The appointment of artificial intelligence (AI) veteran Mo Elshenawy as chief technology officer reflects Hims & Hers’ long-term bet on AI to improve diagnostic accuracy, automate treatment pathways and reduce healthcare friction. Supported by $870 million in convertible note financing, the company is investing in AI infrastructure and personalized care tools to scale efficiently and deliver high-quality care at lower costs.

Teladoc Health’s BetterHelp platform remains a market leader in direct-to-consumer virtual mental health care, supported by over 35,000 licensed clinicians. It enables flexible therapy access via mobile, web and text, serving both U.S. and international users. Nearly half of BetterHelp's users had never sought therapy before, indicating that Teladoc Health is expanding the mental health care market. Although BetterHelp’s growth remained challenged in first-quarter 2025 — marked by a 10.8% revenue decline and a 4% drop in paying users — management continues to focus on reaccelerating engagement and monetization through optimized marketing and product refinements.

Teladoc Health’s Integrated Care segment addresses complex clinical needs through solutions like Primary360 and Chronic Care Complete. These offerings blend virtual primary care, expert medical services and remote patient monitoring. Chronic Care Complete supports individuals with multiple conditions using devices, health coaches and mental health access, increasing user stickiness and average revenue per member.

Teladoc Health has a strong international footprint, serving over 90 million members across diverse channels including hospitals, health systems and insurers. Its Inpatient Connected Care technology turns hospital TVs into virtual care endpoints, improving care delivery and hospital efficiency. International operations across Europe, South America and Asia help diversify revenue and reduce regional concentration risks.

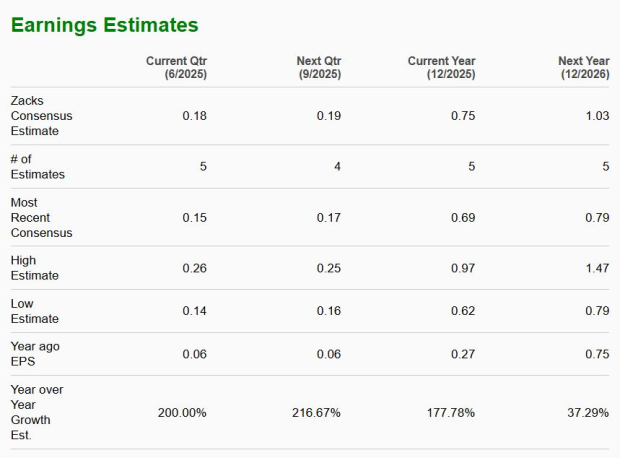

The Zacks Consensus Estimate for HIMS’ 2025 earnings per share suggests a 177.8% improvement from 2024.

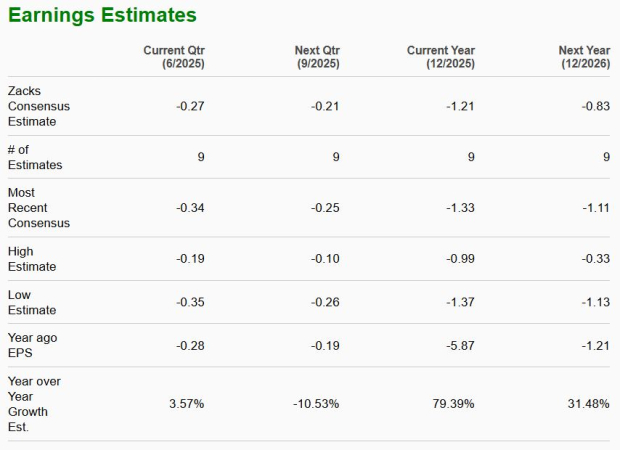

The Zacks Consensus Estimate for TDOC’s 2025 loss per share implies an improvement of 79.4% from 2024.

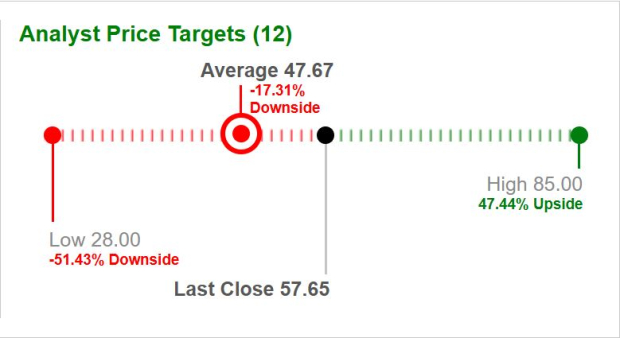

Based on short-term price targets offered by 12 analysts, the average price target for Hims & Hers comes to $47.67, implying a decline of 17.3% from the last close.

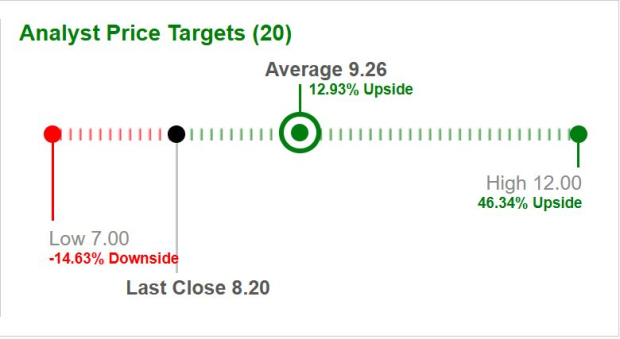

Based on short-term price targets offered by 20 analysts, the average price target for Teladoc Health comes to $9.26, implying an increase of 12.9% from the last close.

While both Hims & Hers and Teladoc Health are promising players in the direct-to-consumer space, HIMS, a Zacks Rank #1 (Strong Buy) firm, presents a more stable and financially sound investment opportunity at this stage. With strong profitability and margins along with consistently growing user engagement, Hims & Hers offers a capital-efficient model that generates substantial free cash flow and delivers steady returns. You can see the complete list of today’s Zacks Rank #1 stocks here.

Teladoc Health, a Zacks Rank #3 (Hold) firm, is rapidly growing and expanding its clinical footprint. The company expanded across all service areas, and its continued strength in virtual mental health care looks promising. For investors seeking lower execution risk, financial predictability and a proven track record, Hims & Hers emerges as a more compelling choice.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 28 min | |

| 1 hour | |

| 1 hour | |

| 1 hour |

Hims & Hers Health Fourth-Quarter Sales Rise, Gives Soft First-Quarter Guidance

HIMS

The Wall Street Journal

|

| 3 hours |

Stocks to Watch Monday Recap: Diamondback, Netflix, Novo Nordisk, Lilly

HIMS

The Wall Street Journal

|

| 3 hours | |

| 3 hours | |

| 3 hours |

Dow Jones Futures: Trump Tariffs Spark Stock Market Sell-Off; Apple, Nvidia, Tesla Are Key Movers

HIMS

Investor's Business Daily

|

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 4 hours | |

| 9 hours | |

| 9 hours |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite