|

|

|

|

|||||

|

|

The cryptocurrency market has been witnessing a strong rally this month. Bitcoin (BTC), the largest cryptocurrency globally, touched the all-time high of 123,091.61 on July 14. Thereafter, it hovers around 118,000. Ethereum (ETH) rebounded sharply and is up more than 57% in the past month.

Positive developments on the global tariff and trade front and the evaporation of a near-term recession fear in the U.S. economy boosted cryptocurrencies. Meanwhile, this space gathers momentum predominantly through favorable regulatory developments.

At this stage, it should be fruitful to invest in crypto-centric stocks with a favorable Zacks Rank for near-term gain. Five such stocks are: Robinhood Markets Inc. HOOD, Interactive Brokers Group Inc. IBKR, IREN Ltd. IREN, Visa Inc. V and Cipher Mining Inc. CIFR.

On July 18, President Donald Trump signed the GENIUS Act (Guiding and Establishing National Innovation for US Stablecoins) seeking to regulate the stablecoin market of the nation. Stablecoins are digital assets that are built to maintain a stable value relative to a “stable” asset like the US dollar. Giant retailers such as Walmart and Amazon are considering launching their own stablecoins to reduce dependence on traditional payment networks like plastic money.

Two major cryptocurrency-related regulations still pending are The CLARITY Act and The Anti-CBDC Surveillance State Act. The CLARITY Act aims to define when crypto is a commodity or a security.

The CLARITY Act would establish a regulatory framework for digital assets other than stablecoins. This will allow crypto exchanges to register with the Commodity Futures Trading Commission thereby reducing the Securities and Exchange Commission’s regulation of digital currencies.

The Anti-CBDC Surveillance State Act aims to prevent the Federal Reserve from issuing a Central Bank Digital Currency (CBDC) directly to individuals or indirectly through intermediaries. The bill also prohibits the Federal Reserve from developing or issuing a CBDC without explicit authorization from Congress.

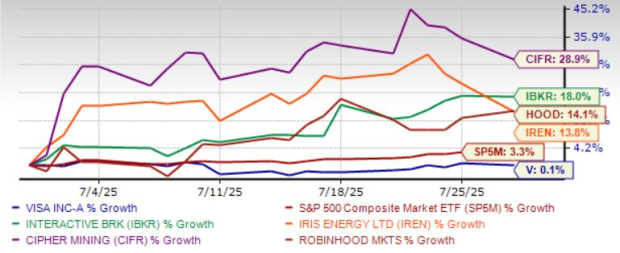

The chart below shows the price performance of our five picks in the past month.

Robinhood Markets operates a financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds, options, gold, and cryptocurrencies. HOOD buys and sells Bitcoin, Ethereum, Dogecoin, and other cryptocurrencies using its Robinhood Crypto platform.

Given the higher retail participation in markets, HOOD’s trading revenues are expected to improve in the near future. Buyouts and product diversification efforts to become a leader in the active trader market will likely bolster its financials.

HOOD’s vertical integration will likely enhance its product velocity. Further, a robust liquidity position will help HOOD in sustainable share repurchases. HOOD currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Robinhood Markets has an expected revenue and earnings growth rate of 26.8% and 20.2%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 6.5% over the last 30 days.

Zacks Rank #1 Interactive Brokers Group is a global automated electronic broker. IBKR executes, processes and trades in cryptocurrencies. IBKR’s commodities futures trading desk also offers customers a chance to trade cryptocurrency futures.

IBKR’s efforts to develop proprietary software, lower compensation expenses relative to net revenues, enhance its emerging market customers and global footprint, along with relatively high rates, are expected to continue aiding revenues. IBKR’s initiatives to expand its product suite and the reach of its services will support financials.

Interactive Brokers Group has an expected revenue and earnings growth rate of 7.4% and 9.7%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 9.7% in the last 30 days.

IREN is a Bitcoin mining company. IREN builds, owns and operates data center infrastructure with a focus on entry into regions where it can access abundant and/or under-utilized renewable energy to power its operations. IREN currently carries a Zacks Rank #2 (Buy).

IREN has an expected revenue and earnings growth rate of 86.1% and more than 100%, respectively, for the current year (ending June 2026). The Zacks Consensus Estimate for current-year earnings has improved 17.3% over the last 30 days.

Zacks Rank #2 Visa’s ongoing shift to digital payments is advantageous for Visa, with strong domestic volumes supporting its overall performance. V is taking a significant step toward modernizing cross-border money movement.

In a move aimed at enhancing the efficiency of global transactions, V is expanding its stablecoin settlement capabilities to the high-performing Solana blockchain. This expansion of V includes collaboration with prominent merchant acquirers Worldpay and Nuvei, marking a pivotal development in the world of digital payments.

Visa has an expected revenue and earnings growth rate of 10.3% and 13.1%, respectively, for the current year (ending September 2025). The Zacks Consensus Estimate for current-year earnings has improved 0.1% over the last 30 days.

Zacks Rank #2 Cipher Mining is an industrial-scale bitcoin mining company. CIFR also offers high-performance computing (HPC) services, such as artificial intelligence. CIFR continues to develop its pipeline of power capacity at high-quality data center sites, either for bitcoin mining or HPC.

Cipher Mining has an expected revenue and earnings growth rate of 72% and -150%, respectively, for the current year. The Zacks Consensus Estimate for current-year earnings has improved 18.6% in the last 60 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 13 min | |

| 13 min | |

| 3 hours | |

| 3 hours | |

| Feb-18 | |

| Feb-18 |

Riot Surges On Activist Data Center Proposal, ARK Resumes Coinbase Buys

CIFR

Investor's Business Daily

|

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Riot Rises On Activist Data Center Proposal, ARK Resumes Coinbase Buys

CIFR

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite