|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Fomento Economico Mexicano S.A.B. de C.V. FMX, alias FEMSA, reported second-quarter 2025 net majority earnings per ADS of 42 cents (Ps. 78 cents per FEMSA unit), down from $1.87 in the year-ago quarter and missed the Zacks Consensus Estimate of 91 cents.

Net consolidated income was Ps. 5,593 million (US$297 million), reflecting growth of 64.3% from the year-ago quarter.

Total revenues were US$10.84 billion (Ps. 211,364 million), which rose 6.3% year over year in the local currency. However, revenues missed the Zacks Consensus Estimate of $11.2 billion. Revenue growth was driven by gains across its business units outside Mexico and favorable currency rates due to the depreciation of the Mexican Peso against most of operating currencies. Including the currency effects and M&A, revenues grew 2.2% year over year.

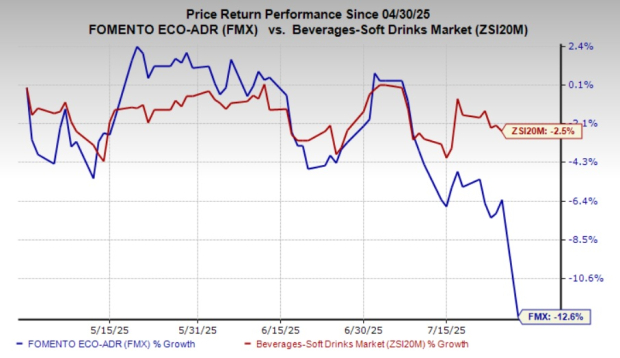

Shares of this Zacks Rank #3 (Hold) company have lost 12.6% in the past three months compared with the industry’s 2.5% decline.

FEMSA’s gross profit rose 4.2% year over year to Ps. 85,922 million (US$4.56 billion). The consolidated gross margin contracted 80 basis points (bps) to 40.7%, caused by gross margin contractions in Proximity Europe, Health and Coca-Cola FEMSA divisions, and a greater mix of operations outside of Mexico in Proximity Americas, including acquisitions. This was partly offset by margin expansion in Fuel and OXXO Mexico. Including the currency effects and M&A, gross profit remained flat year over year.

The company’s gross margin remained flat at Proximity Americas and contracted 190 bps at Proximity Europe, 60 bps at Health and 70 bps at the Coca-Cola FEMSA segment. However, the gross margin improved 70 bps at the Fuel segment.

FEMSA’s operating income (income from operations) improved 1.2% year over year to Ps. 17,832 million (US$947 million). Including the currency effects and M&A, operating income declined 1.5% year over year. The consolidated operating margin decreased 50 bps to 8.4%, caused by declines across the Proximity Americas, Health and Coca-Cola FEMSA segments, mainly due to the higher-margin businesses in Mexico. This was partly negated by operating margin growth in the Proximity Europe and Fuel divisions.

Fomento Economico Mexicano S.A.B. de C.V. price-consensus-eps-surprise-chart | Fomento Economico Mexicano S.A.B. de C.V. Quote

Proximity Americas: Total revenues for the segment rose 6.9% year over year to Ps. 83,958 million (US$4.5 billion). The company reported a 0.4% drop in same-store sales for Proximity Americas, caused by a 6.6% store traffic decline, offset by a 6.6% rise in average customer tickets. Including currency effects and M&A, revenues at Proximity Americas rose 2% year over year and same-store sales declined 0.6%. The soft top-line performance reflects a difficult quarter in Mexico, weighed by adverse weather and a soft consumer backdrop, partially offset by higher average ticket as Holy Week shifted into the period.

The Proximity Americas division had 25,180 OXXO stores as of June 30, 2025. Operating income declined 2.8% year over year and 3.1% including currency effects and M&A. The segment's operating margin contracted 90 bps to 9%, caused by higher selling expenses related to increased labor costs. This increase was also caused by elevated administrative expenses from ongoing investments in commercial capabilities like segmentation, revenue management and data analytics.

Proximity Europe: Total revenues for the segment grew 31.4% year over year to Ps. 15,065 million (US$800 million). The segment benefited from currency appreciation of the Euro and the Swiss Franc against the Mexican peso. Excluding currency effects, total revenues for the segment were up 5.9% year over year, aided by improved retail sales, mainly in Switzerland, partly offset by lower sales in its B2B and B2C foodservice businesses. Operating income for the segment rose 54.4% year over year. The operating margin expanded 70 bps to 4.6% driven by higher retail sales and effective cost management.

Health Division: The segment reported total revenues of Ps. 21,850 million (US$1.16 billion), up 15.6% year over year and 6.7% on a currency-neutral basis. Revenues were aided by growth in Colombia and Ecuador, partially offset by a challenging competitive landscape in Mexico. The segment’s store base reached 4,321 locations as of June 30, 2025. Same-store sales rose 13.1% in Mexican pesos and 4.8% on a currency-neutral basis. The operating income improved 5.7% year over year, while the operating margin contracted 30 bps to 3.8%.

Fuel Division: Total revenues rose 0.6% year over year to Ps. 17,100 million (US$908.2 million). Average same-station sales rose 4.9%, driven by a 4.2% increase in the average volume and a 0.6% gain in the average price per liter, offset by a decline in the wholesale business volume. The company had 559 OXXO Gas service stations as of June 30, 2025. Operating income improved 13.6%, while the operating margin expanded 60 bps to 4.7%, led by higher efficiencies and cost controls.

Coca-Cola FEMSA: Total revenues for the segment advanced 5% year over year to Ps. 72,917 million (US$3.9 billion). On a currency-neutral basis, revenues were up 2.4%. Coca-Cola FEMSA’s consolidated operating income increased 0.2% year over year and declined 2.6% on a currency-neutral basis. The segment’s operating margin contracted 60 bps to 13.4%.

As of June 30, 2025, FEMSA had cash and cash equivalents of Ps. 129,825 million (US$6.9 billion). The company’s long-term debt was Ps. 136,215 million (US$7.2 billion). In the second quarter of 2025, capital expenditure totaled Ps. 9,203 million (US$488.8 million), a decline from the prior year due to reduced spending in Proximity Americas, caused by a pause in the expansion strategy in OXXO Chile and Peru, and lower spending in the Health division.

We have highlighted three better-ranked stocks from the Consumer Staples sector, namely PepsiCo Inc. PEP, The Vita Coco Company COCO and Zevia ZVIA.

PepsiCo is one of the leading global food and beverage companies. The company currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for PEP’s 2025 sales indicates growth of 1.2% from the previous year’s reported figures. PepsiCo delivered a trailing four-quarter average earnings surprise of 1.01%.

Vita Coco produces and distributes coconut water products under the Vita Coco brand name in the United States, Canada, Europe, the Middle East, Africa and the Asia Pacific. It presently carries a Zacks Rank #2.

The Zacks Consensus Estimate for Vita Coco’s 2025 sales and EPS indicates growth of 12.5% and 6.5%, respectively, from the prior-year reported levels. COCO delivered a trailing four-quarter earnings surprise of 28.2%, on average.

Zevia develops and distributes zero-sugar beverages in the United States and Canada. The company offers soda, energy drinks and organic tea under the Zevia brand name. ZVIA currently has a Zacks Rank #2.

The Zacks Consensus Estimate for the company’s 2025 sales and earnings implies growth of 3.4% and 48.4%, respectively, from the previous year’s reported numbers.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite