|

|

|

|

|||||

|

|

Exelixis, Inc. (EXEL) reported mixed results for the second quarter of 2025.

Adjusted earnings of 75 cents per share beat the Zacks Consensus Estimate of 65 cents. The company registered adjusted earnings of 84 cents per share in the year-ago quarter. Adjusted earnings exclude the impact of stock-based compensation expenses.

Including stock-based compensation expense, earnings were 65 cents per share in the reported quarter compared with 77 cents in the year-ago period.

However, net revenues of $568.3 million missed the Zacks Consensus Estimate of $579 million. The top line was also down 10.8% year over year.

The stock is trading down in pre-market in response to the revenue miss.

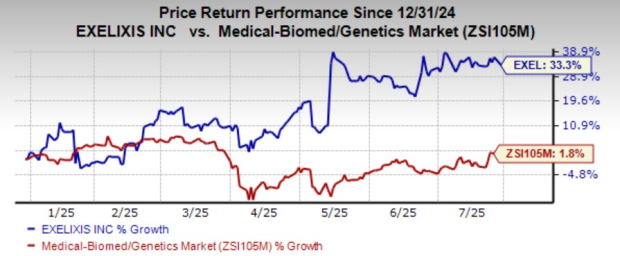

Exelixis’ shares have risen 33% year to date compared to the industry’s gain of 1.8%.

The year-over-year decline in revenues can be attributed to lower collaboration revenues even though product revenues recorded strong growth.

Net product revenues were $520 million, up 18.8% year over year. This rise was primarily driven by increased sales volume.

Cabometyx (cabozantinib) generated revenues of $517.9 million, which missed the Zacks Consensus Estimate of $527 million but beat our model estimate of $511.3 million. The drug is approved for advanced renal cell carcinoma (RCC) and previously treated hepatocellular carcinoma. Cometriq (cabozantinib capsules) generated $2.1 million in net product revenues for treating medullary thyroid cancer.

In March 2025, Exelixis obtained FDA approval for the label expansion of Cabometyx for the treatment of adult and pediatric patients 12 years of age and older with previously treated, unresectable, locally advanced or metastatic, well-differentiated pancreatic and extra-pancreatic neuroendocrine tumors (NET).

Demand for this new indication was just over 4% of the total demand for cabozantinib in the second quarter and EXEL expects that contribution to increase going forward.

Collaboration revenues, comprising license and collaboration services revenues, totaled $48.2 million, which plunged 70% from $199.6 million recorded in the year-ago quarter. The decrease was primarily related to a $150.0 million commercial milestone recognized during the year-ago quarter. This milestone payment was in connection with partner Ipsen achieving $600 million in cumulative net sales of cabozantinib in its related license territory over four consecutive quarters.

Research and development expenses (including stock-based compensation) amounted to $200.3 million, down 5.1% year over year. The decline was primarily related to decreases in manufacturing costs to support development candidates and clinical trial costs.

Selling, general and administrative expenses totaled $134.9 million, up 2.1% year over year. This uptick was primarily related to increases in marketing expenses, stock-based compensation and personnel expenses.

In August 2024, Exelixis announced that the board of directors authorized the repurchase of up to $500 million of its common stock. Subsequently, in February 2025, EXEL’s board of directors authorized the repurchase of up to an additional $500 million of its common stock.

Under these programs, as of June 30, 2025, Exelixis has repurchased $796.3 million of its common stock, at an average price of $36.69 per share. The company still has $204 million remaining under the $500 million stock repurchase plan authorized by the company's board in February 2025.

Exelixis, Inc. price-consensus-eps-surprise-chart | Exelixis, Inc. Quote

Total revenues are expected to be between $2.25 billion and $2.35 billion. Net product revenues are estimated to be in the range of $2.05-$2.15 billion.

The current guidance includes the impact of a 2.8% price increase of Cabometyx in the United States, effective Jan. 1, 2025.

Research and Development expenses are expected to be in the range of $925-$975 million. Selling, general and administrative expenses are anticipated to be in the $475-$525 million range. The effective tax rate for the company is anticipated in the 21-23% range for 2025.

The company is developing zanzalintinib, a next-generation oral investigational tyrosine kinase inhibitor (TKI). Last month, EXEL announced positive top-line results from the late-stage STELLAR-303 study.

This phase III study is a global, multicenter, open-label study that randomized 901 patients equally to receive either investigational TKI zanzalintinib (100 mg) in combination with Roche’s (RHHBY) Tecentriq (atezolizumab) or Stivarga (regorafenib). The study includes patients with previously non-microsatellite instability-high metastatic colorectal cancer.

Zanzalintinib is a third-generation oral TKI that inhibits the activity of receptor tyrosine kinases implicated in cancer growth and spread, including VEGF receptors, MET, AXL and MER.

The STELLAR-303 study met one of its dual primary endpoints, demonstrating a statistically significant improvement in overall survival (OS) for the intent-to-treat (ITT) population when treated with zanzalintinib in combination with Tecentriq compared with the current standard-of-care drug, regorafenib.

Exelixis stated that the trial will continue to a final analysis of the second primary endpoint — OS in the subgroup without liver metastases (non-liver metastases, or NLM).

Roche’s Tecentriq is a cancer immunotherapy that is approved around the world, either alone or in combination with targeted therapies and/or chemotherapies, for various types of cancers.

Enrollment in the STELLAR-304 study was completed in May 2025. This phase III study is evaluating zanzalintinib in combination with Bristol Myers’ (BMY) Opdivo (nivolumab) versus sunitinib in previously untreated patients with advanced non-clear cell renal cell carcinoma (nccRCC). The primary endpoints in the trial are PFS and ORR. Top-line results are expected in the first half of 2026, depending on study event rates.

Cabometyx is also approved for use in combination with BMY’s Opdivo in the first-line setting in RCC.

However, Exelixis has decided not to proceed to the phase III portion of the STELLAR-305 trial on zanzalintinib. The decision was based on the company’s evaluation of emerging data from the phase II portion of the STELLAR-305 trial in advanced squamous cell carcinoma of the head and neck (SCCHN), emerging competition in this indication, and assessment of other, potentially larger, commercial opportunities.

EXEL initiated the phase III STELLAR-311 study in advanced NET. This study is evaluating zanzalintinib versus everolimus as a first oral therapy in patients with advanced NET, regardless of site of origin. The primary endpoint of the trial is PFS per Response Evaluation Criteria in Solid Tumors (RECIST) 1.1 as assessed by Blinded Independent Central Review.

Based on early clinical data generated for XL495, Exelixis has discontinued further development of this program.

Exelixis now has three ongoing phase I studies for its pipeline programs XL309, XB010 and XB628. Additionally, in July, the FDA cleared Exelixis’ IND application for XB371 and the company plans to initiate the phase I study in the coming months.

In July 2025, Exelixis entered into a settlement agreement with Biocon Pharma Limited, which resolved the patent litigation brought in response to Biocon’s abbreviated new drug application (ANDA) seeking approval to market a generic version of Cabometyx prior to the expiration of the applicable patents. Per this settlement, Exelixis will grant Biocon a license to market its generic version of Cabometyx in the United States, beginning Jan. 1, 2031, if approved by the FDA and subject to conditions and exceptions common to agreements of this type.

While EXEL’s overall performance in the quarter was encouraging, the revenue miss was disappointing.

Initial demand for Cabometyx in the recently approved NET indication is encouraging and should fuel sales.

The pipeline progress has been impressive as well, as Exelixis looks to expand its oncology portfolio beyond Cabometyx. The successful development of additional drugs should broaden its portfolio and reduce dependence on its lead drug, Cabometyx.

Exelixis currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 3 hours | |

| 6 hours | |

| 7 hours | |

| 7 hours | |

| 8 hours | |

| 15 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite