|

|

|

|

|||||

|

|

Whirlpool Corporation WHR posted second-quarter fiscal 2025 results, wherein the top line was in line with the Zacks Consensus Estimate, while the bottom line missed estimates. Meanwhile, both sales and earnings per share (EPS) declined year over year.

Shares of the Zacks Rank #3 (Hold) company plunged 14.7% in the pre-market trading session. The decline in share price can be attributed to the combination of disappointing financial results and a cautious outlook. Whirlpool announced it will recommend an annual dividend payout of $3.60 per share, a significant reduction from previous levels.

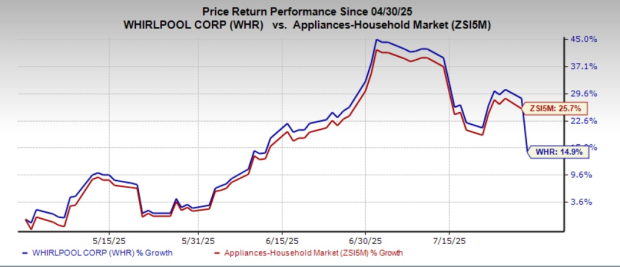

Shares of this company have gained 14.9% in the past three months compared with the industry’s growth of 25.7%.

The appliance maker reported second-quarter adjusted EPS of $1.34 per share, showcasing a decline from $2.39 per share reported in the year-ago period. Also, the metric fell short of the Zacks Consensus Estimate of $1.54 per share.

Whirlpool Corporation price-consensus-eps-surprise-chart | Whirlpool Corporation Quote

Net sales of $3.77 billion declined 5.4% year over year. The decline in sales was primarily driven by weakened global consumer demand, particularly in North America and Latin America. The company faced volume pressure from intensified competition, with foreign rivals pre-loading Asian imports ahead of tariff implementations, leading to a highly promotional environment. Additionally, unfavorable currency exchange rates further weighed on performance.

While major domestic appliance (MDA) segments in North America, Latin America, and Asia reported declines, the Small Domestic Appliances (SDA) segment delivered growth, partially offsetting broader weakness.

Quarterly gross profit was $610 million, down 2.6% from $626 million reported in the year-ago quarter. The gross margin expanded 50 basis points (bps) year over year to 16.2%.

Selling, general and administrative (SG&A) expenses declined 0.8% year over year to $397 million. As a percentage of net sales, SG&A expenses expanded 70 bps year over year to 10.5%.

The ongoing EBIT of $200 million fell 5.7% from $212 million in the year-ago quarter. The ongoing EBIT margin of 5.3% remains flat year over year.

Net sales for the MDA North America segment declined 4.7% year over year to $2.45 billion. Excluding currency effects, Whirlpool’s net sales declined 4.6% year over year in North America due to weak consumer sentiment that pressured both demand and product mix. The market remained highly promotional, intensified by foreign competitors aggressively pre-loading Asian imports ahead of impending tariffs. The segment’s EBIT decreased 11.7% year over year to $144 million, and the EBIT margin contracted 40 bps to 5.9% owing to volume contraction being partially offset by cost-saving initiatives. The Zacks Consensus Estimate for net sales of the MDA North America segment was pegged at $2.57 billion.

Net sales from MDA Latin America declined 10% year over year to $806 million. Excluding currency, the segment’s sales declined 0.9% year over year, driven by implemented pricing actions offset by negative consumer demand in Mexico. The segment’s EBIT of $48 million declined 7.7% year over year. The EBIT margin expanded 20 bps year over year to 6%, attributable to favorable price/mix and cost takeout, partially offset by the negative impact of currency. The Zacks Consensus Estimate for net sales of the MDA Latin America segment was pegged at $754 million.

Net sales in MDA Asia decreased 5.9% year over year to $320 million. Excluding the currency impacts, sales fell 3.7% due to industry decline, partially offset by sustained strong share gains. The segment’s EBIT of $23 million increased 11.2% year over year. Segmental EBIT margin of 7.1% expanded 90 bps, driven by cost take-out actions. The Zacks Consensus Estimate for net sales of the MDA Asia segment was pegged at $355 million.

Net sales in SDA Global increased 7.5% year over year to $201 million. Excluding the currency impacts, sales increased 6.8% due to growth from new product launches and a robust direct-to-consumer business despite an unfavorable industry in North America. The segment’s EBIT of $35 million reflected a 32.9% increase from $26 million reported in the year-ago quarter. Segmental EBIT margin of 17.3% expanded 340 bps from 13.9% in the prior-year quarter due to favorable price/mix. The Zacks Consensus Estimate for net sales of the SDA Global segment was pegged at $200 million.

Whirlpool ended the first quarter with cash and cash equivalents of $1.07 billion, long-term debt of $6.2 billion, and total stockholders’ equity of $2.6 billion. The company declared a dividend of $1.75 per share in the second quarter of 2025.

In the second quarter of 2025, Whirlpool used cash of $702 million from operating activities. It reported a negative free cash of $856 million. WHR incurred capital expenditure of $154 million in the same period.

Whirlpool provided its sales guidance for 2025, anticipating net sales of $15.8 billion, down from $16.6 billion reported in the year-ago period. The company anticipates an ongoing EBIT margin of 5.7%, indicating a rise from 5.3% reported in 2024. Management expects the GAAP and adjusted tax rate to be 20-25% for 2025.

Whirlpool expects its GAAP EPS for 2025 to be between $5.00 and $7.00 against a loss of $5.87 per share. Ongoing EPS is expected to be between $6.00 and $8.00, down from $12.21 per share reported in 2024. The ongoing earnings guidance includes approximately $200 million of cost actions.

Cash provided by operating activities is expected to be nearly $850 million, with an estimated free cash flow $400 million.

We have highlighted three better-ranked stocks, namely adidas AG ADDYY, Revolve Group, Inc. RVLV and Duluth Holdings DLTH.

adidas is a leading brand in the sporting goods market with strong positions in footwear, apparel and hardware. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for adidas’ current fiscal-year sales and EPS indicates growth of 16.5% and 90.4%, respectively, from the year-ago period’s reported figures. ADDYY has a trailing four-quarter negative earnings surprise of 48%, on average.

Revolve Group operates as an online fashion retailer for millennial and Generation Z consumers in the United States and internationally. RVLV currently carries a Zacks Rank #2. RVLV has a trailing four-quarter earnings surprise of 63.4%, on average.

The Zacks Consensus Estimate for Revolve Group’s current financial year’s sales growth of 5.4% and earnings implies a decline of 40.6%, respectively, from the year-ago reported numbers.

Duluth Holdings provides casual wear, workwear and accessories for men and women. The company currently carries a Zacks Rank #2. Duluth Holdings has a trailing four-quarter negative earnings surprise of 21%, on average.

The Zacks Consensus Estimate for DLTH’s current financial-year EPS indicates growth of 18.3% from the year-ago figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| 2 hours | |

| 6 hours | |

| 7 hours | |

| 11 hours | |

| 11 hours | |

| Feb-22 | |

| Feb-20 | |

| Feb-19 | |

| Feb-18 | |

| Feb-16 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite