|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

The space industry is gaining strong momentum in 2025, driven by a combination of increasing global security concerns, the need for faster and more reliable satellite communications and rising collaboration between governments and private space firms. Among the many players aiming to make their mark in this rapidly expanding industry, Rocket Lab USA Corporation (RKLB) and Intuitive Machines (LUNR) have drawn significant investor interest.

Rocket Lab is known for offering end-to-end space solutions. It has a solid presence in small satellite launch services, satellite design and production and advanced space systems. On the other hand, Intuitive Machines primarily focuses on lunar services. It specializes in lunar landers, payload delivery to the Moon, data services and building infrastructure for long-term lunar operations.

Both RKLB and LUNR are steadily expanding their capabilities to take advantage of the rising demand in the space economy. But with their different business models and target markets, investors may be wondering which of the two could offer better returns in 2025. Let’s explore further to find out.

Recent Achievements: In July 2025, RKLB announced a new partnership with Bollinger Shipyards to develop an ocean landing platform for its upcoming Neutron reusable rocket. The 400-foot vessel, named Return On Investment, will be equipped with Rocket Lab’s landing and recovery systems to enable offshore rocket landings. Scheduled for delivery in early 2026, this platform marks a key milestone in the company’s shift toward reusability and expanded launch capabilities for larger payloads.

In June, Rocket Lab completed its 68th successful Electron launch, further solidifying its reputation as a reliable provider in the small satellite launch market. The company continues to benefit from its strong partnerships with NASA and the U.S. government, which play a key role in supporting its long-term growth and expanding customer base.

Financial Stability: At the end of the first quarter, Rocket Lab held $428 million in cash and cash equivalents. Its short-term debt stood at $20 million, while long-term debt was around $419 million. So, we may safely conclude that the company holds a moderate solvency position, which should enable it to continue funding its research and development efforts and scale production for both launch vehicles and satellite systems.

Challenges to Note: One concern for investors is Rocket Lab’s high-cost structure, due to ongoing investments in new technologies such as the Neutron launch vehicle, reusability programs for Electron and the expansion of its space systems offerings. These initiatives often result in elevated expenses, which tend to weigh on profitability.

Additionally, the space sector demands significant development timelines. Projects like Neutron may take longer than expected to reach operational status, which may delay expected revenue generation for RKLB and thereby affect its growth prospects.

Recent Achievements: In July 2025, Intuitive Machines partnered with San Jacinto College and Rhodium Scientific to launch a state-supported training program focused on handling pharmaceuticals returned from orbit using its Zephyr reentry vehicle.

The company also received approval to expand its Houston Spaceport headquarters by three acres, with a $12 million investment to build new production, testing and mission support facilities. This move is aimed at scaling operations to meet future government and commercial demand.

In addition, Intuitive Machines partnered with Space Forge to advance U.S.-based semiconductor manufacturing in space. The collaboration will use Zephyr to return semiconductor materials made in orbit, supporting the growth of commercial in-space production capabilities. These announcements are indicative of RKLB’s expanding role in varied space services.

Financial Stability: LUNR ended the first quarter of 2025 with $375 million in cash and cash equivalents. The company did not report any notable debt as of March 2025. This indicates a strong financial position, which could support it to reliably fund its ongoing operations and future growth plans.

Challenges to Note: While Intuitive Machines is expanding its capabilities across lunar services and space-based manufacturing, several challenges could impact its growth. It remains highly dependent on government contracts, especially those related to NASA’s lunar missions. Any delays, funding changes or mission cancellations could directly affect its revenue flow and business operations.

Another concern is the early-stage nature of many of its commercial ventures, such as space-based pharmaceutical returns and semiconductor manufacturing. These areas require complex logistics, significant investment and regulatory approvals before they can scale. Until these programs move beyond the development phase and begin generating steady income, the company’s commercial success remains largely unproven.

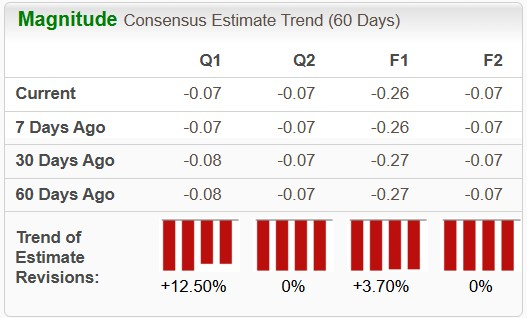

The Zacks Consensus Estimate for RKLB’s 2025 sales implies a year-over-year surge of 32.8%, and the same for its loss suggests an improvement. The stock’s bottom-line estimates for 2025 have also improved over the past 60 days.

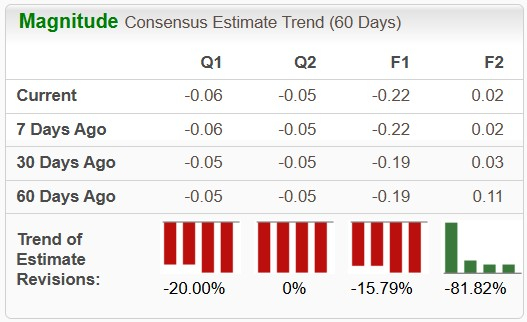

The Zacks Consensus Estimate for LUNR’s 2025 sales implies a year-over-year surge of 18.8%, and the same for its loss suggests an improvement. However, the stock’s bottom-line estimates for 2025 and 2026 have moved south over the past 60 days.

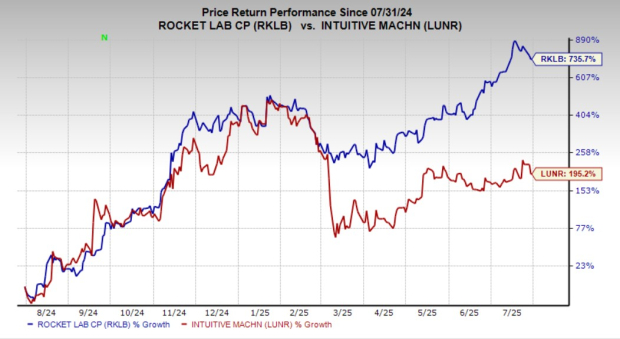

RKLB (up 735.7%) has outperformed LUNR (up 195.2%) over the past year.

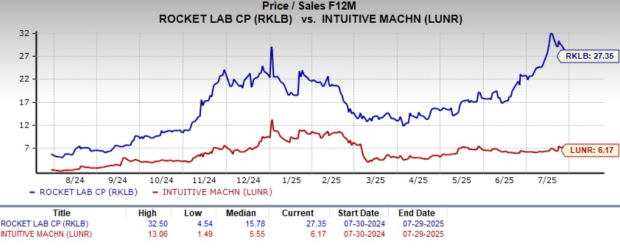

LUNR is trading at a forward sales multiple of 6.17X, below RKLB’s forward sales multiple of 27.35X.

The image below, reflecting a negative Return on Invested Capital for LUNR and RKLB, suggests that neither of these space stocks is generating enough profit from its investments to cover the cost of its capital.

Both Rocket Lab and Intuitive Machines boast notable growth opportunities in the expanding space sector, but the former appears to be the stronger contender at this stage. Its outperformance at the bourses, improving earnings outlook and consistent launch record give it an edge.

Intuitive Machines shows long-term potential and offers attractive valuation, but its heavy reliance on lunar missions and downward revision in earnings estimate raise red flags.

While RKLB has a Zacks Rank #3 (Hold), LUNR carries a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 | |

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite