|

|

|

|

|||||

|

|

Rising global aircraft deliveries, expanding airline fleet sizes and increasing demand for maintenance, repair, and overhaul (MRO) services are fueling growth across the aviation services industry. These trends, supported by the steady recovery in global air travel and defense modernization programs, are boosting investor interest in aerospace service providers like Astronics Corporation ATRO and AAR Corp. AIR.

Astronics focuses on cutting-edge aircraft electrical systems, lighting technologies and connectivity solutions — essential for enhancing passenger experience and cockpit modernization in both commercial and military aircraft. AAR, meanwhile, operates as a diversified aviation services provider, offering aftermarket support, parts supply, and integrated solutions to airlines, governments and defense contractors across the globe.

With technological advancements, heightened focus on aircraft efficiency and gradually easing supply-chain pressures drawing attention to aviation support companies, ATRO and AIR remain in the spotlight for investors evaluating opportunities in this space. So, an investor is likely to be left with the inevitable question: Which stock emerges stronger? Let’s take a closer look to find out.

Astronics ended March 2025 with a cash and cash equivalent of $26 million. While its long-term debt totaled $160 million, as of March 2025-end, its current debt was nil. So, it is safe to conclude that the stock boasts a solid solvency position in the near term, which should enable it to duly meet its capital expenditure target of $35-$40 million in 2025.

A major part of this investment is expected to be dedicated to new product innovations to effectively expand core competency in its existing business. This financial stability should also bolster ATRO’s strategy of enhancing its value through strategic acquisitions.

In contrast, AAR’s cash and cash equivalents (including restricted cash) amounted to $96.5 million, as of May 31, 2025. Its long-term debt totaled $968 million, while its current debt was nil, at the end of the fourth quarter of fiscal 2025. So, one can safely conclude that the stock holds a solid solvency position for the near term, which should offer it the flexibility to invest in differentiated capability and efficiency to steadily meet the growing aftermarket services demand, and thereby capture more market share.

With respect to growth drivers, the steadily improving air passenger traffic worldwide (for the past couple of years), following a major setback during the initial years of the COVID-19 pandemic, has been playing the role of the primary growth catalyst for both ATRO and AIR. Evidently, Astronics registered an 11.3% year-over-year sales improvement in first-quarter 2025, partially backed by a solid 13.3% surge in its sales to the commercial transport market. On the other hand, AIR, during the fiscal fourth quarter, witnessed a solid increase of 12% in sales to commercial customers, partly driven by strong demand for new parts distribution activities.

Sales growth for defense-related aerospace parts and equipment, backed by an increasing defense product acquisition trend worldwide, has also been contributing to both ATRO and AIR’s top-line performance. Notably, an impressive 94.8% improvement in sales to the military aircraft market partially drove the 11.3% year-over-year overall sales improvement for ATRO in the first quarter of 2025. On the other hand, AIR witnessed a solid 18.1% improvement in its sales from the government and defense business segment during fiscal 2025.

In terms of divergent growth trajectories, AAR benefits primarily from rising MRO activity fueled by aging aircraft, increased fleet utilization, and delayed new aircraft deliveries. In contrast, Astronics is driven by growing demand for advanced avionics, in-flight connectivity, and aircraft electrification across both traditional and emerging aerospace markets.

With ATRO and AIR operating in the broader aerospace sector, both stocks face industry-specific challenges that investors should consider before investing in them.

While both Boeing BA and Airbus have signaled intentions to increase aircraft production rates in 2025 compared to 2024, actual growth so far has been slower than anticipated and remains below pre-pandemic levels. This shortfall is primarily due to ongoing supply-chain disruptions, an issue that continues to affect component suppliers like ATRO and AIR.

Given that both companies count Boeing and Airbus among their key OEM clients, the limited availability of critical parts and the resulting delays in aircraft assembly could suppress demand for the specialized equipment and systems supplied by ATRO and AIR. Consequently, this may weigh on their commercial aerospace revenue growth in the near term.

Moreover, the recently imposed U.S. import tariffs on many of the nation’s trading partners could cause long-term disruptions in global trade, with the aerospace sector being no exception, thus further exacerbating this sector’s supply-chain challenges. This, in turn, may negatively impact the commercial aerospace business of both ATRO and AIR.

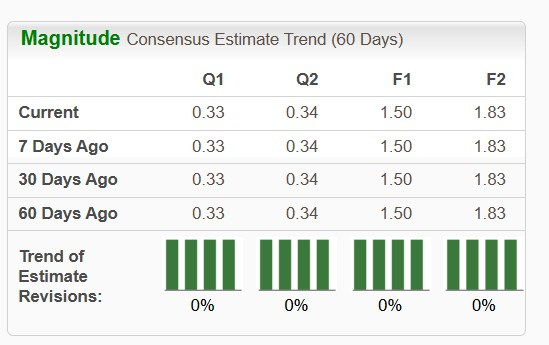

The Zacks Consensus Estimate for ATRO’s 2025 sales and earnings per share (EPS) implies an improvement of 6.4% and 37.6%, respectively, from the year-ago quarter’s reported figures. ATRO’s near-term EPS estimates have shown no movement over the past 60 days.

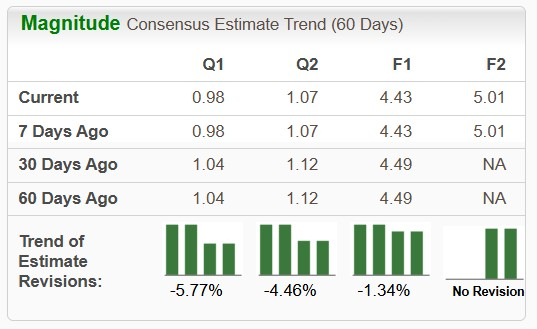

The Zacks Consensus Estimate for AIR’s fiscal 2026 sales implies a year-over-year improvement of 3.4%, while that for EPS suggests a 13.3% surge. The stock’s near-term EPS estimates have shown downward movement over the past 60 days, except for fiscal 2027.

ATRO (up 50.5%) has outperformed AIR (up 38.1%) over the past three months. Also, in the past year, ATRO has outperformed AIR. While ATRO’s shares surged 50.4%, AIR rose 17.8%.

Astronics is trading at a premium, with its forward 12-month price/earnings of 20.49X being more than AIR’s forward price/earnings of 16.83X.

Given that these stocks are facing the brunt of the supply-chain challenge, which is still affecting the aerospace sector, a comparative analysis of their long-term debt-to-capital suggests that ATRO is less debt-ridden than AIR.

While both Astronics and AAR stand to benefit from long-term aerospace tailwinds, including fleet modernization and rising defense demand, Astronics appears better positioned to outperform in the near term.

ATRO has delivered a stronger stock performance over AAR, which, despite benefiting from solid MRO growth and trading at a more attractive valuation, shows limited near-term upside considering its heavier debt load and recent downward EPS estimate revisions. Overall, Astronics offers a more compelling growth profile with strategic resilience and financial discipline.

While ATRO carries a Zacks Rank #3 (Hold), AIR has a Zacks Rank #4 (Sell) at present.

You can see the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 10 hours | |

| 10 hours | |

| Feb-15 | |

| Feb-14 |

Boeing Holds In Buy Zone, Leads 5 Stocks To Watch In Short Trading Week

BA

Investor's Business Daily

|

| Feb-14 | |

| Feb-14 | |

| Feb-13 | |

| Feb-13 | |

| Feb-13 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-12 | |

| Feb-11 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite