|

|

|

|

|||||

|

|

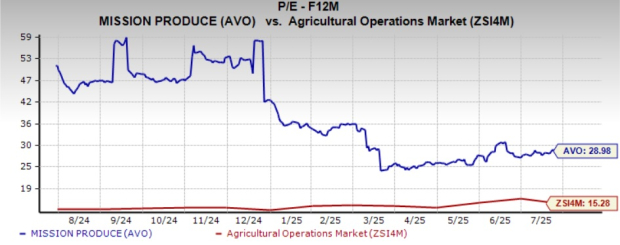

Mission Produce, Inc. AVO stock has gained momentum recently, driven by progress on key strategic initiatives aimed at strengthening customer relationships across products and global markets. However, the company’s current forward 12-month price-to-earnings (P/E) multiple of 28.98X raises concerns about whether the stock's valuation is justified. This multiple is significantly higher than the Zacks Agriculture - Operations industry average of 15.28X, making the stock appear relatively expensive.

The price-to-sales ratio of Mission Produce is 0.69X, above the industry’s 0.48X. This adds to investor unease, which suggests it may not be a strong value proposition at the current levels.

At 28.98X P/E, Mission Produce trades at a significant premium to its industry peers. The company’s peers, such as Archer Daniels Midland Company ADM, Corteva Inc. CTVA and Adecoagro AGRO, are delivering solid growth and trade at more reasonable multiples. Archer Daniels, Corteva and Adecoagro have forward 12-month P/E ratios of 12.39X, 22.36X and 11.68X — all significantly lower than that of AVO.

The AVO stock currently seems somewhat overvalued, and a premium valuation may suggest that investors have strong expectations for its growth.

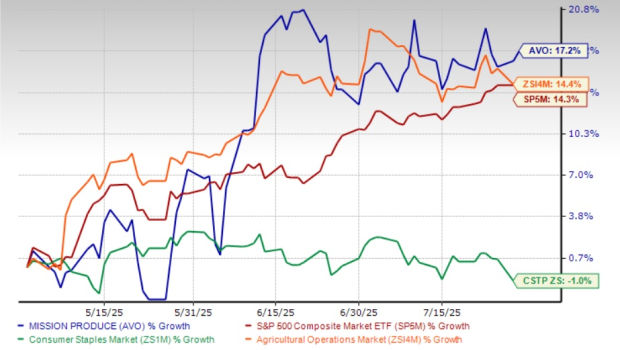

In the past three months, the company’s shares have rallied 17.2%, outperforming the broader Agricultural - Operations industry’s growth of 14.4% and the Consumer Staples sector’s fall of 1%. The stock has also outpaced the S&P 500’s rally of 14.3% in the same period.

Mission Produce’s performance is notably stronger than its competitors. The stock has outperformed Archer Daniels and Adecoagro, which rose 13.9% and 1% in the past three months. However, AVO has slightly underperformed Corteva, which gained 17.5% in the last three months.

The company’s recent stock momentum and a premium valuation suggest that investors have high expectations for AVO's future performance and growth potential.

The company’s capability to execute its strategy and capitalize on a favorable pricing environment is essential for ensuring profitability and consistent performance in its Marketing and Distribution segment. While success in these areas can strengthen market leadership, failure can pose serious challenges for AVO.

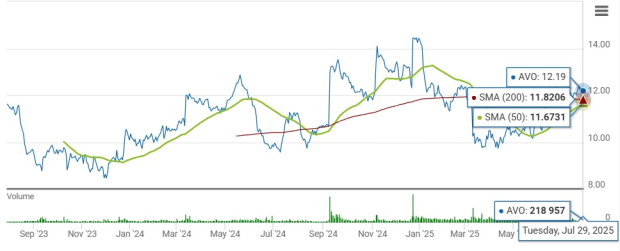

Mission Produce’s current share price of $12.19 is 20.1% below its 52-week high mark of $15.25 and 27.5% above its 52-week low of $9.56. Additionally, Mission Produce trades above its 50 and 200-day moving averages, indicating a bullish sentiment.

Mission Produce is gaining investor attention as it builds on a strong foundation of operational resilience and strategic growth. The company has demonstrated its ability to manage seasonal supply challenges effectively, thanks to its global sourcing network and vertically integrated structure. These strengths have allowed Mission Produce to meet customer demand consistently, even amid market constraints, reinforcing its reputation as a reliable player in the fresh produce space.

Mission Produce’s recent progress highlights its evolving position in key product categories and international markets. Its mango business continues to expand, gaining share and strengthening its role as a leading U.S. distributor. At the same time, operations in the U.K. are progressing well, with deeper customer engagement driving improved use of its facilities. These developments are the result of targeted investments that are now yielding strategic benefits.

Looking ahead, Mission Produce is well-positioned to capitalize on strong seasonal harvests and favorable consumer demand trends. Its diverse portfolio, which includes avocados, mangos and blueberries, combined with its wide distribution footprint, enhances its ability to serve global markets year-round. A strong Peruvian harvest is expected to increase industry avocado volumes by 10-15% in the third quarter, boosting sales opportunities. As the company focuses on customer relationships, product innovation and operational efficiency, it is building a compelling case for long-term growth in the fresh produce industry.

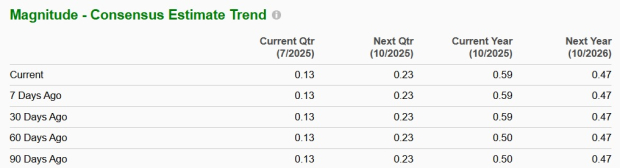

The Zacks Consensus Estimate for Mission Produce’s fiscal 2025 and 2026 EPS has been unchanged in the past 30 days, indicating a neutral sentiment among analysts.

For fiscal 2025, the Zacks Consensus Estimate for AVO’s sales implies year-over-year growth of 8.1%, while the estimate for EPS indicates a 20.3% fall. The consensus mark for fiscal 2026 sales and earnings suggests year-over-year declines of 8% and 20.3%, respectively.

AVO’s strong execution on strategic priorities supports its recent stock momentum and justifies investor optimism despite a premium valuation. The company continues to enhance customer relationships, expand its product portfolio and strengthen its global footprint, especially through gains in its mango business and improved facility utilization in the U.K.

While Mission Produce trades at a higher valuation than industry peers, this premium reflects growth expectations for the future, driven by its vertically integrated model, broad sourcing network and consistent operational performance. Its ability to navigate supply challenges and capitalize on seasonal harvests reinforces the company’s position as a reliable, global produce distributor.

Though analyst estimates for EPS are muted in the near term, top-line growth and strategic expansion suggest long-term upside. In short, Mission Produce’s focused execution, resilient model and global growth prospects make it a compelling pick for investors. For those willing to pay a premium for quality and strategic clarity, AVO presents a solid Buy opportunity in the agricultural sector.

The company currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-16 | |

| Feb-16 | |

| Feb-16 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite