|

|

|

|

|||||

|

|

Shares of Bausch Health Companies Inc. (BHC) declined 6.3% after the company reported mixed results for the second quarter of 2025.

Adjusted earnings per share of 90 cents missed the Zacks Consensus Estimate of 97 cents. The earnings were up from 89 cents in the year-ago quarter.

Total revenues of $2.53 billion were up 5% year over year. The top line beat the Zacks Consensus Estimate of $2.5 billion.

Excluding the impact of foreign exchange of $21 million, acquisitions of $6 million, and divestitures and discontinuations (which negatively impacted the prior year by $2 million), revenues increased 4% organically.

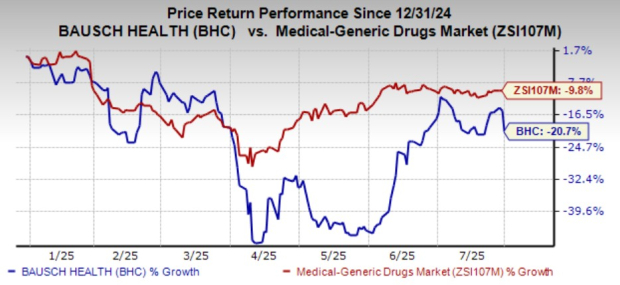

BHC’s shares have lost 20.7% year to date compared with the industry’s decline of 9.8%.

BHC's Q2 in Detail

The company reports revenues under five segments — Salix, International, Diversified Products, Solta Medical and Bausch + Lomb.

Salix revenues totaled $627 million, up 12% year over year. Within this segment, Xifaxan revenues were up 10%, led by strong growth in underlying demand. Trulance revenues almost doubled while Relistor revenues were up 14%, driven by a more favorable net pricing compared to the year-ago quarter.

Xifaxan 550 mg tablets are indicated for the reduction in the risk of overt hepatic encephalopathy recurrence and the treatment of IBS-D in adults.

Salix revenues comfortably beat the Zacks Consensus Estimate of $589 million and our model estimate of $585.3 million.

International revenues totaled $278 million, up 1% year over year, driven by growth in EMEA region. The figure missed both the Zacks Consensus Estimate and our model estimate of $280 million. Revenues also increased 1% organically (excluding the impact of foreign exchange and divestitures and discontinuations), led by growth in Canada and EMEA002E.

Solta Medical reported revenues of $128 million, up 25% year over year, driven by volume expansion globally. The figure beat the Zacks Consensus Estimate of $123 million but missed our model estimate of $130 million. Revenues were up 26% organically, primarily driven by South Korea.

Diversified Product revenues amounted to $219 million, down 13% from the year-ago level. Within this segment, neurology sales decreased 8% year over year due to fluctuations in demand for Cardizem. Sales from the Dentistry business were flat year over year. The Generics business was down 13%. The Dermatology business was down 26% due to lower net realized pricing and expected lower demand for mature non-promoted brands.

Diversified Product revenues missed the Zacks Consensus Estimate of $225 million but beat our model estimate of $216.6 million.

Revenues from Bausch + Lomb totaled $1.3 billion, up 5% year over year. The figure beat the Zacks Consensus Estimate of $1.2 billion and our model estimate of $1.25 billion. Bausch + Lomb’s revenues increased 3% organically on a year-over-year basis, driven by growth in the vision care segment.

Bausch Health Cos Inc. price-consensus-eps-surprise-chart | Bausch Health Cos Inc. Quote

BHC is conducting an internal review on pipeline candidate amiselimod, a new oral S1P receptor modulator that targets the treatment of mild to moderate ulcerative colitis.

The company submitted its application seeking approval of Cabtreo (fixed-dose, triple-combination topical treatment for acne vulgaris) to the EMA. The treatment was approved in Canada in the third quarter and launched in October 2024.

The phase III studies in the RED-C program on rifaximin for the prevention and delay of the first episode of hepatic encephalopathy are in the treatment phase. Top-line results are expected by early 2026.

The company’s program for Clear and Brilliant Touch, a fractionated laser device for skin rejuvenation, is also advancing. In addition to the United States, approvals were received for Australia, New Zealand, Philippines, Thailand, Taiwan, Malaysia and Singapore in 2024. BHC is awaiting the European regulatory response to the submission.

Bausch Health launched Fraxel FTX, a fractional laser system targeting treatment in skin rejuvenation, addressing common skin concerns such as sun damage, wrinkles, acne scars, and pigmentation irregularities in the United States in April 2025.

BHC now expects revenues to be in the range of $10-$10.250 billion (previous guidance: $9.950-$10.2 billion). Excluding Bausch + Lomb, revenues are still projected to be in the $4.95-$5.10 billion band. Bausch + Lomb revenues are expected to be in the range of $5.05-$5.150 billion (previous guidance: $5-$5.1 billion).

Bausch reported mixed second-quarter results, with earnings missing estimates but sales beating the same.

The company’s performance for the first half of 2025 has been pretty decent with most business segments performing well. Xifaxan continues to drive growth.

Bausch Health recently announced that it will indirectly acquire DURECT Corporation (DRRX). The acquisition includes larsucosterol, a novel therapeutic molecule that can harness the power of epigenetic modulation. Larsucosterol, an endogenous sulfated oxysterol and an epigenetic modulator, has demonstrated promising results for the treatment of alcoholic hepatitis (AH) in phase II studies.

Under the terms of the agreement, Bausch Health will pay $1.75 per share in an all-cash transaction for an upfront consideration of approximately $63 million at closing, with the potential for two additional net sales milestone payments of up to $350 million. This upfront consideration represents a premium of approximately 217% to the trading price of DURECT's common stock as of July 28, 2025.

Nonetheless, the colossal debt continues to weigh on the shares. As of June 20, 2025, the company’s debt obligations amounted to $21.7 billion and cash balance totaled $1.7 billion. BHC announced an upcoming repayment of approximately $900 million of debt.

Bausch currently carries a Zacks Rank #2 (Buy).

A couple of other top-ranked stocks in the pharma/biotech sector are Arvinas (ARVN) and CorMedix (CRMD), each sporting a Zacks Rank #1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for Arvinas’ 2025 loss per share have narrowed from $1.60 to $1.50. Loss per share estimates for 2026 have narrowed from $3.28 to $2.98 during the same period.

Arvinas’ earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 82.09%.

In the past 60 days, estimates for CorMedix’s earnings per share have increased from 93 cents to 97 cents for 2025. During the same time, earnings per share estimates for 2026 have increased from $1.64 to $1.65. Year to date, shares of CRMD have rallied 42.4%.

CorMedix’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 25.82%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-27 | |

| Feb-26 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-24 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-20 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite