|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Blackbaud, Inc. BLKB reported second-quarter 2025 non-GAAP earnings per share (EPS) of $1.21, which surpassed the Zacks Consensus Estimate by 15.2%. The bottom line increased around 12% year over year.

Total revenues decreased 2.1% year over year to $281.4 million. This was due to the divestiture of EVERFI. The top line surpassed the Zacks Consensus Estimate by 1.3%.

The company is increasing its full-year 2025 financial guidance across all major metrics, reflecting its strong first-half performance. Management stated that revenue results and profitability highlight disciplined execution, continued productivity gains and the resilience of its financial model. Blackbaud remains committed to creating long-term value for both its customers and shareholders.

GAAP recurring revenue declined 2% to $275.6 million, primarily due to the divestiture of EVERFI, accounting for 98% of total revenue.

Non-GAAP organic revenues were up 6.8% on a reported basis and 6% on a constant-currency basis, year over year. Non-GAAP organic recurring revenues rose 6.9% on a reported basis and 6.1% on a constant-currency basis.

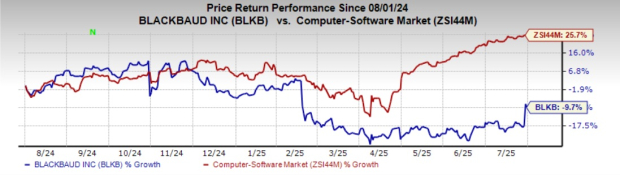

After the announcement, shares of the company jumped around 11% in the trading session yesterday. Shares of the company have lost 9.7% in the past year against the Zacks Computer - Software industry's growth of 25.7%.

Non-GAAP gross margin was 63.4% compared with 62.9% a year ago. Total operating expenses fell 7.8% on a year-over-year basis to $111.1 million.

GAAP operating margin increased 540 basis points (bps) to 20.1%.

Non-GAAP operating margin increased 350 bps to 33.5%. Non-GAAP adjusted EBITDA margin was 27.9%.

As of June 30, 2025, Blackbaud had total cash, cash equivalents and restricted cash of $911.8 million compared with $456.6 million as of March 31, 2025. Total debt (including the current portion) as of June 30, 2025, was $1.1 billion compared with $1.2 billion as of March 30, 2025.

For the second quarter, cash provided by operating activities was $66.9 million compared with $53.8 million in the prior-year quarter. Non-GAAP adjusted free cash outflow was $53.1 million against the free cash flow generated of $36.4 million in the year-ago quarter.

As of June 30, 2025, Blackbaud had nearly $545 million available under its stock buyback program, which was expanded and renewed in July 2024.

Blackbaud, Inc. price-consensus-eps-surprise-chart | Blackbaud, Inc. Quote

In the first half of 2025, Blackbaud repurchased around 4% of its outstanding shares. Overall, the company expects to repurchase up to 5% of its outstanding common stock during fiscal 2025.

Blackbaud raised its guidance for full-year 2025. The company projects GAAP revenues between $1.120 billion and $1.130 billion, reflecting approximately 5% organic growth at the midpoint on a constant currency basis. This represents a $5 million increase, driven by strong transactional revenue in the first half of the year and favorable foreign exchange impacts compared to initial expectations. Earlier, the company anticipated GAAP revenues of $1.115 billion and $1.125 billion. The Zacks Consensus Estimate is pegged at $1.12 billion.

The company projects non-GAAP adjusted EBITDA margin in the range of 35.4-36.2% compared with the prior projection of 34.9-35.9%. Non-GAAP EPS is anticipated to be between $4.30 and $4.50 compared to the earlier expectation of $4.16 and $4.35. The Zacks Consensus Estimate for EPS is pegged at $4.23.

Non-GAAP adjusted free cash flow for 2025 is forecasted to be in the range of $190-$200 million compared with $185-$195 million projected earlier.

Non-GAAP annualized effective tax rate is still anticipated to be approximately 24.5%. Interest expense is expected in the band of $65 million to $69 million.

Fully diluted shares are still estimated to be 48.5 million to 49.5 million. Capital expenditures are expected to be in the range of $55 million to $65 million, which includes $50-$60 million of capitalized software and content development costs.

The company empowered developers with advanced AI skills. It unveiled its vision for Agentic AI, aimed at helping customers drive greater efficiency and build stronger connections in areas like donor cultivation, stewardship and sustainer management at its annual developer conference.

During its May Product Update Briefings, Blackbaud highlighted its Intelligence for Good strategy, demonstrating how responsible, high-impact AI is being seamlessly embedded into its products.

In a strategic move, Blackbaud partnered with Constant Contact to launch a new integration that allows social impact organizations to engage supporters more effectively across email, SMS, social media and other digital channels—all directly within Blackbaud Raiser’s Edge NXT.

Blackbaud currently has a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Cadence Design Systems CDNS reported second-quarter 2025 non-GAAP earnings per share (EPS) of $1.65, which beat the Zacks Consensus Estimate by 5.1%. The bottom line increased 28.9% year over year, exceeding management’s guided range of $1.55-$1.61.

Revenues of $1.275 billion beat the Zacks Consensus Estimate by 1.3% and increased 20.3% year over year. The figure beat the management’s guided range of $1.25-$1.27 billion.

In the past year, shares of CDNS have jumped 42.2%.

Simulations Plus, Inc. SLP reported third-quarter fiscal 2025 adjusted earnings of 45 cents per share, which expanded 66.7% year over year. The figure also surpassed the Zacks Consensus Estimate of 26 cents per share.

Quarterly revenues jumped 10% year over year to $20.4 million, driven by continued momentum across its software and services business segments, along with a $2.4 million boost from the Pro-ficiency acquisition.

In the past, shares of SLP have declined 67.3%

SAP SE SAP reported second-quarter 2025 non-IFRS earnings of €1.50 ($1.70) per share, climbing 37% from the year-ago quarter’s levels. The Zacks Consensus Estimate was pegged at $1.63.

Driven by robust cloud growth, disciplined cost control, and expanding AI capabilities, SAP reported total revenues on a non-IFRS basis of €9.03 billion ($10.24 billion), representing a 9% year-over-year increase (up 12% at constant currency or cc). The Zacks Consensus estimate was pegged at $10.37 billion.

Shares of SAP have surged 41.3% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite