|

|

|

|

|||||

|

|

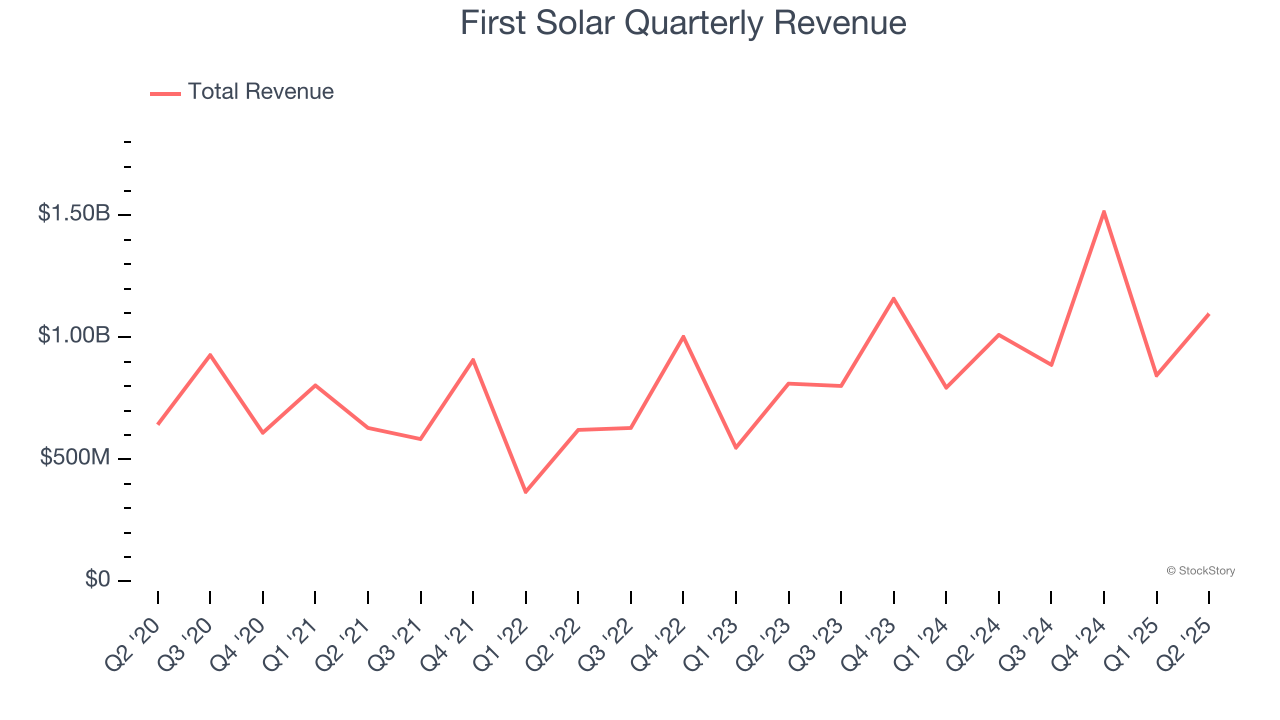

Solar panel manufacturer First Solar (NASDAQ:FSLR) reported Q2 CY2025 results beating Wall Street’s revenue expectations, with sales up 8.6% year on year to $1.10 billion. The company’s full-year revenue guidance of $5.3 billion at the midpoint came in 4.4% above analysts’ estimates. Its GAAP profit of $3.18 per share was 19.6% above analysts’ consensus estimates.

Is now the time to buy First Solar? Find out by accessing our full research report, it’s free.

“In our view, the recent policy and trade developments have, on balance, strengthened First Solar’s relative position in the solar manufacturing industry,” said Mark Widmar, Chief Executive Officer.

Headquartered in Arizona, First Solar (NASDAQ:FSLR) specializes in manufacturing solar panels and providing photovoltaic solar energy solutions.

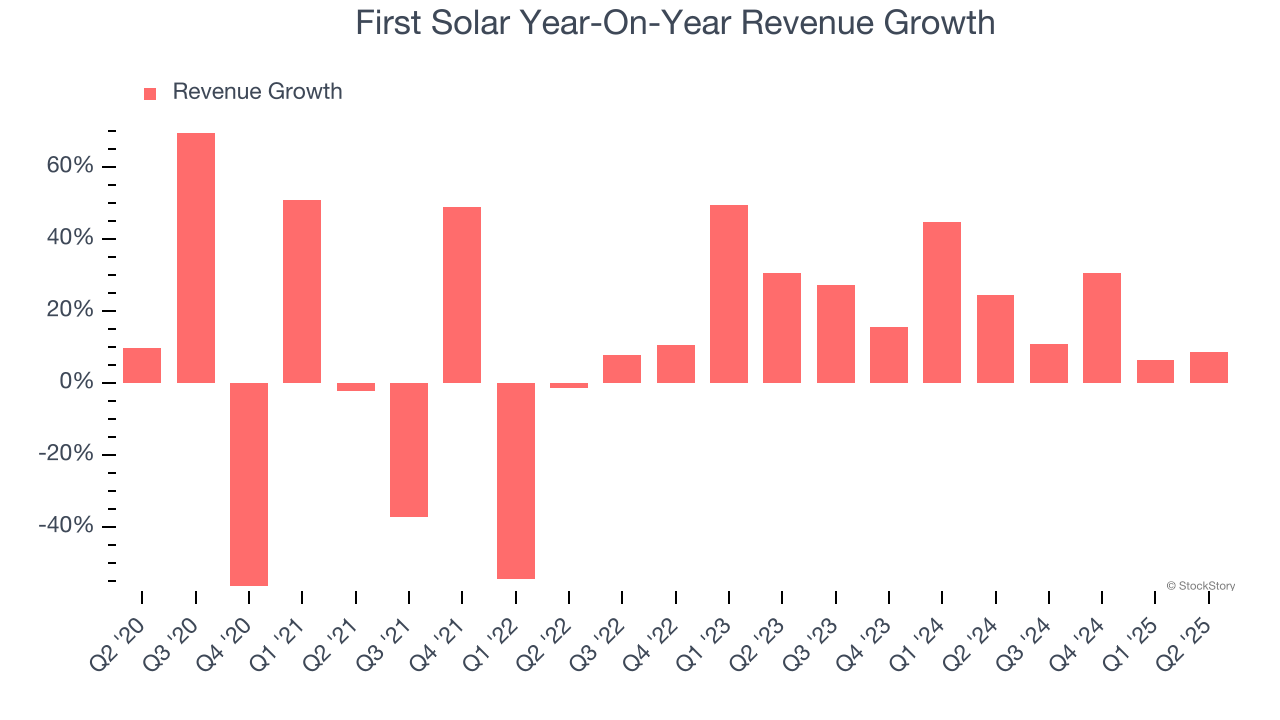

Examining a company’s long-term performance can provide clues about its quality. Any business can have short-term success, but a top-tier one grows for years. Unfortunately, First Solar’s 6.8% annualized revenue growth over the last five years was mediocre. This fell short of our benchmark for the industrials sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. First Solar’s annualized revenue growth of 20.5% over the last two years is above its five-year trend, suggesting its demand recently accelerated. First Solar recent performance stands out, especially when considering many similar Renewable Energy businesses faced declining sales because of cyclical headwinds.

This quarter, First Solar reported year-on-year revenue growth of 8.6%, and its $1.10 billion of revenue exceeded Wall Street’s estimates by 4.9%.

Looking ahead, sell-side analysts expect revenue to grow 36.9% over the next 12 months, an improvement versus the last two years. This projection is eye-popping and indicates its newer products and services will fuel better top-line performance.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

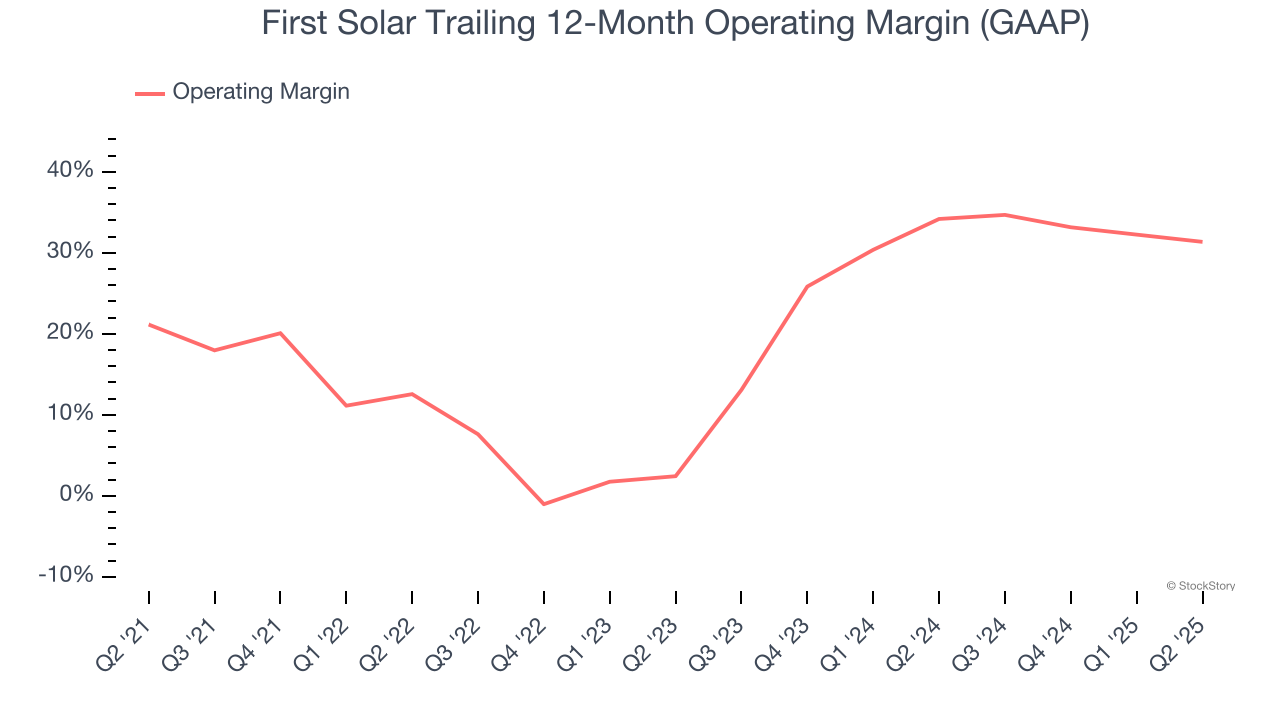

First Solar has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 22.1%.

Analyzing the trend in its profitability, First Solar’s operating margin rose by 10.2 percentage points over the last five years, as its sales growth gave it operating leverage.

This quarter, First Solar generated an operating margin profit margin of 33%, down 3.9 percentage points year on year. Since First Solar’s operating margin decreased more than its gross margin, we can assume it was less efficient because expenses such as marketing, R&D, and administrative overhead increased.

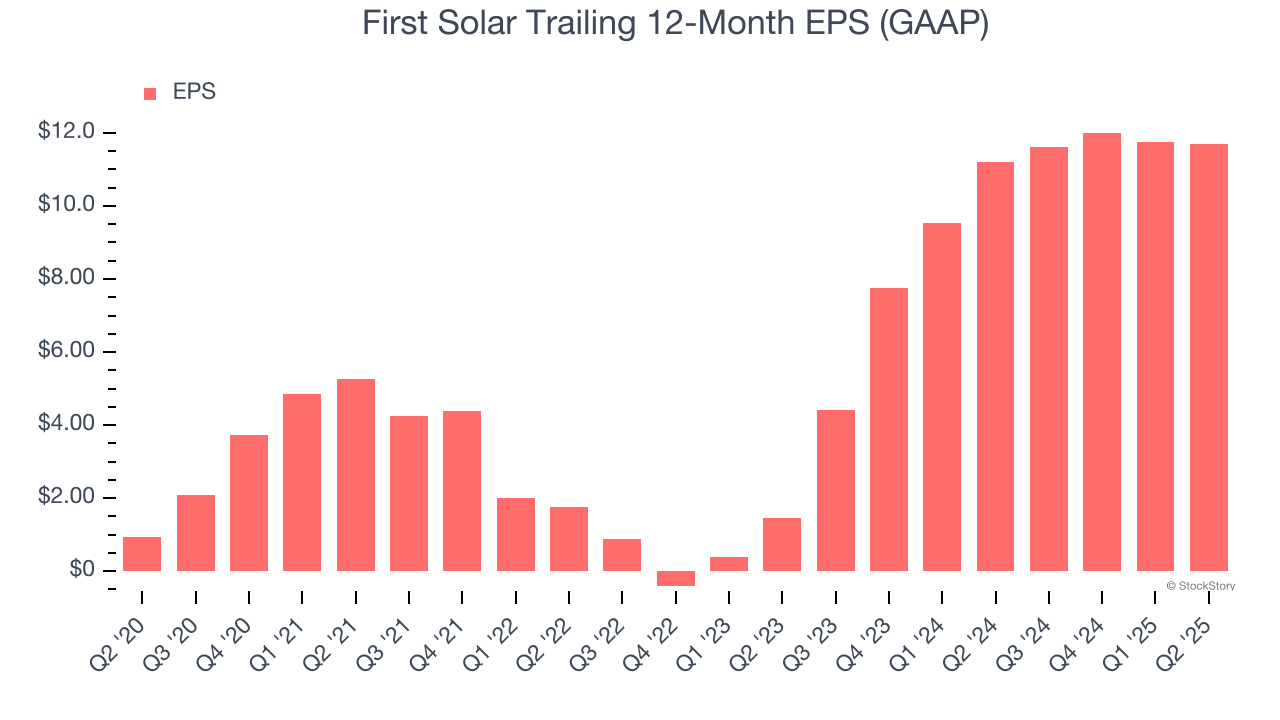

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

First Solar’s EPS grew at an astounding 66.1% compounded annual growth rate over the last five years, higher than its 6.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into the nuances of First Solar’s earnings can give us a better understanding of its performance. As we mentioned earlier, First Solar’s operating margin declined this quarter but expanded by 10.2 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For First Solar, its two-year annual EPS growth of 183% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, First Solar reported EPS at $3.18, down from $3.25 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects First Solar’s full-year EPS of $11.69 to grow 76.7%.

We were impressed by how significantly First Solar blew past analysts’ EBITDA expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 4% to $182.25 immediately following the results.

First Solar put up rock-solid earnings, but one quarter doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-17 | |

| Feb-13 | |

| Feb-13 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite