|

|

|

|

|||||

|

|

Colgate-Palmolive Company CL reported second-quarter 2025 results, wherein the top and bottom lines beat the Zacks Consensus Estimate and improved year over year. Results benefited from organic sales growth and pricing gains. The company is focused on investing in scaling its capabilities in key areas such as digital, data and analytics to enhance competitive advantages and drive profitability.

On a Base Business basis (non-GAAP basis), earnings were 92 cents per share, up 1% from the prior-year period. The bottom line surpassed the Zacks Consensus Estimate of 89 cents.

Net sales of $5.11 billion rose 1% from the year-ago quarter and surpassed the Zacks Consensus Estimate of $5.05 billion. On an organic basis, the company’s sales advanced 1.8%, which includes a 0.6% unfavorable impact from reduced private-label pet volume. Foreign exchange also hurt net sales by 1%.

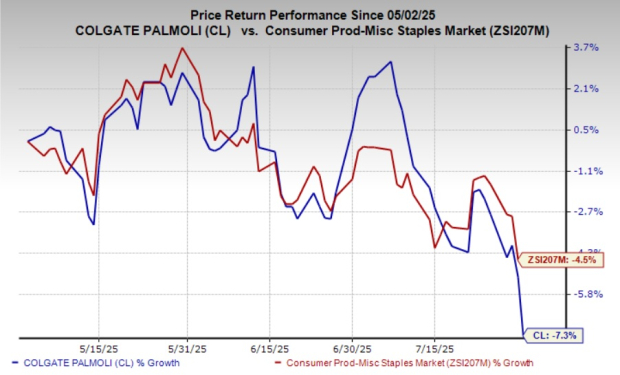

The Zacks Rank #3 (Hold) company's shares have lost 7.3% in the past three months compared with the industry’s decline of 4.5%.

Colgate's organic sales were driven by a 0.2% drop in organic volume and a 2% improvement in pricing. Reported volume remained flat in the second quarter. We estimated organic sales growth of 2.3% for the quarter under review, with a 2.1% rise in pricing and a 0.2% increase in volume.

In the earnings release, management highlighted that the company maintained its leadership in the toothpaste market, holding a 41.1% global market share year to date. In addition, Colgate continued to lead the manual toothbrush market with a 32.4% global market share year to date.

The base business gross profit of $3.07 billion decreased 0.2% from the year-ago quarter. The company’s second-quarter base business gross profit margin contracted 70 basis points (bps), reaching 60.1%. We expected adjusted gross margin to contract 30 bps to 60.5%.

Adjusted selling, general and administrative expenses totaled $1.96 billion, up 1.3% from $1.94 billion in the prior-year quarter.

The company’s adjusted operating profit of $1.09 billion declined 3% year over year. The adjusted operating profit margin contracted 80 bps year over year to 21.3%. We expected the adjusted operating margin to contract 90 bps to 21.2% for the second quarter.

Colgate-Palmolive Company price-consensus-eps-surprise-chart | Colgate-Palmolive Company Quote

North America’s net sales (20% of total sales) dipped 1% year over year on a reported basis and 0.9% on an organic basis. The sales decline was due to a decrease of 0.5% in pricing and 0.4% in volume.

Latin America’s net sales (24% of the total sales) declined 4.8% year over year as a 3% pricing gain and a 0.4% increase in volume were more than offset by an 8.2% unfavorable currency impact. On an organic basis, regional sales rose 3.4%.

Europe’s net sales (14% of the total sales) increased 7.8% year over year on a reported basis and 2% on an organic basis. Sales growth was driven by a 2.2% rise in pricing and a 5.7% positive currency effect, offset by a 0.2% decline in volume.

The Asia Pacific segment’s net sales (13% of the total sales) rose 0.8% year over year, reflecting a 1.6% drop in volume, more than offset by a 1.6% rise in pricing and 0.9% favorable currency. Regional organic sales were flat year over year.

Africa/Eurasia’s net sales (6% of the total sales) improved 8% year over year, driven by 4.3% growth in volume, a 3.4% jump in pricing and a 0.2% favorable currency effect. Organic sales for the segment advanced 7.7%.

Hill’s Pet Nutrition’s net sales (23% of the total sales) improved 3.8% from the year-ago quarter on a reported basis and 2% on an organic basis. Results benefited from a 2.9% rise in pricing, a 0.1% rise in volume and a 0.8% favorable currency. Organic volume for the segment declined 0.9%.

Colgate ended second-quarter 2025 with cash and cash equivalents of $1.22 billion and a total debt of $8.8 billion. Net cash provided by operating activities was $1.5 billion for the six months ended June 30, 2025. The free cash flow before dividends was $1.3 billion for the six months ended June 30, 2025.

The company returned $880 million in cash to its shareholders via dividends in the six months ended June 30, 2025.

Colgate expects the uncertainty and volatility across the global markets to continue, with the impact of tariffs remaining evident.

Based on the existing spot rates and reflecting the anticipated impact of tariffs announced and in effect as of July 31, management presently projects net sales to grow in low single digits, with a flat to low-single-digit adverse impact of foreign exchange. Earlier, Colgate had estimated a low-single-digit negative impact from unfavorable currency exchange rates.

The company now predicts an organic sales increase at the lower end of the 2-4% guidance provided earlier. On a GAAP basis, management envisions both gross profit margin and advertising investment to be roughly flat as a percentage of sales, and earnings per share (EPS) to increase by low single digits.

On a non-GAAP (Base Business) basis, Colgate expects both gross profit margin and advertising to be nearly flat as a percentage of sales, and EPS to grow low single digits.

BJ's Wholesale Club BJ has emerged as one of the preferred destinations for shoppers when it comes to essentials and other items. The company currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

BJ’s Wholesale delivered a trailing four-quarter earnings surprise of 17.7%, on average. The Zacks Consensus Estimate for BJ’s current financial-year sales and EPS indicates growth of 5.5% and 6.2%, respectively, from the year-ago numbers.

Kimberly-Clark KMB is principally engaged in the manufacture and marketing of a wide range of consumer products around the world. KMB delivered a trailing four-quarter average earnings surprise of 8.8%.

The Zacks Consensus Estimate for KMB’s current financial-year sales and EPS implies a decline of 18.8% and 2.5%, respectively, from the year-ago numbers. The company currently carries a Zacks Rank #2.

National Vision EYE is one of the leading and rapidly growing optical retailers in the United States. EYE delivered a trailing four-quarter earnings surprise of 81.8%, on average.

The Zacks Consensus Estimate for National Vision’s current financial-year sales and EPS indicates growth of 3% and 26.9%, respectively, from the year-ago number. The company currently carries a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour |

Colgate-Palmolive Stock Up 23% So Far This Year, Shines Brightly. Gets Rating Upgrade.

CL

Investor's Business Daily

|

| 1 hour |

Colgate-Palmolive Stock Shines, Up 23% So Far This Year. Gets Rating Upgrade

CL

Investor's Business Daily

|

| 8 hours | |

| 9 hours | |

| 10 hours | |

| 11 hours | |

| 11 hours | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-22 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite