|

|

|

|

|||||

|

|

Biotech bigwig Gilead Sciences, Inc. (GILD) is scheduled to report second-quarter 2025 results on Aug. 7, after market close. The Zacks Consensus Estimate for sales and earnings is pegged at $6.95 billion and $1.95 per share, respectively.

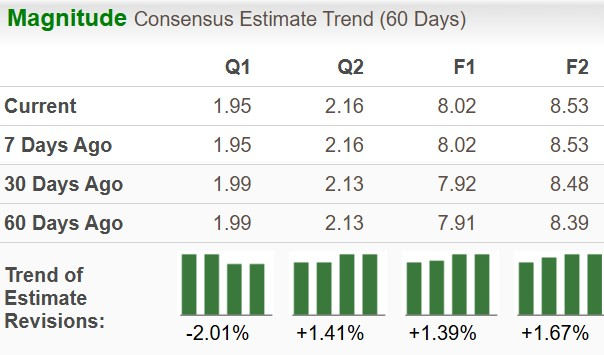

Earnings estimate for 2025 has increased to $8.02 from $7.91 per share over the past 60 days, while that for 2026 has increased to $8.53 from $8.39 in the same timeframe.

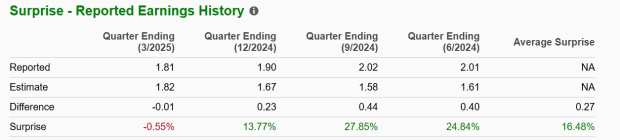

GILD has a good track record. Its earnings beat estimates in three of the trailing four quarters and missed in the remaining one, delivering an average surprise of 16.48%. In the last reported quarter, the company’s earnings missed estimates by 0.55%.

Per our proven model, the combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

Earnings ESP for GILD is +0.58%. The company currently carries a Zacks Rank #3. You can uncover the best stocks to buy or sell before they're reported with our Earnings ESP Filter.

Gilead has a market-leading HIV franchise, led by flagship HIV therapies — Biktarvy and Descovy. Biktarvy sales and Descovy for pre-exposure prophylaxis (PrEP) have fueled GILD’s top-line growth in the past several quarters.

HIV sales were up in the first quarter despite the impact of the new Medicare Part D model implementation due to increased demand for Biktarvy and Descovy. This trend has most likely prevailed in the second quarter as well.

As per the new model, manufacturers now must provide discounts on the cost of drug for Medicare patients during the initial coverage and catastrophic phases. Secondly, the introduction of manufacturer discounts for people who qualify for the low-income subsidy program might have also had an adverse impact on HIV sales. Since this population is disproportionately affected by HIV, the HIV sales have likely been affected due to the larger cost-sharing obligations.

The top-line estimate for Biktarvy and Descovy is pegged at $3.4 billion and $577 million, respectively, and our model estimate for the same is pinned at $3.4 billion and $533 million.

The company recently obtained FDA approval for its twice-yearly injectable HIV-1 capsid inhibitor, lenacapavir, for the prevention of HIV. This groundbreaking injectable therapy marks the first and only twice-yearly PrEP option available in the United States.

The Liver Disease portfolio includes drugs for chronic hepatitis C virus, chronic hepatitis B virus and chronic hepatitis delta virus. Higher demand for viral hepatitis medicines has likely boosted sales of this franchise in the second quarter.

The FDA had earlier granted accelerated approval to seladelpar for the treatment of primary biliary cholangitis (PBC), in combination with ursodeoxycholic acid (UDCA), in adults who have had an inadequate response to UDCA, or as monotherapy in patients unable to tolerate UDCA, under the brand name Livdelzi. The European Commission has also granted conditional marketing authorization to seladelpar for the treatment of PBC.

Incremental sales from this new drug, driven by launches in additional countries, might have positively impacted the Liver Disease portfolio sales in the second quarter.

Veklury sales continue to be highly variable.

Cell Therapy product sales (Yescarta and Tecartus) have likely decreased in the to-be-reported quarter due to competitive headwinds, both in the United States and internationally. In particular, Tecartus sales have likely suffered due to these headwinds.

The Zacks Consensus Estimate and our model estimate for Cell Therapy product sales are pinned at $490 million and $486.5 million, respectively.

Trodelvy, indicated for second-line metastatic triple-negative breast cancer and pre-treated HR+/HER2- metastatic breast cancer, might have experienced strong demand in the second quarter even though the first-quarter sales were impacted by inventory dynamics. The Zacks Consensus Estimate and our estimate for Trodelvy sales are pinned at $324 million and $341 million, respectively.

Both R&D and SG&A expenses might have decreased in the second quarter, as in the previous quarter.

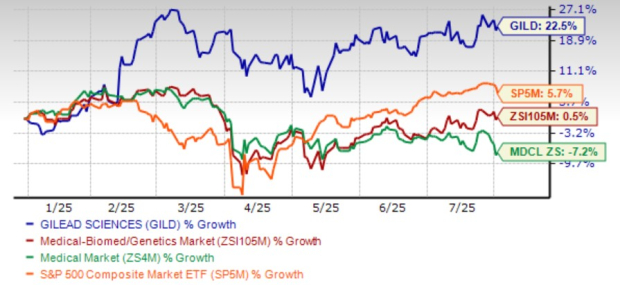

Shares of GILD have risen 22.5% year to date compared with the industry’s gain of 0.5%. The stock has outperformed the sector and the S&P 500 in this timeframe.

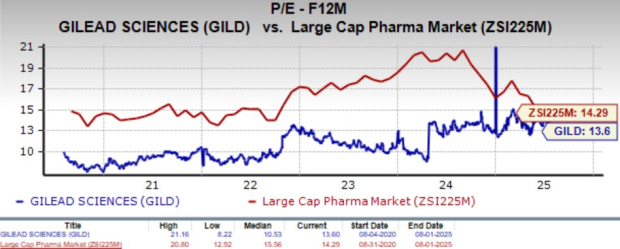

Going by the price/earnings ratio, GILD’s shares currently trade at 13.60x forward earnings, higher than its mean of 10.53x but lower than 14.29x for the large-cap pharma industry.

Gilead has a market-leading portfolio of HIV treatments. The company’s consistent efforts to develop additional innovative HIV treatments are being appreciated by investors. While HIV sales might be under slight pressure in 2025, the recent approval of lenacapavir for the prevention of the disease should solidify Gilead’s HIV franchise (as lenacapavir needs to be taken twice yearly unlike daily oral pills) and result in incremental sales.

The approval of Livdelzi has expanded the liver-disease portfolio.

Gilead’s oncology portfolio, comprising the Cell Therapy franchise and breast cancer drug Trodelvy, has diversified its overall business. The uptake of Trodelvy has been good.

However, the Cell Therapy franchise, comprising Yescarta and Tecartus, is currently under pressure due to competitive headwinds (both in the United States and Europe) that are expected to continue in the rest of 2025.

GILD’s strategic deals and acquisitions to diversify its business are encouraging.

Gilead is one of the largest biotechs in the industry, and such large companies are generally considered safe havens for investors interested in this sector. Gilead’s efforts to constantly innovate its HIV portfolio should enable it to maintain growth amid competition from GSK plc (GSK). The company’s strategic deals and acquisitions to diversify its business are encouraging.

GILD has also collaborated with Merck (MRK) to evaluate the investigational combination of islatravir and lenacapavir for the treatment of HIV.

However, we recommend investors to wait and watch for now as the HIV and Cell Therapy businesses navigate the expected challenges in 2025.

For investors already owning the stock, staying invested would be a prudent move. The company’s attractive dividend yield is a strong positive for investors.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-28 | |

| Feb-28 | |

| Feb-28 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-27 | |

| Feb-26 | |

| Feb-26 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite