|

|

|

|

|||||

|

|

New Feature: See Wall Street analyst ratings directly on Finviz charts for deeper context into price action.

Tutor Perini Corporation TPC is scheduled to report its second-quarter 2025 results on Aug. 6, after market close.

In the first quarter of 2025, the company reported significantly better-than-expected results, with earnings per share (EPS) and revenues topping the Zacks Consensus Estimate by 783.3% and 15.1%, respectively. Both metrics also grew year over year by 77% and 19%, respectively. Increased project execution activities, backed by the robust public infrastructure spending market in the United States, aided the quarter’s performance, reflecting increased contributions from the three reportable segments.

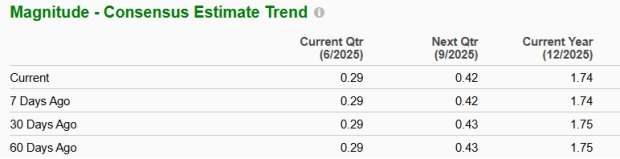

The Zacks Consensus Estimate for second-quarter EPS has remained unchanged at 29 cents over the past 60 days. However, the estimated figure indicates 52.6% growth from the year-ago EPS of 19 cents.

The consensus mark for revenues is pegged at $1.23 billion, indicating 9.2% year-over-year growth from $1.13 billion.

For 2025, TPC is expected to register a 155.6% year-over-year increase in earnings to $1.74 per share. Its top line is expected to witness growth of 18.7% year over year.

Our proven model does not conclusively predict an earnings beat for Tutor Perini this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Earnings ESP: TPC has an Earnings ESP of 0.00%. You can uncover the best stocks before they’re reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank #4 (Sell).

You can see the complete list of today’s Zacks #1 Rank stocks here.

Revenues

The top-line performance of the company is expected to have improved during the second quarter year over year because of the robust public infrastructure spending market, resulting in increased contributions from the Civil (contributed 48.9% to first-quarter 2025 revenues) and Specialty Contractors (contributed 14.2% to first-quarter 2025 revenues) segments. Moreover, TPC’s focus on bidding for projects that have favorable contract terms, limited competition and higher margins is likely to have catalyzed the quarter’s growth trends and its long-term prospects.

Moreover, TPC’s collaboration with its Guam-based subsidiary, Platt Construction, is likely to have been an additional tailwind. This strategic partnership captured four multiple-award construction contract opportunities recently, having a combined contract capacity of more than $32 billion over the next eight years. Such prospects for revenue visibility and incremental profitability position the company well for the upcoming rendezvous despite the ongoing macro challenges.

However, these tailwinds are expected to have been offset by soft contributions from the Building (contributed 36.9% to first-quarter 2025 revenues) segment during the quarter to be reported because of reduced project execution activities on a mass-transit project in California.

Segment-wise, the Zacks Consensus Estimate for the revenues for the Civil and Specialty Contractors segments is pegged at $615 million and $168 million, indicating year-over-year increases of 6.4% and 3.1%, respectively. Contrarily, the revenues for the Building segment are expected to decline year over year by 4.4% to $415 million.

Margins

The bottom line of TPC is expected to have gained year over year during the to-be-reported quarter on the back of increased leverage from elevated top-line growth and growth in income from construction operations in the Civil segment. The income from construction operations in the Civil segment is likely to have been driven by increased project execution activities across several large-scale and high-margin projects.

With the market remaining in Tutor Perini’s favor, its focus on high-margin and long-term projects is expected to keep boosting its margins in the upcoming period, alongside creating room for revenue visibility.

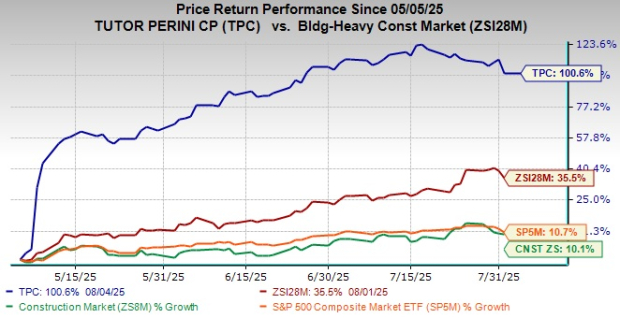

Shares of this California-based general contracting company have soared 100.6% in the past three months, significantly outperforming the Zacks Building Products - Heavy Construction industry, the broader Zacks Construction sector and the S&P 500 index.

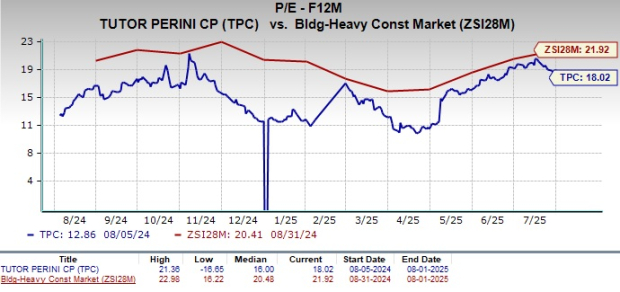

TPC’s current valuation looks promising for investors. The stock is currently trading at a discount compared with the industry peers, with a forward 12-month price-to-earnings (P/E) ratio of 18.14X. The discounted valuation of the stock, compared with its peers, advocates for an attractive entry point for investors.

Tutor Perini is currently facing softness in its Building segment because of reduced construction activities on a project in California, as it is nearing closure. Besides this, the company is facing challenges due to the ongoing macro uncertainties and lingering inflationary pressures. Moreover, it faces substantial competition in its line of business, especially across construction services, from renowned market players including AECOM ACM, Granite Construction Inc. GVA and KBR, Inc. KBR.

TPC is not an exception when facing adverse impacts in the form of rising material costs tied to tariff risk, mainly in steel and equipment-heavy projects. The increased costs and expense structure increase margin pressure prospects, which might not be heavy in the near term but might take a toll in the long term, given the ambiguity surrounding the new tariff regime. During the first quarter of 2025, TPC’s general and administrative expenses increased year over year by 4% to $69.1 million.

It can be concluded from the above discussion that Tutor Perini is capitalizing on robust infrastructure spending. Its primary focus on bidding for projects having favorable contract terms, limited competition and higher margins benefits its prospects.

However, in the long term, these prospects are expected to be hurt due to increased cost and expense structure, as the tariff-related risks are most likely to increase as time goes by. Moreover, potential risks like project delays are additional concerns to TPC’s prospects, reducing revenue visibility.

Despite a discounted valuation and recent stock gains, the company's weak Building segment, exposure to macroeconomic uncertainty, inflationary pressures, and rising material and labor costs pose ongoing headwinds. Given these factors, investors may want to stay on the sidelines until clearer signs of sustained, broad-based improvement emerge.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 1 hour | |

| Feb-22 | |

| Feb-21 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-18 | |

| Feb-17 | |

| Feb-17 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite