|

|

|

|

|||||

|

|

SkyWater Technology SKYT is set to report its second-quarter 2025 results on Aug. 6.

For the to-be-reported quarter, SKYT expects revenues between $55 million and $60 million, with Advanced Technology Services (ATS) revenues in the $49-$53 million range and tools revenues just under $1 million. Wafer Services revenues are expected to be between $5 million and $6 million. Loss is expected between 16 cents and 22 cents per share.

The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $57.3 million, indicating a decrease of 38.6% from the figure reported in the year-ago quarter.

The consensus mark for loss is currently pegged at 17 cents per share, unchanged over the past 30 days. SkyWater reported earnings of 2 cents in the year-ago quarter.

SKYT’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average earnings surprise being 203.9%.

SkyWater Technology, Inc. price-eps-surprise | SkyWater Technology, Inc. Quote

Let’s see how things are shaping up prior to this announcement.

SkyWater’s second-quarter 2025 results are expected to have benefited from strong adoption of the company’s ThermaView, which is a dedicated 90-nanometer CMOS and MEMS platform, focused on the rapidly growing advanced thermal imaging market. More than half of Wafer Services’ revenues came from new products that include ThermaView in the first quarter of 2025. The trend is expected to have continued in the to-be-reported quarter.

However, ATS business revenues are expected to have suffered from continued budget delays and sluggish federal spending in the second quarter of 2025.

Tariffs are expected to have had a limited impact on SkyWater’s overall operations and no significant impact on defense, its primary end market. Stringent cost control is expected to have benefited margins in the to-be-reported quarter.

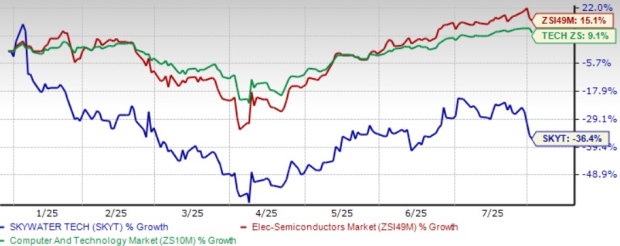

SkyWater shares have dropped 36.4% year to date, underperforming the broader Zacks Computer and Technology sector’s return of 9.1% and the Zacks Electronic Semiconductors industry’s return of 15.1%.

SkyWater shares have lagged peers, including Lam Research LRCX, Rambus RMBS and Semtech SMTC over the same timeframe. While Lam Research and Rambus shares have returned 35.4% and 38.9%, respectively, Semtech shares declined 18.2%.

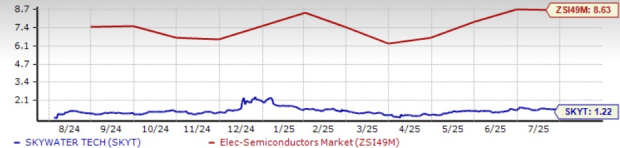

SkyWater is currently trading below the 50-day and 200-day moving averages, indicating a bearish trend.

However, SkyWater stock is very cheap at this moment, as suggested by the Value Score of B.

In terms of the forward 12-month Price/Sales, SKYT is trading at 1.22X, much lower than the industry’s 8.63X, Semtech’s 3.97X, Rambus’ 10.25X, and Lam Research’s 6.46X.

SkyWater’s prospects are driven by a strong portfolio. ThermaView’s strong debut signals long-term growth potential with applications spanning defense, industrial and medical sectors. As SkyWater positions itself to gain a rapid footprint within the projected $9 billion global thermal imaging market by 2027, the platform is expected to be a key driver of sustained expansion in Wafer Services.

The company is expected to benefit from the growing demand for quantum computing. In 2024, advanced computing was SKYT’s second-largest end market following aerospace and defense. More than 90% of SkyWater’s revenues from the advanced compute segment in 2024 were related to quantum technology development with key customers, including D-Wave and Si-Quantum. The company’s Technology as-a-Service model is gaining significant traction due to its ability to offer scalable production-ready solutions and support for superconducting photonic as well as other qubit technologies.

Meanwhile, the ATS segment is expected to make a strong recovery in the second half of 2025 due to improved funding. The company expects Florida's advanced packaging platform development to further contribute to ATS revenues. The Fab 25 acquisition significantly enhances its ATS capabilities by incorporating its existing technology for foundational nodes such as embedded processors, MCUs, memory, mixed-signal, RF and power applications, bolstering scale and versatility. These technologies are critical to high-growth sectors including automotive (autonomous driving and EV power control), industrial automation and sensing, medical devices and defense systems.

The acquisition of Fab 25 adds approximately 400,000 wafer starts annually to SkyWater’s purely U.S.-based foundry footprint and is expected to generate revenues and cash flow immediately supported by a four-year supply agreement valued at more than $1 billion.

Despite a strong portfolio, SKYT’s second-quarter 2025 revenues are expected to have declined due to budgetary issues in the ATS division. Growth is now expected to happen only in the second half amid a challenging macroeconomic environment due to tariffs. We believe these factors make the stock risky for investors in the near term.

SkyWater currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| Feb-23 | |

| Feb-23 | |

| Feb-23 | |

| Feb-22 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-20 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 | |

| Feb-19 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite