|

|

|

|

|||||

|

|

Astera Labs ALAB is set to report its second-quarter 2025 results on Aug. 5.

For the to-be-reported quarter, ALAB expects revenues between $170 million and $175 million, suggesting an increase between 7% and 10% year over year. Earnings are expected between 32 cents and 33 cents per share.

The Zacks Consensus Estimate for second-quarter revenues is currently pegged at $172.7 million, indicating an increase of 124.7% from the figure reported in the year-ago quarter.

The consensus mark for earnings is currently pegged at 33 cents per share, unchanged over the past 30 days and suggests massive 153.85% growth over the figure reported in the year-ago quarter.

Astera Labs, Inc. price-consensus-chart | Astera Labs, Inc. Quote

ALAB’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters, the average earnings surprise being 28.41%.

Let’s see how things are shaping up prior to this announcement.

Astera Labs expects accelerated shipments of Scorpio P-Series switches and Aries 6 retimers on a customized rack-scale AI platform based on market-leading GPUs to boost top-line growth. Scorpio revenues are expected to grow sequentially in the second quarter.

Astera Labs is benefiting from strong demand for Aries and Taurus product families, both expected to grow on a sequential basis in the second quarter of 2025. Diversification across both GPU and custom ASIC-based systems for a variety of applications, including scale-up and scale-out connectivity, is a key catalyst for ALAB’s Aries product family. Continued deployment of AI and general-purpose systems at leading hyperscaler customers is benefiting the Taurus system.

However, uncertainty over tariff-related issues and stiff competition from the likes of Credo Technology CRDO and Broadcom AVGO are major headwinds. The company continues to invest in product development to stay ahead of the competition. In first-quarter 2025, research and development (R&D) expenses jumped 20% year over year to $64.6 million. Operating expense is expected to be between $73 million and $75 million in the second quarter of 2025, driven by higher R&D expenses.

Astera Labs shares have dropped 1% year to date, underperforming the broader Zacks Computer and Technology sector’s return of 9.1% and the Zacks Internet Software industry’s return of 17.5%.

Astera Labs stock is not so cheap, as the Value Score of F suggests a stretched valuation at this moment.

In terms of the forward 12-month Price/Sales, ALAB is trading at 26.26X, higher than the industry’s 5.65X.

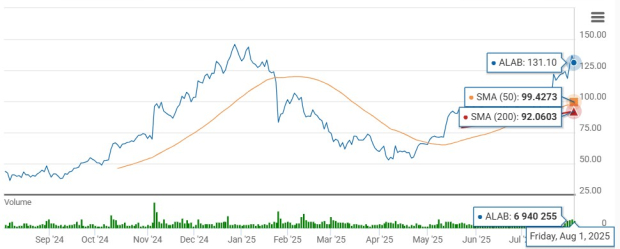

Astera Labs is currently trading above the 50-day and 200-day moving averages, indicating a bullish trend.

Astera Labs has emerged as a key player in next-gen data center connectivity with a full-stack portfolio spanning PCIe 6.0, Ultra Accelerator (UA) Link, and CXL 3.0. Apart from shipping PCIe Gen 6 Scorpio P-Series Smart Fabric Switches, Aries 6 PCIe/CXL Smart Retimers, and Aries 6 PCIe Smart Cable Modules, the company added Aries 6 PCIe Smart Gearboxes. The addition of PCIe 6 over Optics Technology is noteworthy.

Astera Labs plans to provide a broad portfolio of connectivity solutions for the entire AI rack through purpose-built silicon hardware and software to support computing platforms based on both custom ASICs and merchant GPUs is a key catalyst. UA Link, which combines the memory semantics of PCIe and the fast speed of Ethernet, but is devoid of the software complexity and performance limitations of Ethernet, is a game-changer. ALAB expects to deliver UA Link solutions in 2026 to solve scale-up connectivity challenges for next-generation AI infrastructure. The growing proliferation of UA Link is expected to be a multibillion-dollar additional market opportunity for Astera Labs by 2029.

A rich partner base that includes NVIDIA NVDA, Alchip and Wistron is noteworthy. Astera Labs has showcased the first end-to-end PCIe 6 interoperability with NVIDIA’s Blackwell GPU and Micron’s NVMe SSD, with both Aries 6 PCIe Smart Retimer and Scorpio-P PCIe SmartFabric Switch. ALAB is advancing next-gen data center infrastructure with the introduction of a PCIe 6-ready reference design based on NVIDIA Blackwell-based MGX platform that leverages Scorpio Smart Fabric Switches for AI and cloud infrastructure. ALAB has announced a collaboration with NVIDIA to provide scale-up connectivity solutions for the new NVIDIA NVLink Fusion ecosystem.

However, Astera Labs is facing stiff competition from both Broadcom and Credo Technology. Broadcom’s launch of PCIe Gen 6 portfolio, featuring high-port switches and retimers tested for interoperability with partners like Micron and Teledyne LeCroy, is a noteworthy development. Credo Technology continues to gain share in the optical segment, with a major DSP win for an 800G transceiver and the launch of ultra-low-power optical DSPs based on 5nm technology. It also reported a healthy pipeline of PCIe Gen6 AECs and retimers, with further customer wins expected to support fiscal 2026 growth.

Astera Labs benefits from a strong portfolio and partner base amid rising competition and tariff uncertainties. A stretched valuation somewhat dims the stock’s appeal ahead of second-quarter 2025 results.

ALAB currently has a Zacks Rank #3 (Hold), which implies that investors should wait for a more favorable entry point to accumulate the stock. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

This article originally published on Zacks Investment Research (zacks.com).

| 20 min | |

| 47 min | |

| 1 hour | |

| 2 hours | |

| 2 hours | |

| 3 hours |

Asian shares are mixed after Nvidia's losses pull Wall St lower, as AI-linked layoffs rattle markets

NVDA

Associated Press Finance

|

| 4 hours | |

| 4 hours | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 | |

| Feb-26 |

Dow Jones Futures Fall; Nvidia Hits AI Stocks, But S&P 500 Holds Key Support

NVDA -5.46%

Investor's Business Daily

|

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite