|

|

|

|

|||||

|

|

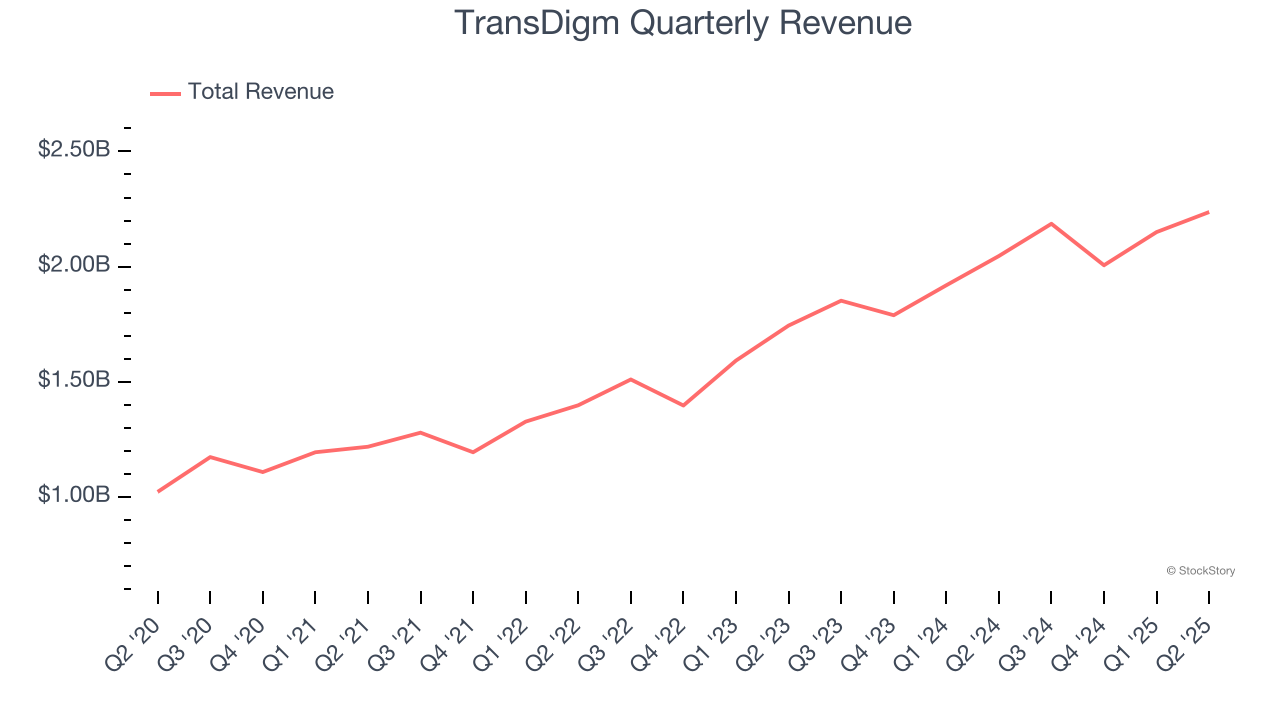

Aerospace and defense company TransDigm (NYSE:TDG) fell short of the market’s revenue expectations in Q2 CY2025, but sales rose 9.3% year on year to $2.24 billion. The company’s full-year revenue guidance of $8.79 billion at the midpoint came in 0.9% below analysts’ estimates. Its non-GAAP profit of $9.60 per share was 3.1% below analysts’ consensus estimates.

Is now the time to buy TransDigm? Find out by accessing our full research report, it’s free.

"Our commercial aftermarket and defense markets performed well this quarter, and as expected, growth within the commercial aftermarket continued to moderate. However, sales in the commercial OEM market fell short of our expectations, primarily due to lower than anticipated OEM build rates and inventory destocking," stated Kevin Stein, TransDigm Group's President and Chief Executive Officer.

Supplying parts for nearly all aircraft currently in service, TransDigm (NYSE:TDG) develops and manufactures components and systems for military and commercial aviation.

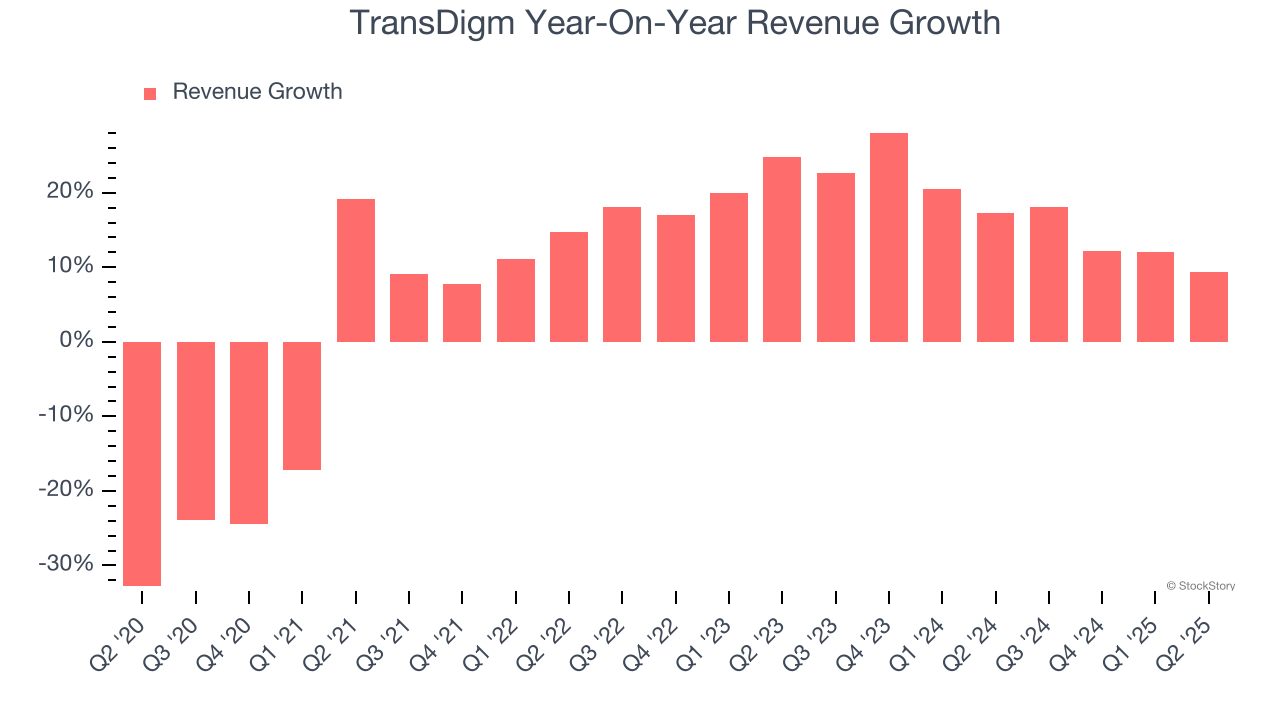

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Thankfully, TransDigm’s 9.4% annualized revenue growth over the last five years was solid. Its growth surpassed the average industrials company and shows its offerings resonate with customers, a great starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. TransDigm’s annualized revenue growth of 17.2% over the last two years is above its five-year trend, suggesting its demand was strong and recently accelerated.

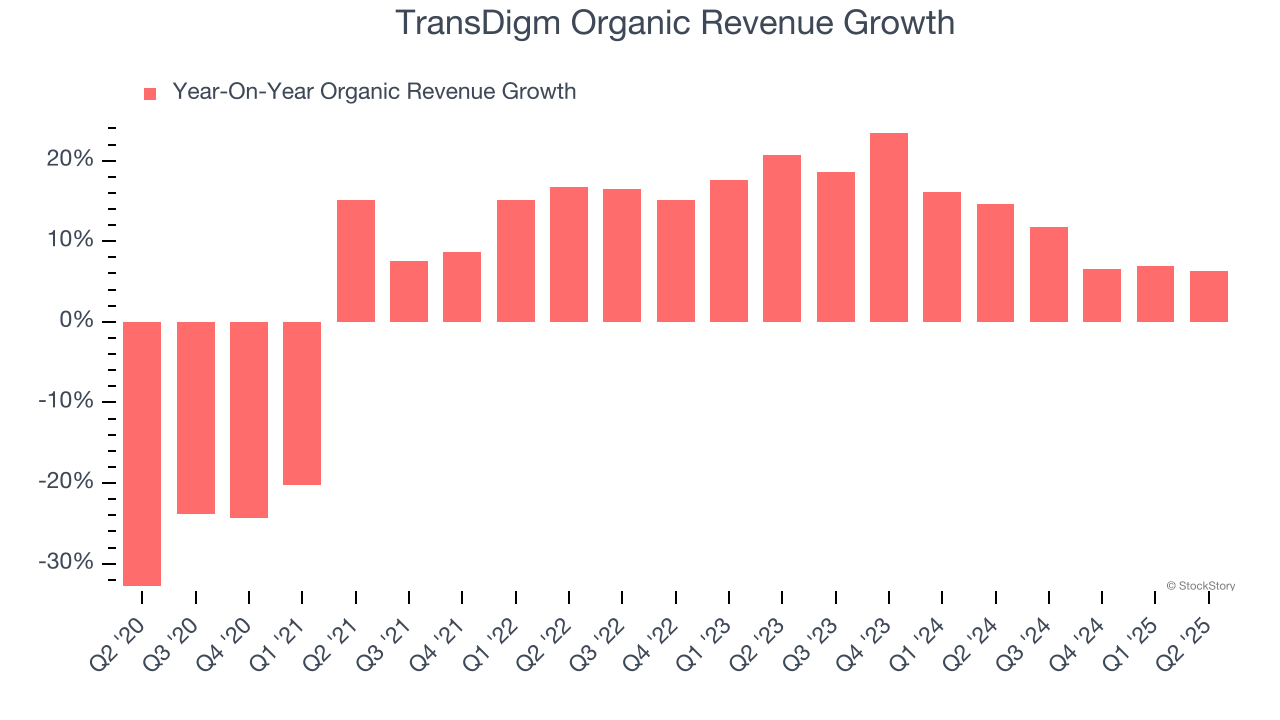

We can better understand the company’s sales dynamics by analyzing its organic revenue, which strips out one-time events like acquisitions and currency fluctuations that don’t accurately reflect its fundamentals. Over the last two years, TransDigm’s organic revenue averaged 13% year-on-year growth. Because this number is lower than its two-year revenue growth, we can see that some mixture of acquisitions and foreign exchange rates boosted its headline results.

This quarter, TransDigm’s revenue grew by 9.3% year on year to $2.24 billion, missing Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 10.2% over the next 12 months, a deceleration versus the last two years. Despite the slowdown, this projection is healthy and implies the market sees success for its products and services.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

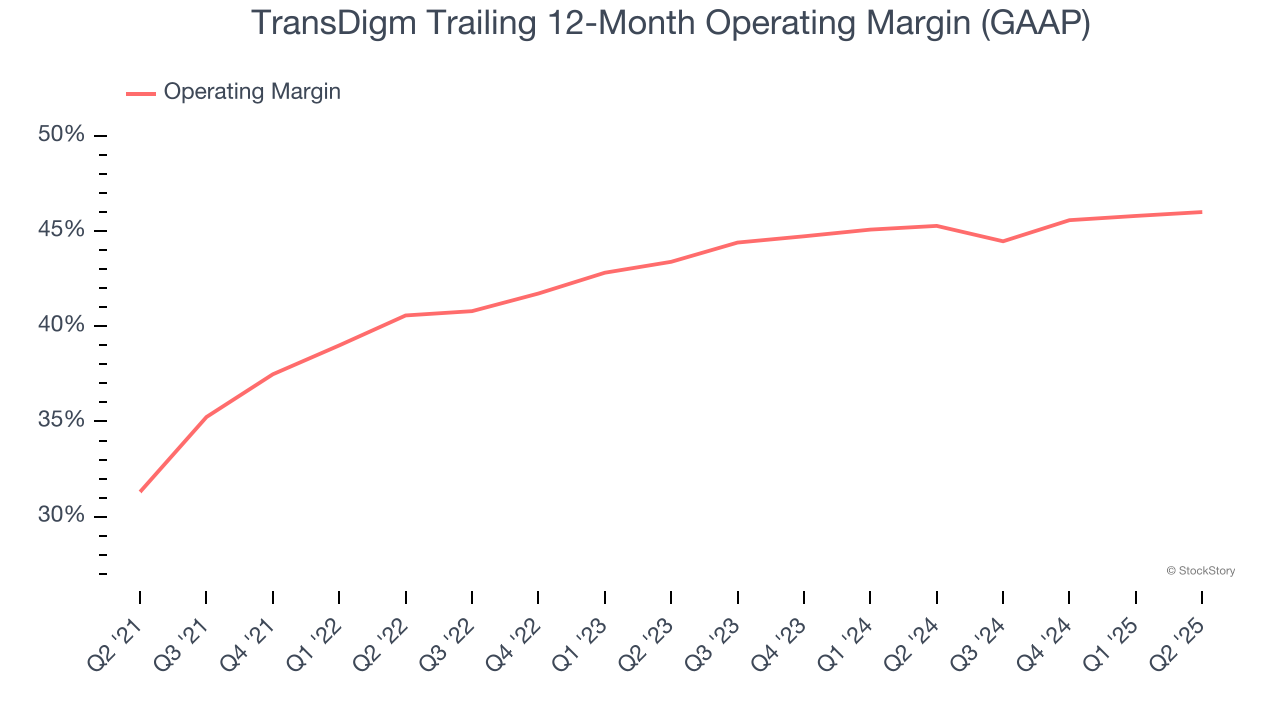

TransDigm has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 42.3%.

Looking at the trend in its profitability, TransDigm’s operating margin rose by 14.7 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q2, TransDigm generated an operating margin profit margin of 46.4%, in line with the same quarter last year. This indicates the company’s overall cost structure has been relatively stable.

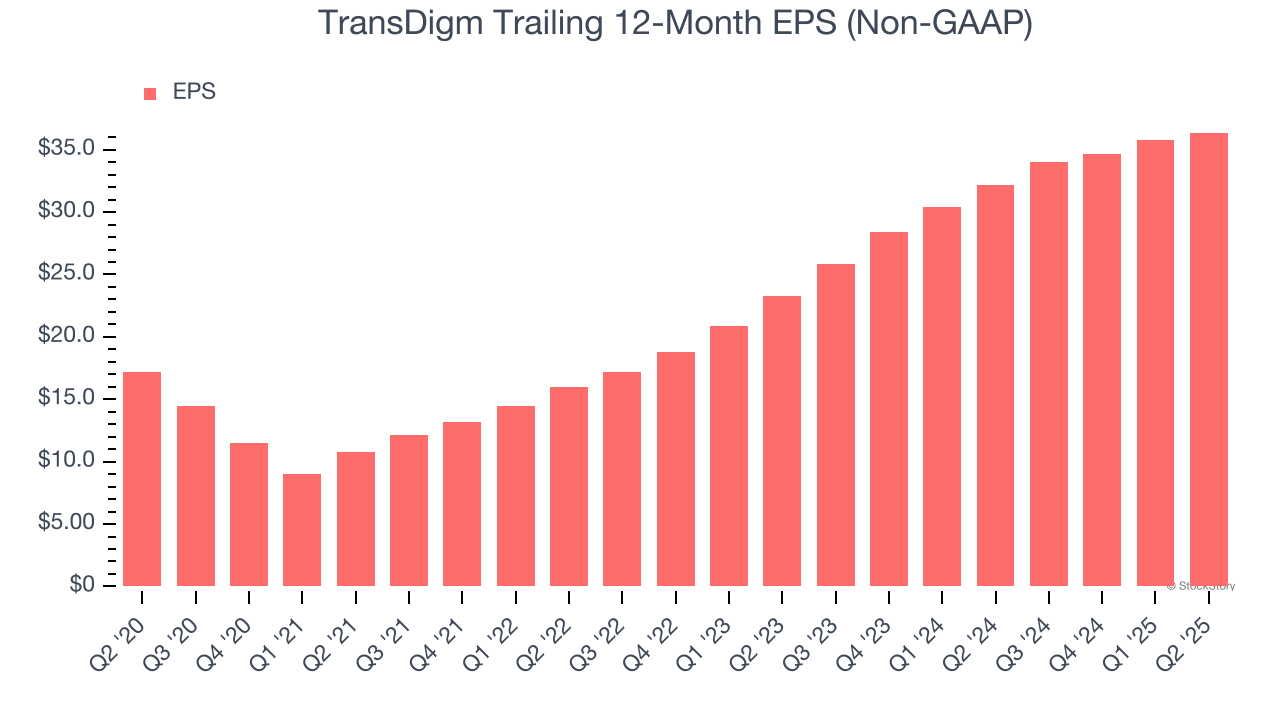

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

TransDigm’s EPS grew at a spectacular 16.2% compounded annual growth rate over the last five years, higher than its 9.4% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

We can take a deeper look into TransDigm’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, TransDigm’s operating margin was flat this quarter but expanded by 14.7 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For TransDigm, its two-year annual EPS growth of 24.9% was higher than its five-year trend. We love it when earnings growth accelerates, especially when it accelerates off an already high base.

In Q2, TransDigm reported adjusted EPS at $9.60, up from $9 in the same quarter last year. Despite growing year on year, this print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects TransDigm’s full-year EPS of $36.37 to grow 15.5%.

We struggled to find many positives in these results as it missed analysts' organic revenue, EPS, and EBITDA expectations and lowered its full-year revenue guidance. This was because "sales in the commercial OEM market fell short of expectations, primarily due to lower than anticipated OEM build rates and inventory destocking". Overall, this was a softer quarter. The stock traded down 9.9% to $1,450 immediately after reporting.

TransDigm’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.

| 7 hours | |

| Feb-22 | |

| Feb-10 | |

| Feb-10 | |

| Feb-07 | |

| Feb-05 | |

| Feb-05 | |

| Feb-05 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-04 | |

| Feb-03 |

Join thousands of traders who make more informed decisions with our premium features. Real-time quotes, advanced visualizations, backtesting, and much more.

Learn more about FINVIZ*Elite